We hope you love the products and services we recommend! All of them were independently selected by our editors. Just so you know, BuzzFeed may collect a share of sales or other compensation from the links on this page. Oh, and FYI, prices and rates are accurate as of time of publication.

Strapped for cash and trying to save as much money as you can? It's never too late to start saving, so we've rounded up some helpful tips to get you started.

Here are 50 simple ways you can spend less and save more:

1. Track your spending and set a budget.

2. Start a savings account that earns more interest.

3. Put a portion of each paycheck into your savings.

4. Start a change jar and deposit it into your bank account once it's full.

5. Or try a savings app like Digit, which makes small, automatic transfers from your checking account into savings.

6. Start a travel fund and contribute a set amount each week. By the time it's full, you can set out on the adventure of your choice.

7. Need to withdraw cash? Use the ATMs associated with your bank or credit union to avoid unnecessary fees.

8. Prioritize paying off any high-interest debt, like a credit card.

9. Replace take out meals and sit-down restaurants by cooking your own food at home.

10. Make a list when you're going to the grocery store to avoid the temptation of buying extras you don't need.

11. And if your grocery store has a rewards program, be sure to sign up.

12. Instead of hitting happy hour or grabbing drinks to-go at your local bar, try your hand at being a bartender and craft your own cocktails.

13. And skip the coffee shop and make your own cup of joe at home.

14. Plant a garden so you have fresh fruits and veggies in your backyard or fresh herbs on your fire escape.

15. If you head out to work or school each day, pack a lunch as often as you can.

