Browse links

US residents can opt out of "sales" of personal data.

Challenge accepted.

This challenge, as you might have guessed, helps you save money over the course of one year. The best part is you start off small — in the first week you only have to save $1. Then, each week you increase your savings amount by an additional $1 until you're putting away $52 on the last week of the year. At the end, you'll have saved $1,378! If you're looking for more bang for your buck, try upping the increments to $5, $10, or even $20.

On Wednesdays, we save money. Every Wednesday for an entire year, you're going to put away the amount of money equal to the high temperature in your city. So if it's a high of 101 degrees during the summer, you better bet you're saving $101, baby. Even if you don't live somewhere very hot, you'll still save a good chunk of money, and — if you ask me — it's kind of fun being surprised with the amount you have to save every week.

Obviously, spending NO money at all is pretty unrealistic, but trying not to buy anything beyond essentials might help you save up a lot of cash very fast. Whether it's for a week, a month, or even a year, try to avoid spending money on anything that isn't absolutely necessary, whether that's takeout, new shoes, or drinks with friends. Keep track of what you would have spent, and put that amount into your savings!

This challenge is the definition of "pinching every penny." On day one, you only have to save one penny. That's it! But every day after that, you'll add one more penny to that amount, until the last day when you're putting $3.65 in the bank. And while that might not sound like a lot, by the end you'll still have saved $667, which isn't a bad trade for your spare change

Look, you're not going to save enough money to buy a house just by cutting back on your Starbucks lattes, but that doesn't mean you can't save some money. Try making coffee at home whenever possible, and, as a reward, put whatever you would have spent on a drink into a jar or savings account. You could try this for a month, or make it a permanent lifestyle change — whatever works for you!

If you struggle with impulse spending, this cash-only challenge is for you. First, decide how much money you need to budget for your expenses, such as groceries, takeout, shopping, etc. Then, every month, withdraw only that amount in cash and put it in envelopes labeled with each category (i.e. a budget of $200 in your "groceries" envelope). The goal is to only use that cash for each category, so, for example, once your grocery cash is gone, you can't spend any more for the rest of the month.

Five dollars: the cost of a latte, the delivery charge on takeout, or the price of a pint of ice cream at the store. All necessary evils at times (especially in 2020!), but also a simple way to save a whole lot of money. For an entire year, stash away every $5 bill you come across in a piggy bank, box, or jar. At the end of the year, crack it open and count the results!

Why not make saving money fun? Download a pre-made bingo template of 30 squares containing random dollar amounts that all add up to $500. Every day for a month, choose a square, save that amount, and then cross it off. When you've marked every number, you'll have saved $500. If you want to save more or less, you can create your own bingo board with different amounts.

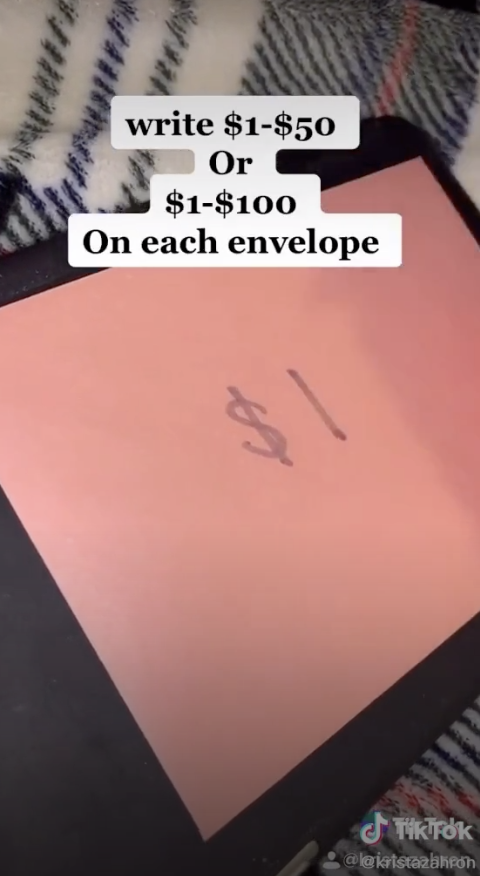

This challenge, which has gone viral on TikTok, is supposed to help you save $5,000 in just one year. Label 100 envelopes with the numbers 1 to 100. Then, every week pick two random envelopes and put the amount of money written on the envelopes inside. If you don't carry cash, transfer the amount into your savings account. For something less challenging, cut it down to six months and only use 50 envelopes.

