As the pandemic stretches on, it makes sense to reevaluate your daily and weekly habits — including your financial ones.

1. Log your weekly (or monthly) spending — and be honest with yourself.

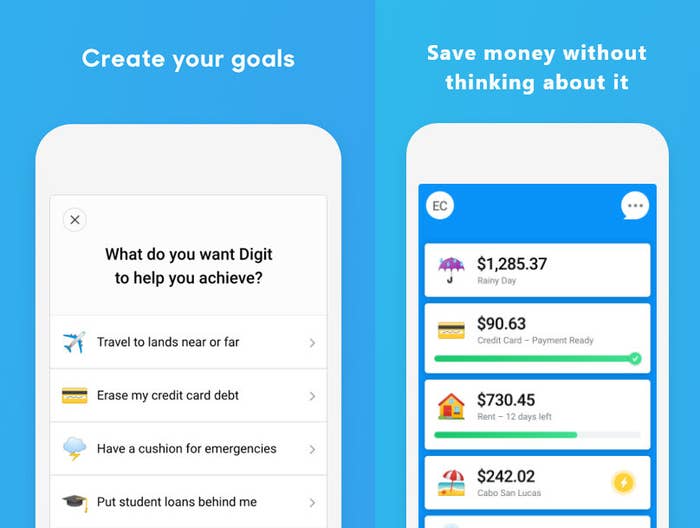

2. Use apps that automatically move money to your savings account.

3. Use the cash envelope method.

4. Meal-prep as much as you can.