16. Head to places like Costco to stock up on staples like laundry soap and toilet paper.

17. Meal prep so you have food for the week and aren't tempted to order out.

18. Save for your retirement by opening an IRA (individual retirement account).

19. Try your hand at investing to give your money a chance to grow.

20. Going shopping? Hit the sales and clearance sections first to find discounted items.

21. Sell your old clothes, shoes, or purses on an online platform like Poshmark or Facebook Marketplace.

22. Or host a garage sale to make a few extra dollars.

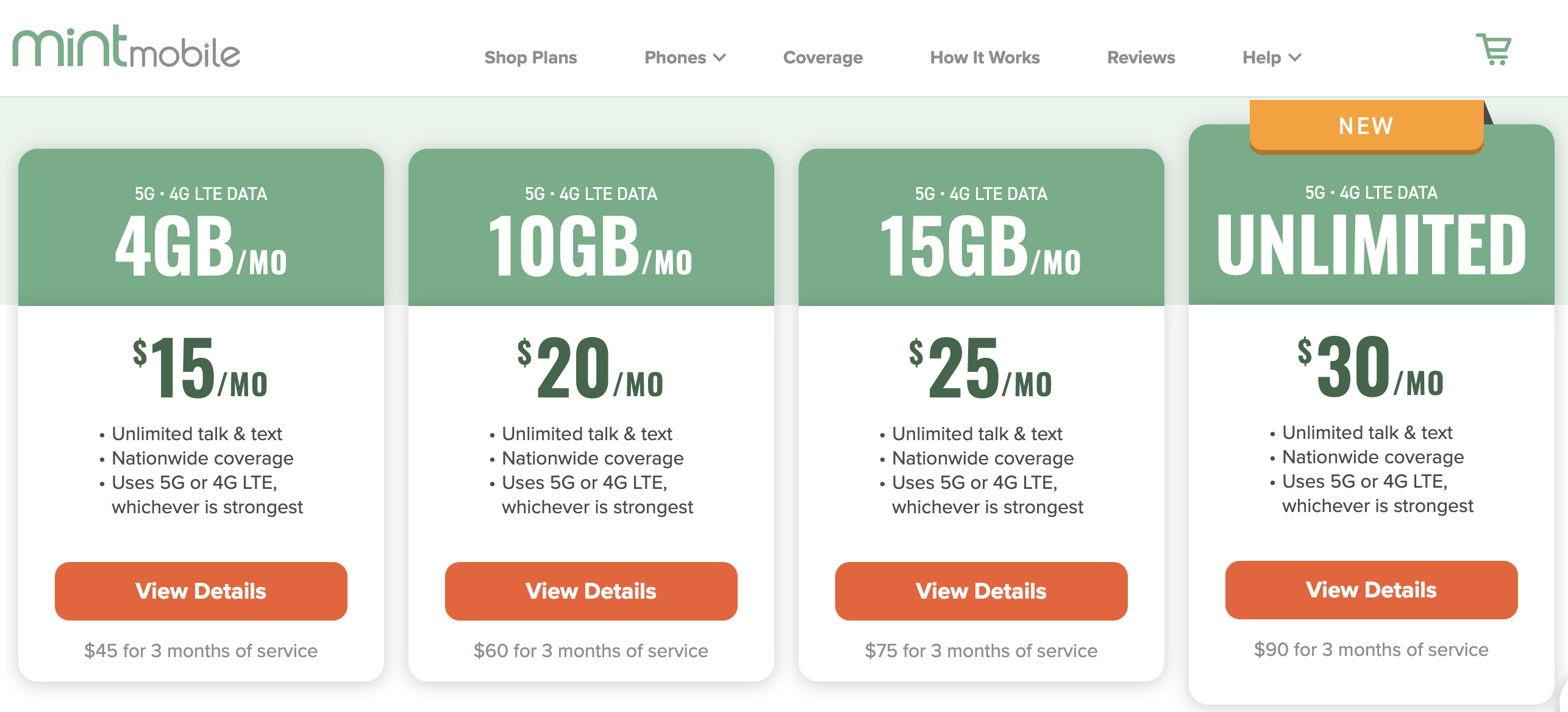

23. If you're on a contract phone plan, consider switching plans to save some cash.

24. Don't rush into big purchases. Instead, sleep on it overnight to make sure it's what you actually want to buy.

25. And if you're sharing finances with a partner, setting some ground rules can really help you stay on track.

26. Shop at your local thrift store and you might score a good find.

27. Take advantage of the cash back or miles rewards on your credit card if it offers them.

29. Plus, save even more on your shopping trips when you use coupons or promo codes.

30. Put your bills on autopay so you don't have to worry about a potential late fee for forgetting that one time.

31. Check out books from your local library if you're an avid reader and want to save on literary costs.

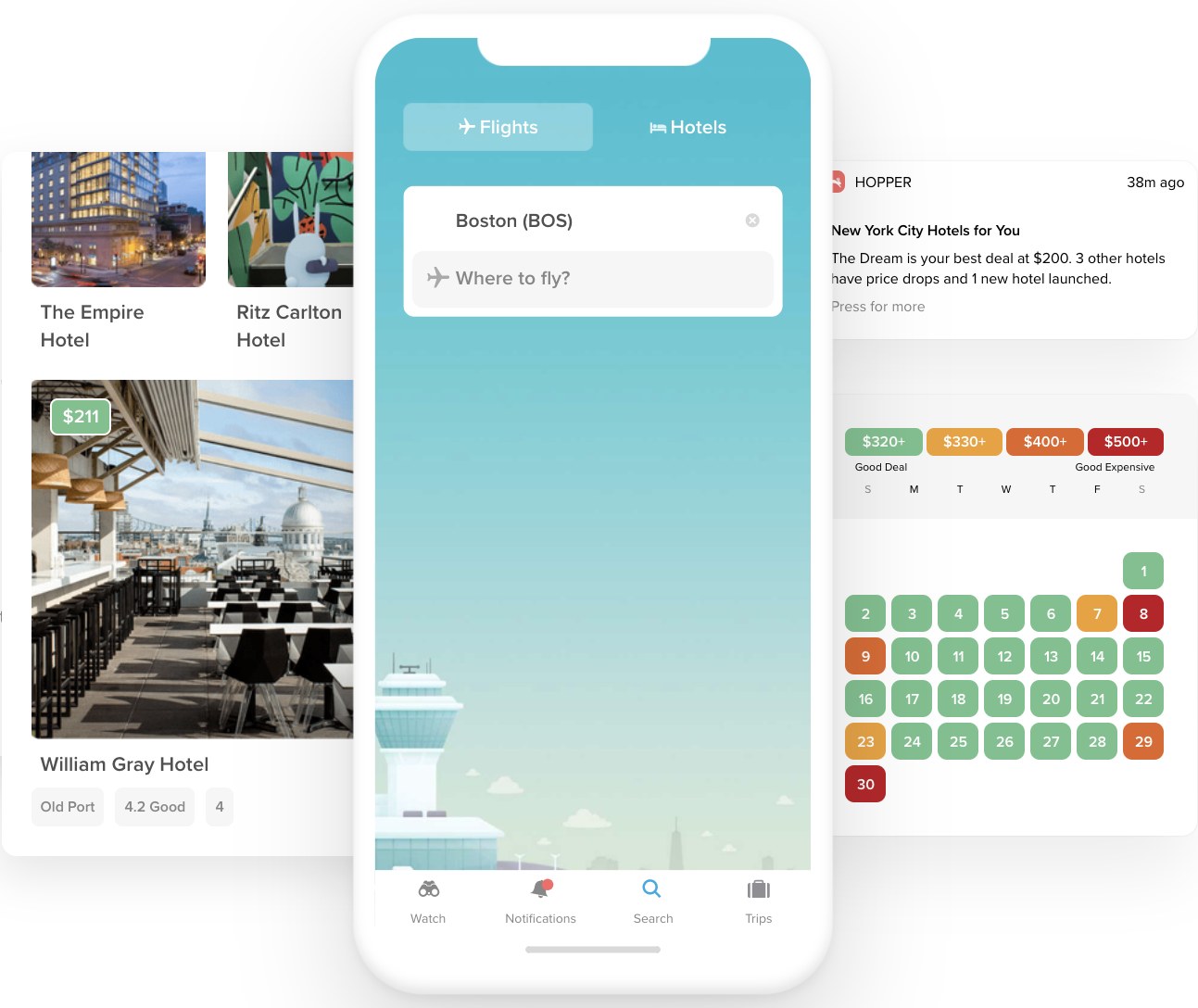

32. Booking a trip? Track the best time to buy a flight through travel apps like Hopper.

33. Compare home or car insurance rates before you renew to make sure you're getting the best price possible.

34. If you can, purchase store-brand medications and generic prescriptions.

35. Want to avoid pricey gym memberships and online subscriptions? Set up a home gym where you can get your sweat on or find a safe place in your neighborhood to take a run or walk.

