We hope you love the products and services we recommend! All of them were independently selected by our editors. Just so you know, BuzzFeed may collect a share of sales or other compensation from the links on this page. Oh, and FYI, prices and rates are accurate as of time of publication.

Having a low credit score can be really stressful. Trust me, I know from experience. My score used to be in the "poor" range and it made necessities like applying for an apartment feel totally nerve-racking.

I've made some changes since then, and by cutting down my debt and paying my bills on time I've managed to bring my scores up to around 700, which is about the middle of the "good" range.

So if you have a low credit score and want to rebuild it, here are 14 things you can do starting today:

1. Make all of your credit and loan payments on time, every time.

2. Check for errors on your credit reports.

3. And see if you can get negative information removed.

4. Consider opening up a secured credit card.

5. Or look into getting a credit-builder loan.

6. Ask someone to cosign for you if you need to.

7. Ask a loved one with a higher score if you can be an authorized user on their credit card.

8. And work on lowering any credit card balances that you're carrying.

9. But don't close your credit card once you've paid it off.

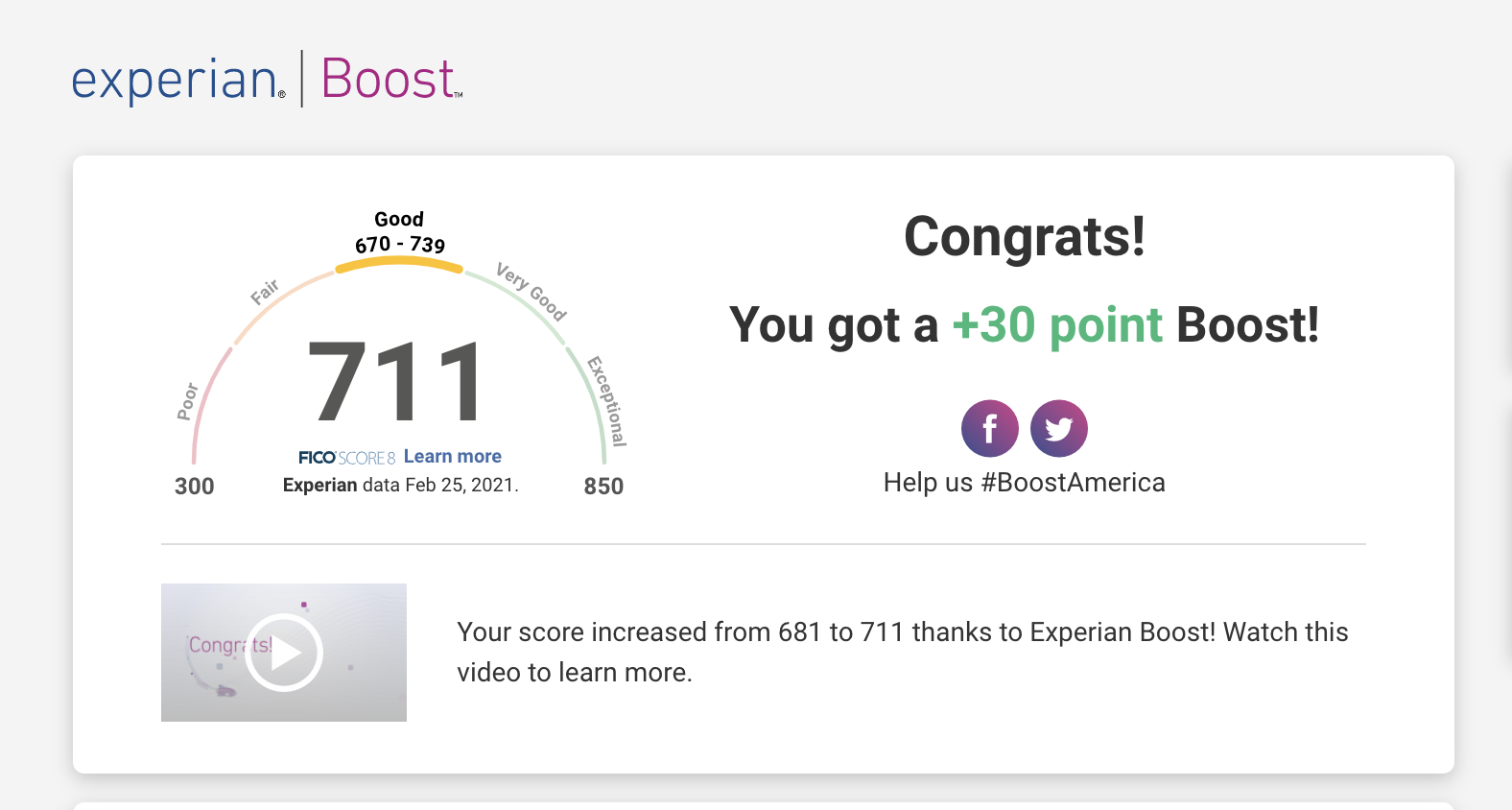

10. See if using Experian Boost to add your streaming subscriptions and utilities to your credit report will help your score.

11. If you work for an employer, see if they offer student loan repayment as a benefit.

12. But don't get too focused on paying off installment loans. Your score might actually drop when your loan ends.

13. If you have collections, make sure they'll actually be removed from your credit report before you pay them off.

14. And if you get a new collections notice that doesn't seem quite right, send a letter to verify it.

Is there something else that's helped you rebuild your credit score? Tell us all about it in the comments below.

And for more money tips and tricks, check out our other personal finance posts.