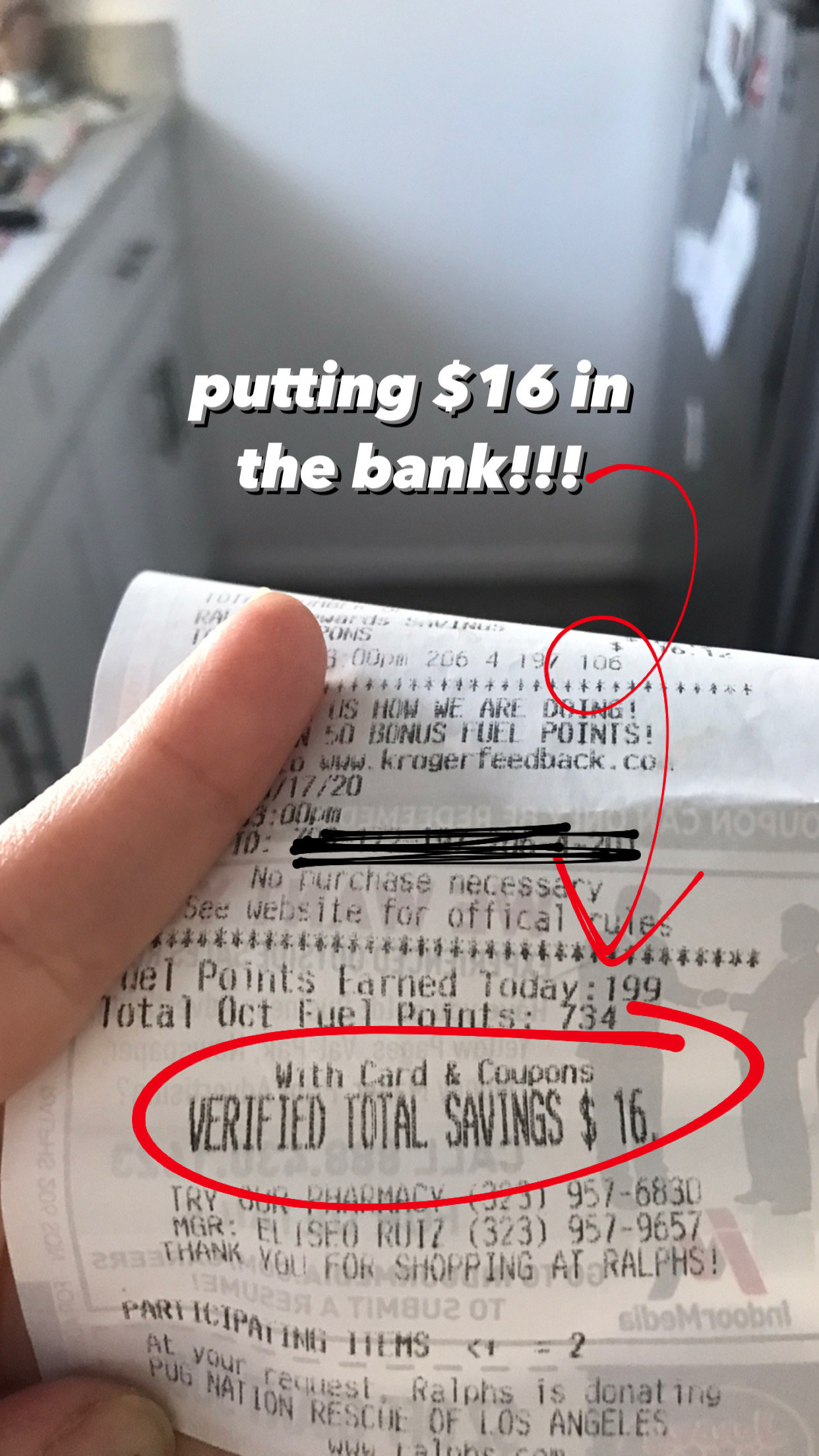

You know how at the very end of your loooooooong CVS receipt it will say something like, "You saved $10.61 today?" Well this challenge ~challenges~ you to actually save that money. Every time you shop, check your receipt for your "savings," and then put that amount of money aside. It might not seem like a lot, but it definitely adds up.

We've all got a bad habit or two. This challenge not only encourages you to save money, it'll help you kick some of those vices. It's pretty simple: Get a jar (or savings account) and put a set amount of money inside every time you give in to your bad habit, whether it's having a cigarette, waking up past noon, or skipping your workout.