36. Looking to refresh your space? DIY a home project like painting your walls or crafting new cabinets.

37. Learn how to sew so you can fix old or damaged clothes instead of getting rid of them.

38. Or repurpose an old pair of pants and turn them into shorts by cutting them down.

39. Create homemade gifts from the heart.

40. Install a programmable thermostat to help reduce heating costs.

41. And don't fall asleep with the lights or TV on.

42. Don't want to pay for cable? Choose one streaming service of your choice instead.

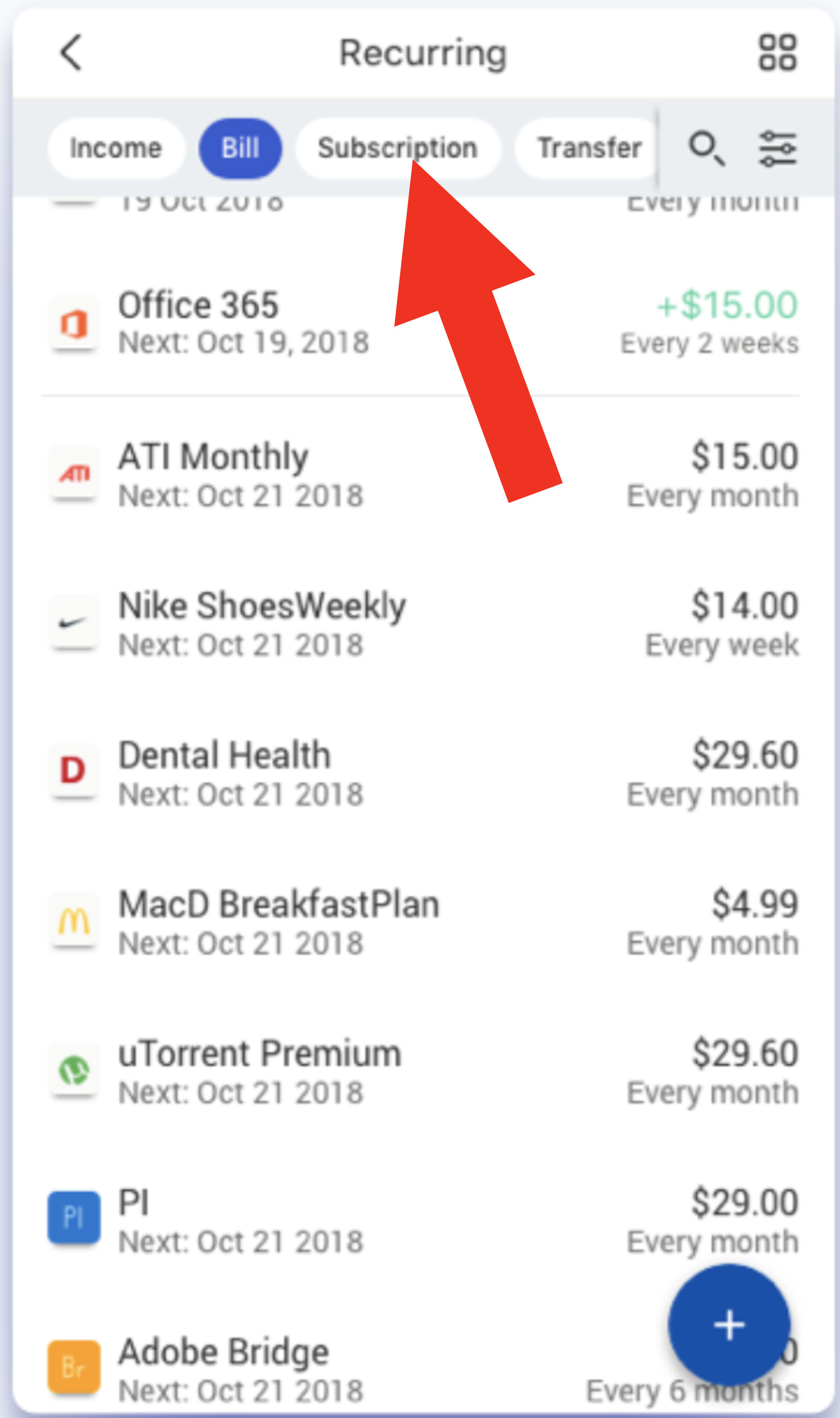

43. And evaluate how many subscription services you actually use and cancel the ones you don't frequent as much.

44. Buy items like jackets or bathing suits during the off-season for extra savings.

45. If you're not going far (and the weather allows) ride your bicycle to cut down on gas costs.

46. And depending on your area, public transportation can be a cheap and easy to get around.

47. If you need to drive, save at the pump by using an app that can help you find the cheapest gas.

48. And stay on top of your car maintenance to avoid surprise fixes down the road.