This is my attempt at making the mind-boggling process of choosing a cash-earning credit card super simple.

Before we get into it, here are just some basic credit card tips before you go opening a bunch of random credit card accounts.

- If you care about your credit score, don't just go randomly opening and closing credit card accounts. You'll want to research and tread carefully because closing accounts with credit history can damage your credit score. Here's a good article to read on how to avoid getting dinged from closing accounts.

- If you're not a responsible credit card user and are prone to overspending or making late payments, your cash back rewards will be minuscule compared to what the interest and late fees will end up costing you. That might sound obvious, but...wanted to get it out of the way. If you don't think you can handle the responsibility of paying on time, you might want to consider the Petal Visa card or the Apple credit card, both of which tout zero fees (no late fees, no annual fees, no foreign transaction fee).

Also, I'm not a financial advisor and can't guarantee how much money you'll actually end up making from signing up for these cards. I just love researching credit cards and trying to figure out how I can maximize my own returns.

All of the following credit cards have NO ANNUAL FEE and cost nothing if you are a responsible credit card user.

The example budgets and spending habits I give in this post are by no means meant to be a reflection of what you or anyone else is supposed to spend or make. All incomes and lifestyles are different — I chose easy round numbers so you can hopefully assess how much you could make back without having to bust out a calculator.

And just a disclaimer, this article was written April 16, 2019, so some credit card terms and bonuses may change.

1. The Citi Double Cash Card gives you 1% back on everything you spend, and another 1% back when you pay it off.

2. The Chase Freedom Unlimited gives you 3% cash back on everything you spend (up to $20,000) for the first year. After that, the cash back percentage goes down to 1.5%.

3. Another option is the Chase Freedom card, which gives you a $150 bonus after the first 3 months* of opening the card, 5% cash back in a pre-determined category that changes every quarter, and 1% cash back on everything else.

Here's what the calendar looks like so far.

4. The Discover it Cash Back card also gives you a whopping 5% cash back in a pre-determined category that changes each quarter. For your first year, they will DOUBLE your cash back amount at the end of the year. On top of that, you get 1% cash back on everything else.

For 2019, the categories are: grocery stores for Q1, gas stations/Uber/Lyft for Q2, restaurants for Q3, and Amazon.com for Q4.

5. The American Express Blue Cash Everyday Card gives you $200 after 3 months* of opening the card, 3% back on all groceries, 2% back on gas, and 1% back on everything else.

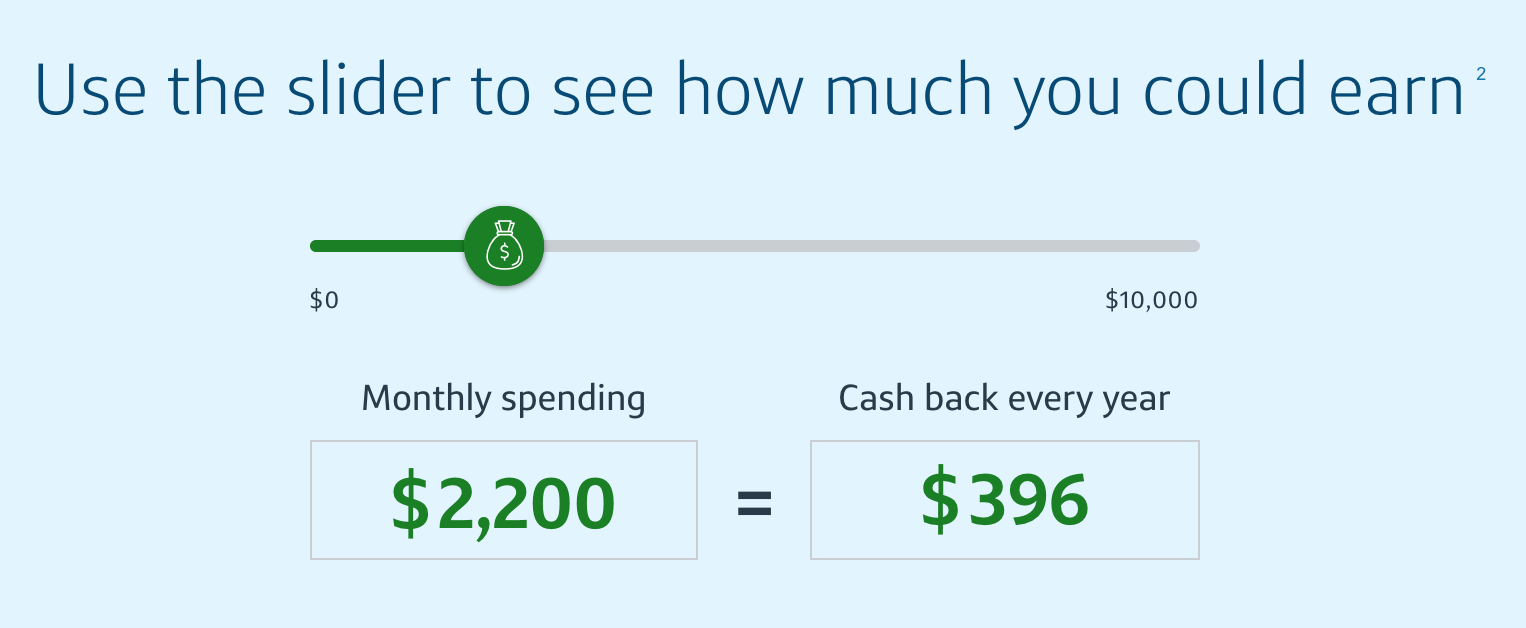

6. The Capital One Quicksilver card comes with a $150 bonus after the first 3 months* and 1.5% cash back on every single purchase.

There's actually this cool little earnings calculator on their site.

7. The HSBC Cash Rewards Mastercard is very similar to the Capital One Quicksilver. Same $150 bonus, same 1.5% cash back rate.

8. Then, of course, there's the Apple credit card, which won't be out until this summer, but features 3% back on Apple products, 2% back on Apple Pay purchases, and 1% back on purchases made with the physical card.

The Amazon Prime card isn't a cash-back card, but you can earn serious Amazon credit back if you're an avid Amazon/Whole Foods shopper. Enough to pay back your Prime membership and then some.

If numbers make your head spin, here's a little guide on which one you should choose depending on your lifestyle....

If you want that instant gratification aka free money fast, the American Express Blue Cash Everyday Card gives you the highest one-time bonus.

If you already have a great travel rewards card, the Chase Freedom and Discover it card each make great supplemental credit cards if you tend to spend a lot on groceries, gas, and restaurants.

If you just need an all-around great cash-back card and find all the categories a little too confusing, go for the Citi® Double Cash Card, the Apple credit card, or the Chase Freedom Unlimited.