If you had told me in my 20s that I was going to become a personal finance writer and editor, I never would have believed it. Not in a million years.

After college, I lived in my hometown of San Diego and made between $30,000 and $36,000 a year working for call centers and start-ups. I was living paycheck to paycheck and was constantly stressed about money. Though I could generally cover all my regular monthly expenses, other bills like my car registration constantly caught me by surprise.

Then, after a layoff, I accepted a random freelance gig where I had to write about money. I had no idea what I was doing, but I needed the money, so I did some research and made it work. One gig turned into another gig, then another, and the next thing I knew, I was a thirtysomething personal finance writer.

I learned a lot about money really quickly, but changing my habits happened slower. It took me a few years to really put my new money knowledge into practice, which I think was the right pace for me. If I'd tried to change everything all at once, it probably wouldn't have worked, and I might have given up.

My finances are still a work in progress, but I've made these seven changes in my 30s that have really helped me feel more secure:

1. In my 20s, I avoided my finances as much as possible. I paid my bills and stuff, but I really only did the bare minimum and never planned ahead.

Now I tackle my finances head-on instead.

2. I used to have lower credit scores, which I also avoided looking at.

In my 30s, I've brought my credit scores up and started monitoring them.

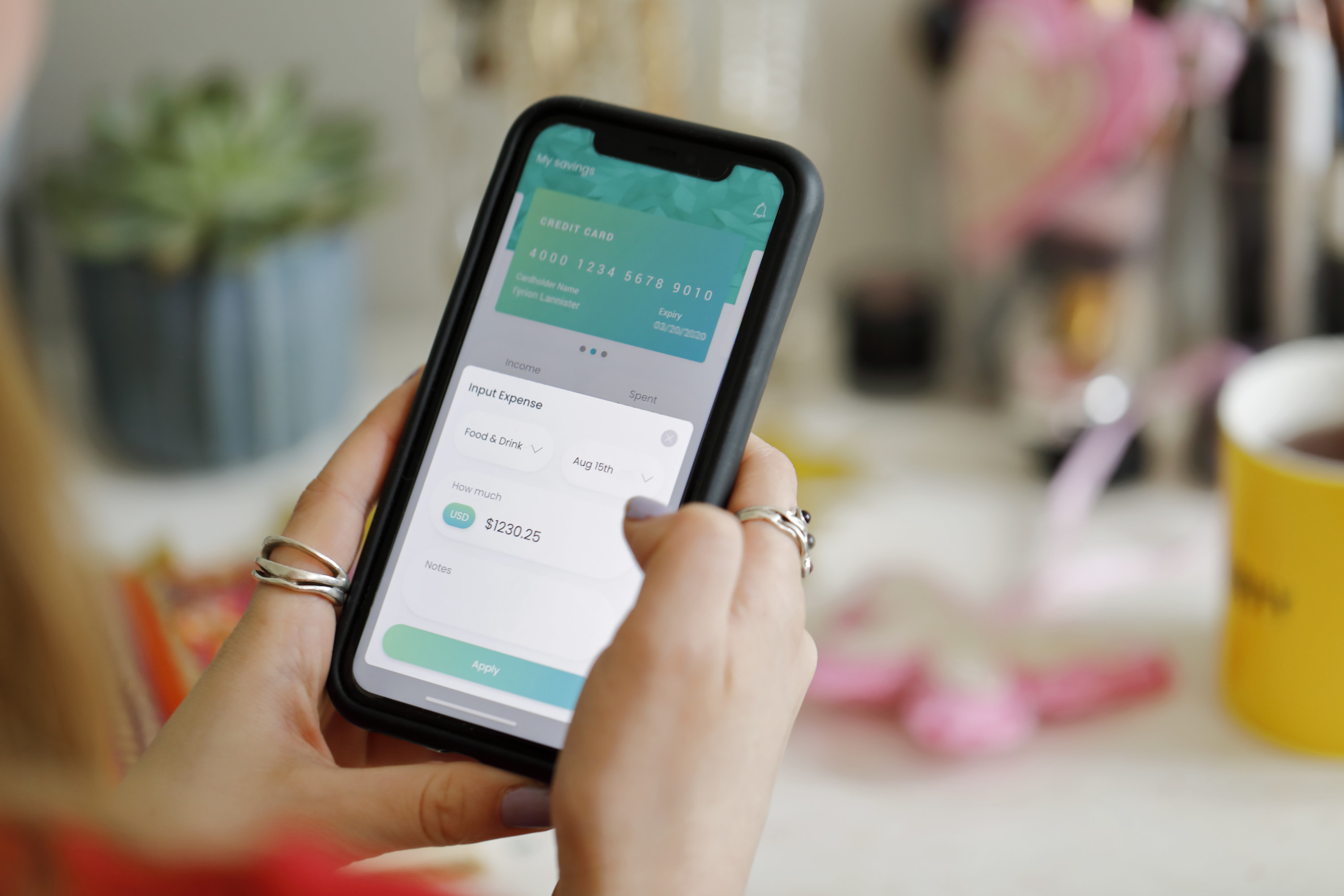

3. In my 20s, I wasn't strategic with my spending and just winged it week to week.

Now I track my spending, use a budget, and think a lot differently about my purchasing decisions.

4. I used to save random amounts of money at random times, and really struggled with growing my funds.

In my 30s, I've learned to pay myself first and save consistently.

5. In my 20s, I relied on debt to cover unexpected bills.

Now I'm growing my emergency fund so I can pay some surprise bills in cash.

6. I barely saved anything for retirement in my 20s.

Now I'm laser-focused on saving as much as I can for my future.

7. Finally, I used to use my debit card or cash for most of my purchases.

But in my 30s, I'm all about getting the most cash back I can with my credit card.

Becoming more financially literate has made a huge difference in my life, so it's super rewarding to be able to share what I've learned in conversations with friends and in my work.

But financial literacy is just one piece of the puzzle. There are also broader systemic issues that need to be addressed to make financial security accessible to all. Still, I think that being open about our money experiences helps us learn from each other by showing what really works and what doesn't.

Now I'm curious — if you're in your 30s, has the way you handle your money changed? Share your experiences in the comments.

And for more stories about life and money, check out the rest of our personal finance posts.