You've heard it a million times: Making a budget (and actually sticking to it) is a surefire way to get a handle on your finances. But if the thought of sitting down and entering alllll your income, bills, and expenses into a great big spreadsheet sounds totally overwhelming, here's some great news: You don't have to!

Any way you set it up, a budget works best when it's in service of a goal. Maybe you want to start stashing away an extra $100 every month. Or perhaps you need to figure out how to get your spending under control. Choose your goal, then make a budget that helps you get there.

It can also help to have some financial frameworks in mind as you plan your budget. Financial advisers often recommend splitting up your money using the 50-30-20 rule.

Ready to get to it? Here are a few budgeting methods to try if spreadsheets aren't your cup of tea:

1. If you're into using cash, give the envelope system a try.

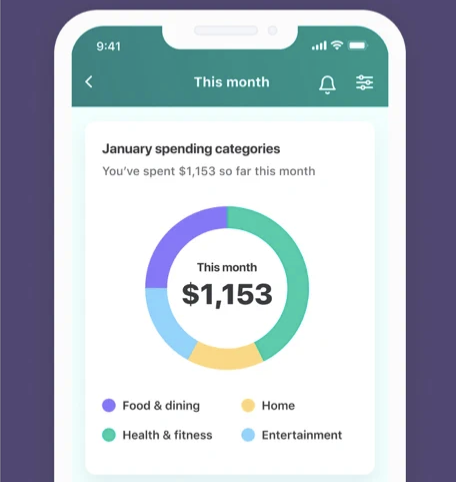

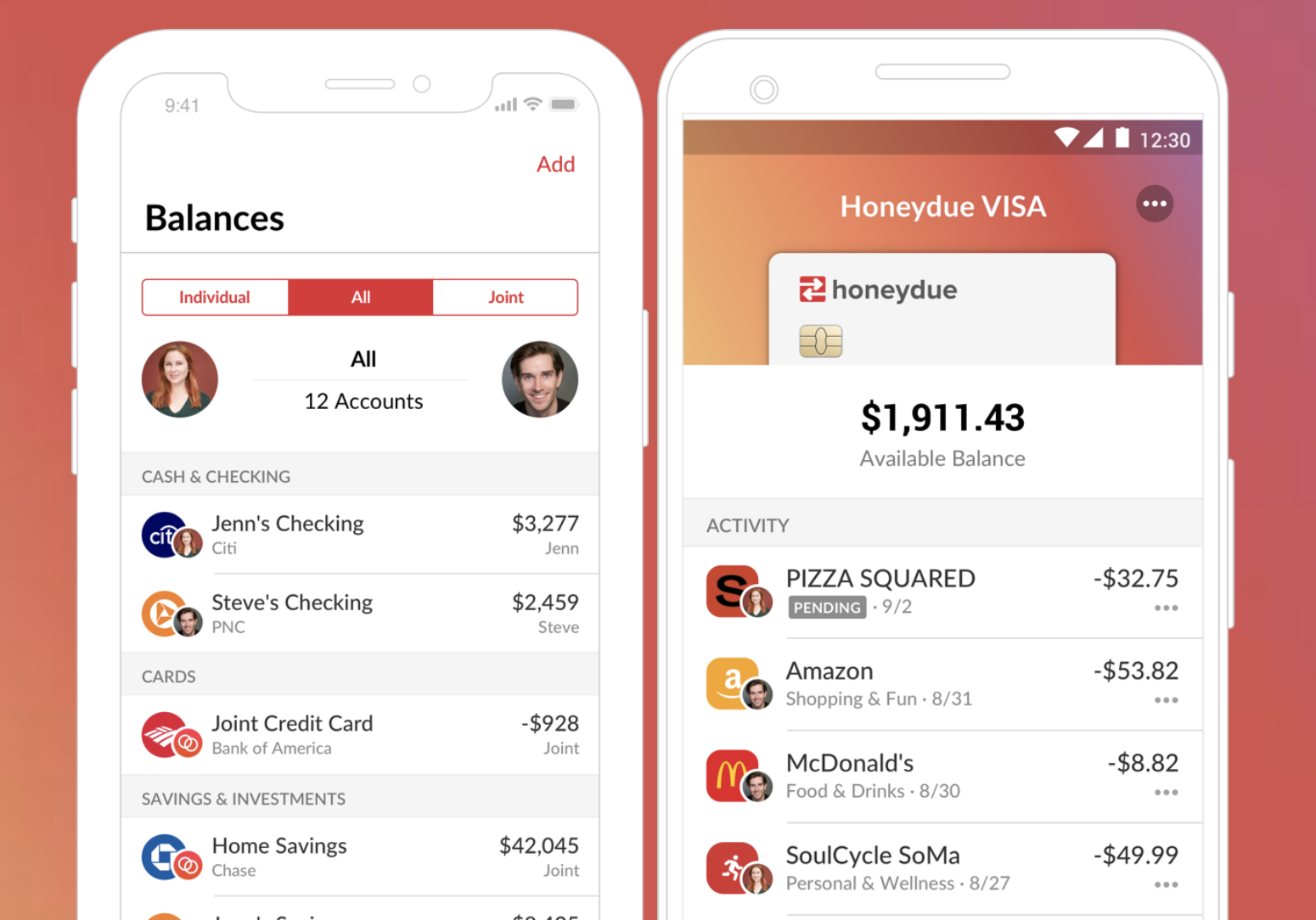

2. For a budget that pretty much makes itself, try an app like Mint or Honeydue.

Or, if you're looking for an easy way to budget with your partner, Honeydue could be the solution.

3. If you are an artiste (or just love writing things down by hand) maybe a bullet journal spread will tickle your fancy.

4. For a no-fuss, no-muss approach, try the multiple accounts method.