In the world of ambient stress, there are few things that top credit card debt.

Recently, I made the decision to finally pay off the proverbial red number that's been growing since my early 20s. And at the end of last year, I was finally able to pay off my entire credit card balance!

Here are the best budgeting tips I have adopted to keep expenses low.

I've also included the habits that I've seen the most financially-savvy people in my life live by.

In general, it's a good rule of thumb to focus on your three biggest expense buckets. For most people, that's food, transportation, and housing. (You'll notice that a good number of my own tips have to do with food!)

1. Eat the same thing every day for lunch.

2. Go vegetarian at least a few days a week.

3. Make dinner with friends instead of going out.

4. When you do go out, drink alcohol less — or not at all.

5. Cut down travel expenses by road-tripping locally, doing house swaps, or going camping.

6. Downgrade your phone's data plan.

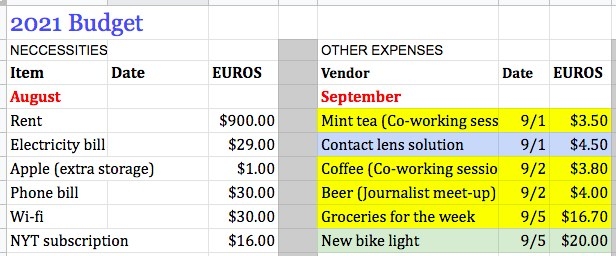

7. Start an Excel sheet where you log every single expense.

8. Give DIY birthday gifts.

9. If you live in city where it's possible, opt for biking, walking, or public transportation instead of driving.

10. Get used to saying no.

11. Work out at home or outside instead of paying for a gym membership.

12. Plan any spending above $20 (or whatever threshold feels right for you).

13. And finally, if you're still in your teens or 20s, don't try to live like you have the budget of a high-flying thirtysomething.