The purpose of an emergency fund is to help you manage disasters, and this past year was chock-full of them. So if your savings are gone, 1) You are not alone.

It can be rough starting over and hard to know where to begin. So here are a few ways to beef up your savings for whatever 2021 has in store.

FYI, experts recommend having an emergency fund that can cover three to six months of your expenses so that when life throws you curveballs, you can pay for surprise bills without going into debt. And if that sounds like a lot of money (because it is), for now just focus on reaching a smaller savings goal that's achievable for you, and you can reassess when you get there.

1. Choose a savings account that will help you win.

2. Try a savings challenge.

3. Actually make a budget so that you can keep better track of your money.

4. Shrink your subscriptions.

5. Save any extra cash that comes your way.

6. Renegotiate your debt.

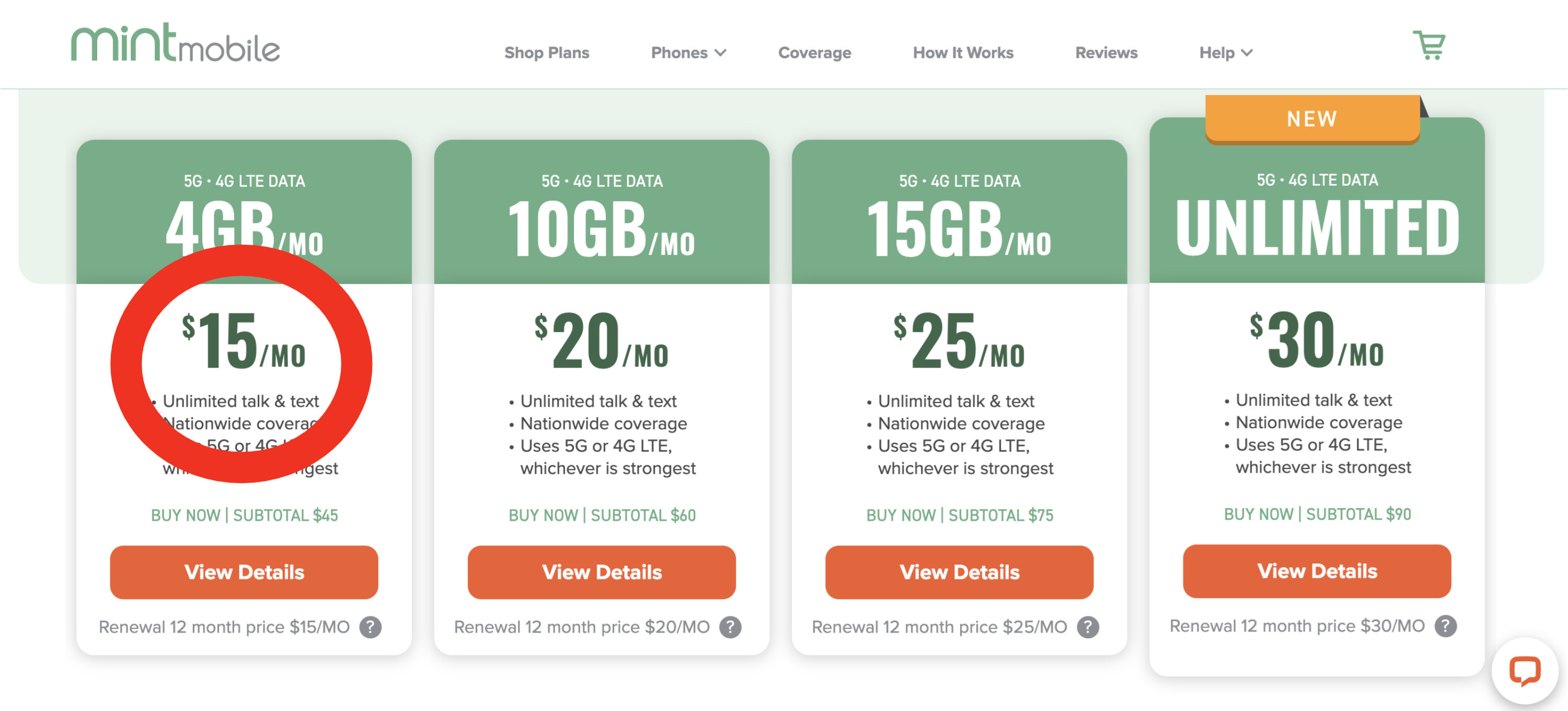

7. Ditch your phone contract for a cheaper plan.

8. Look for ways to reduce your food costs.

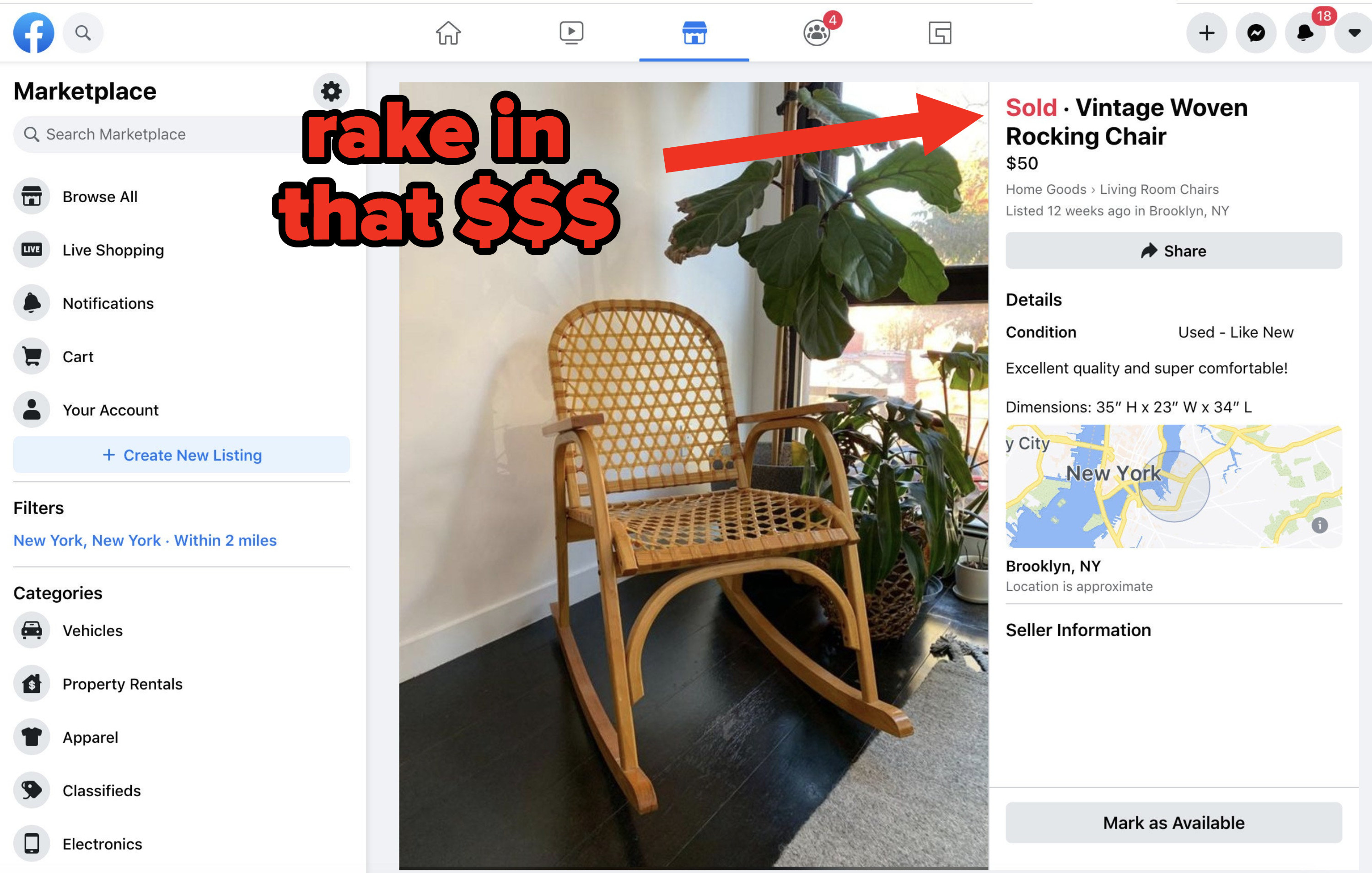

9. Sell the stuff you no longer use.

10. Give your income a boost by picking up a side gig.

11. Or, if you're in a position to do so, try asking for a raise.

12. Unsubscribe from marketing emails that tempt you to spend.

13. Take advantage of credit card perks, like rewards points and cash back features.