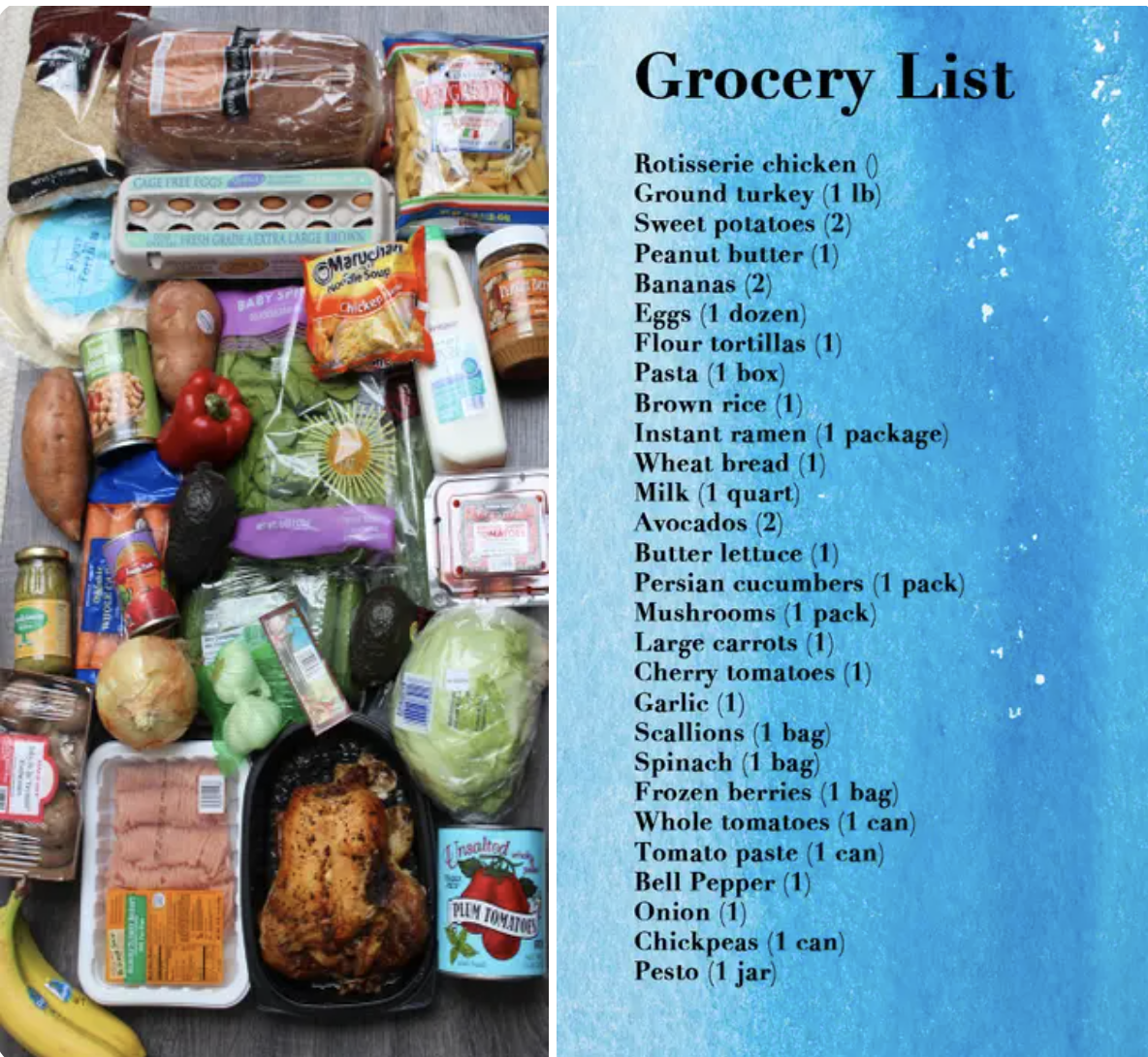

5. Make sure your grocery list actually saves you money, though.

6. And stick to a firm list when you go shopping.

7. Try to finish everything you buy.

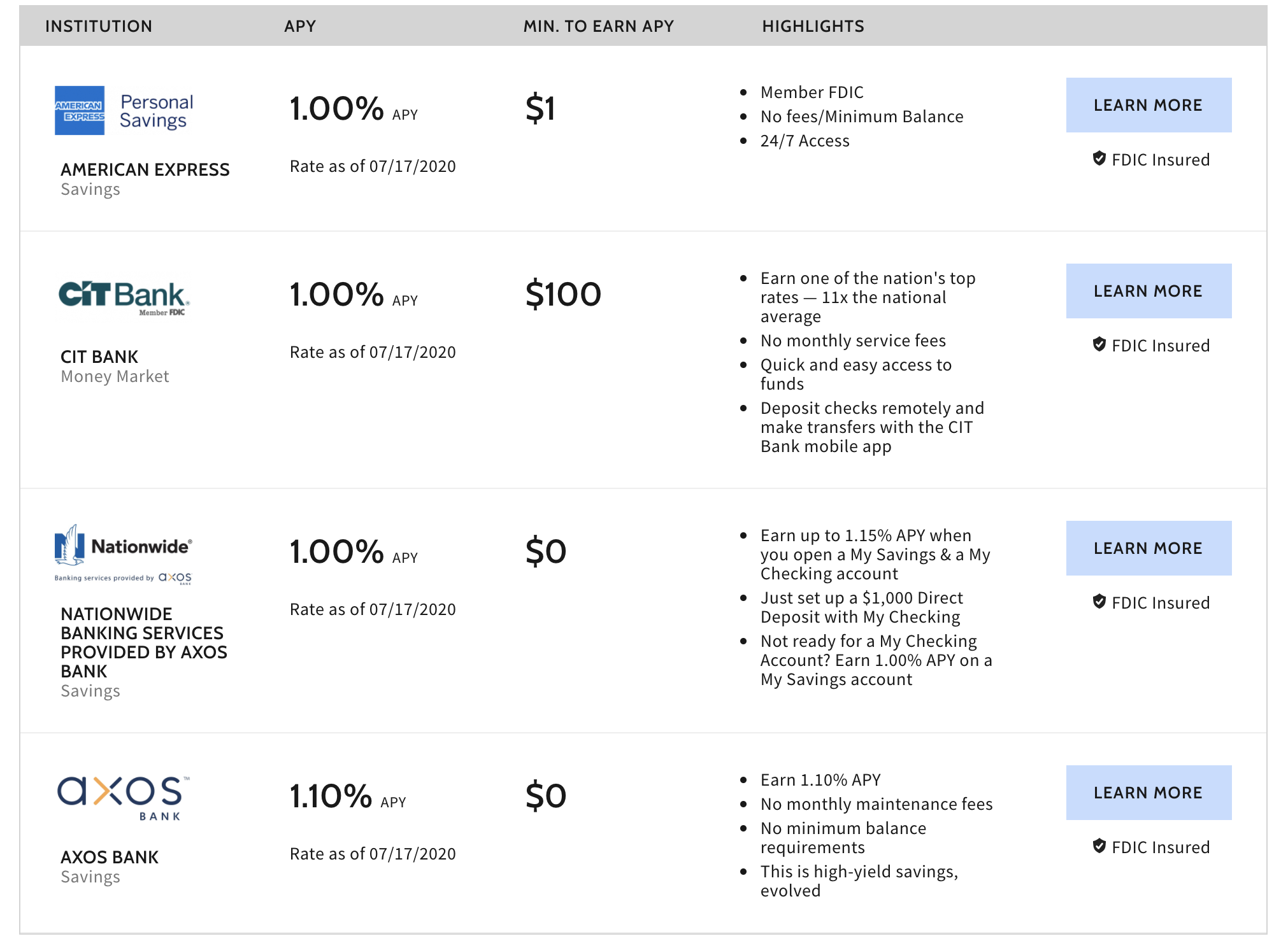

8. Get a high-interest savings account so you earn more money.

9. Save a percentage of your paycheck. (Especially if you're a freelancer!)

10. Collect your spare change.

11. Keep all of your gift cards in one place — and use apps like Honey when making purchases.

12. Don't save your bank info on websites where you tend to overspend.

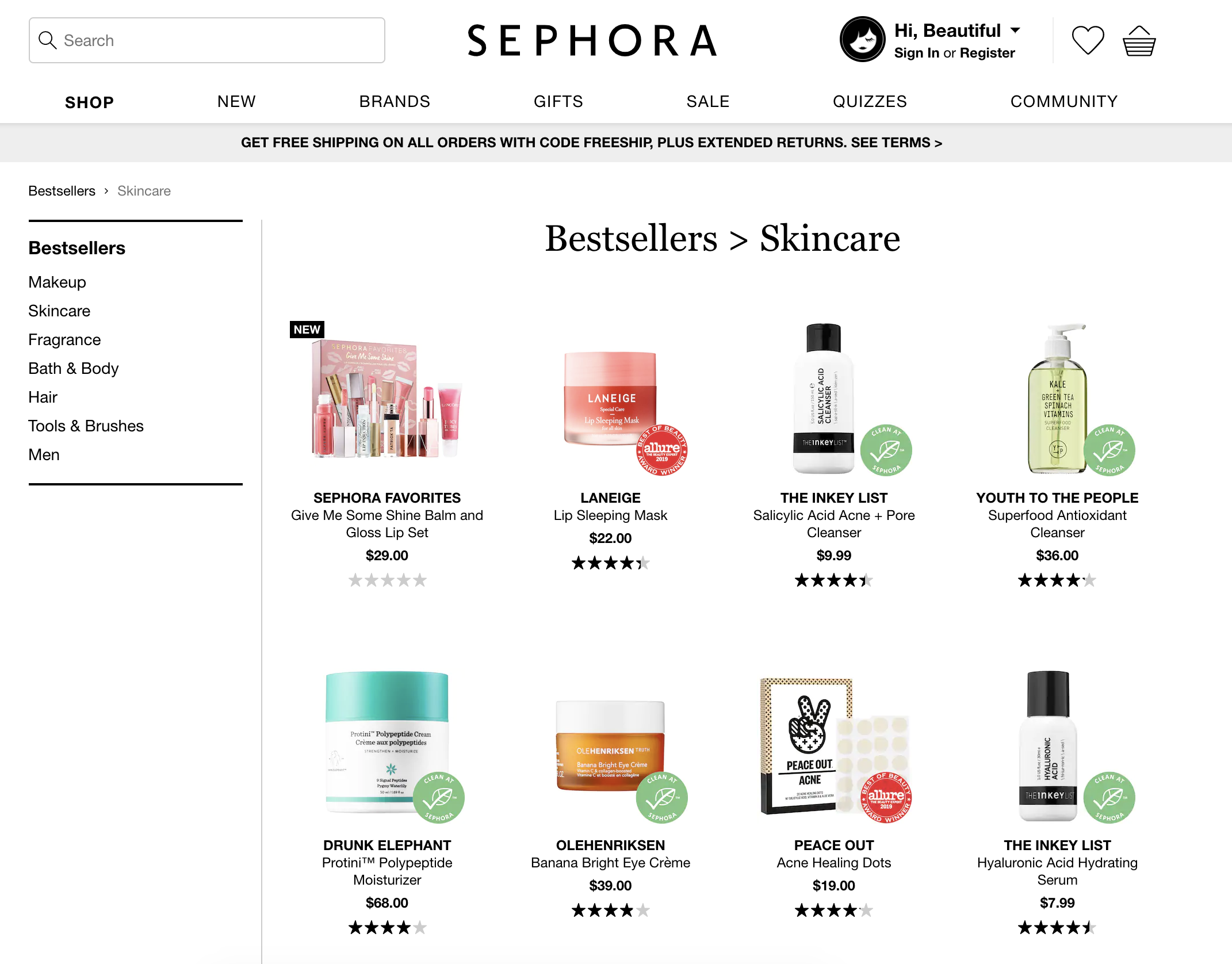

13. Clean out your home — you might already have exactly what you need.

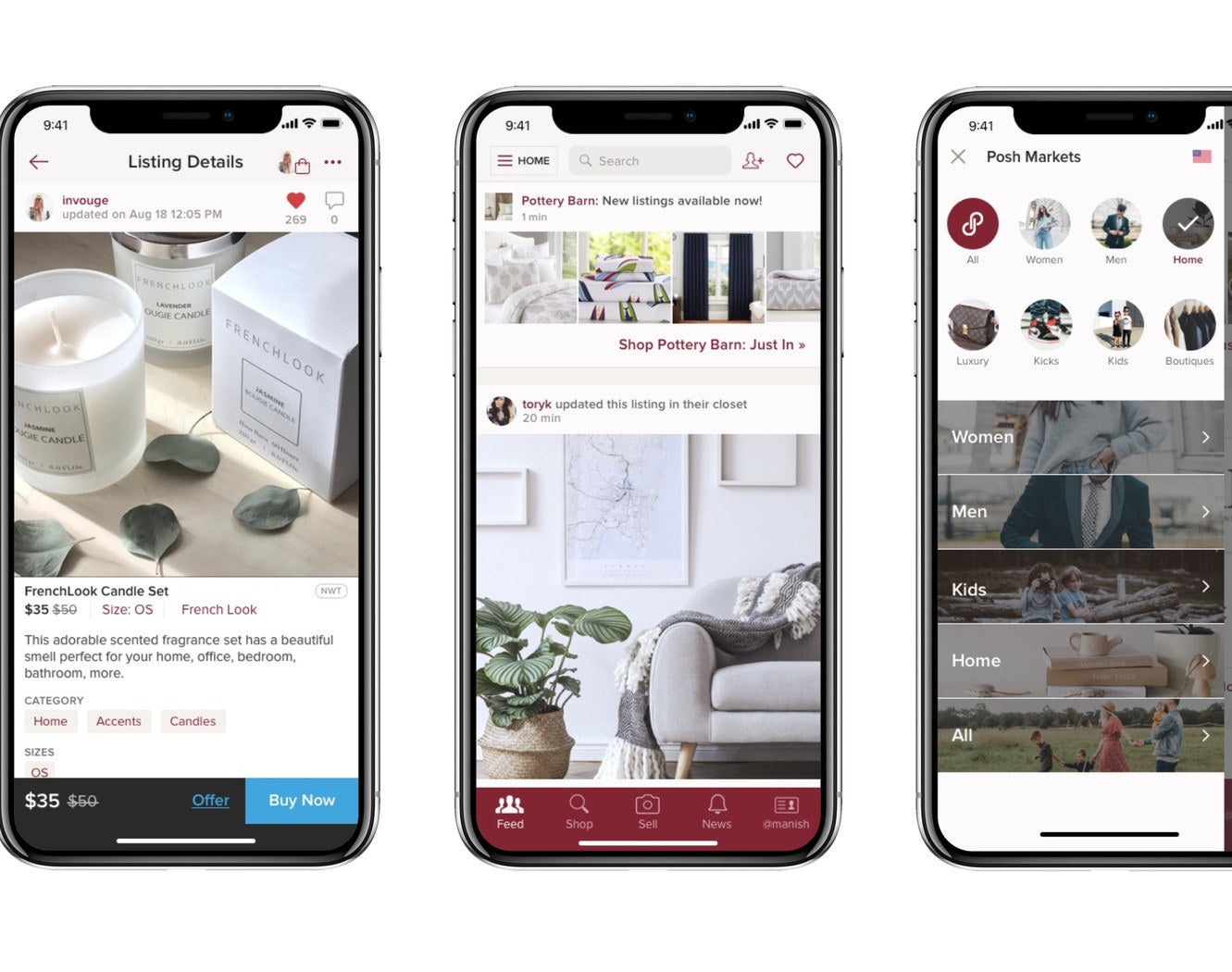

14. Think of what you can realistically sell right now.

15. DIY your own mini project in your home or apartment.

16. Make. Your. Own. Coffee.

17. Apply for a cash-back or rewards credit card.

18. Utilize free entertainment as much as you can.

19. Find personal, free gifts you can give people.

20. As restaurants, bars, and stores open up again, assess what you really need.