Carrying debt can be super stressful — not to mention expensive! From interest charges and finance fees to the penalties you face for making a late payment, you can find yourself paying *a lot* more than the amount you originally owed when it's all said and done.

So what can you do about it??? If you're in a position to start tackling debt, there are tons of ways to pay it down, and two of the most popular strategies are the debt snowball and debt avalanche.

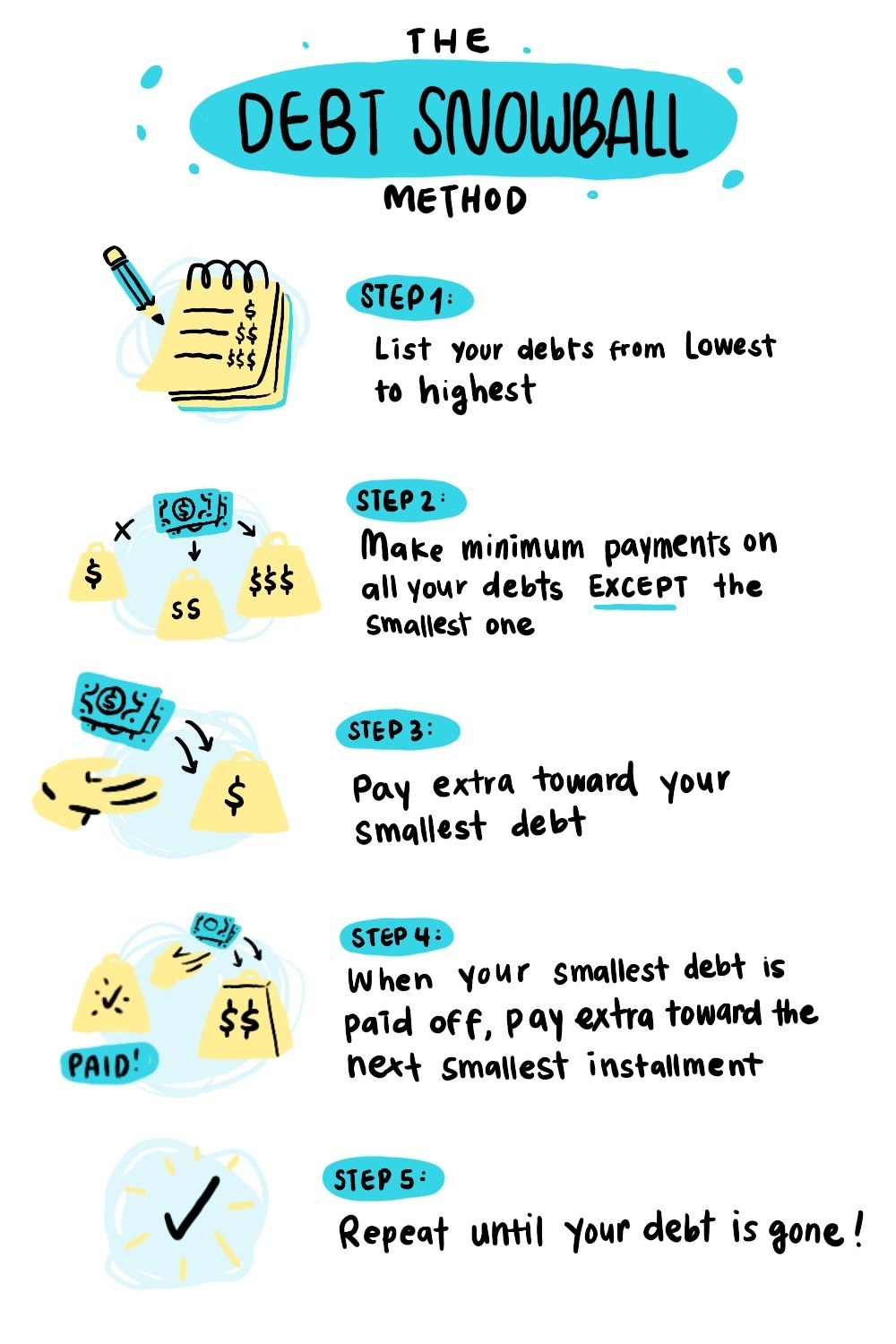

In a nutshell, the debt snowball method involves making minimum payments on all of your debts except the smallest one: You'll pay extra toward that debt and when it's paid off, you'll roll that extra money over to your next smallest debt and repeat until your debts are all gone.

To get your snowball started, make a list of all of your debts and rank them by amount from lowest to highest.

For this example, let's say you have three debts:

1. Medical bill on a payment plan: $1,000

2. Credit card: $1,500

3. Car loan: $5,000

Next, jot down your minimum monthly payment for each debt and add them up.

If your medical payment is $100 per month, your credit card's minimum payment is $60, and your car loan minimum is $150, then your total would be $310.

Now it's time to take a good, honest look at your budget and see how much you can afford to put toward paying off debt each month. To make real progress, this amount should be greater than the total of your minimum payments.

And here's where the magic happens: You're going to keep making minimum payments on all of your debts *except* for the smallest one. For that debt, you'll pay the minimum plus whatever extra cash you decided you can spare in the budgeting step.

So to start, you'll pay the minimums on your credit card and car loan, and pay $190 per month toward your medical bill until it's gone.

Once you've paid off the smallest debt, put the amount you were paying on it toward your next-smallest debt.

With your medical bill out of the way, you'll start paying $250 per month toward your credit card, while still paying the minimum on your car loan.

And when that debt is paid off, roll your snowball over to the next-smallest. By the time you reach your largest debt, you'll be putting your total debt budget toward paying it off.

This means in the end, you'd be putting $400 a month toward paying off your car.

The debt snowball method worked for me, but it might not always be the best choice for everyone.

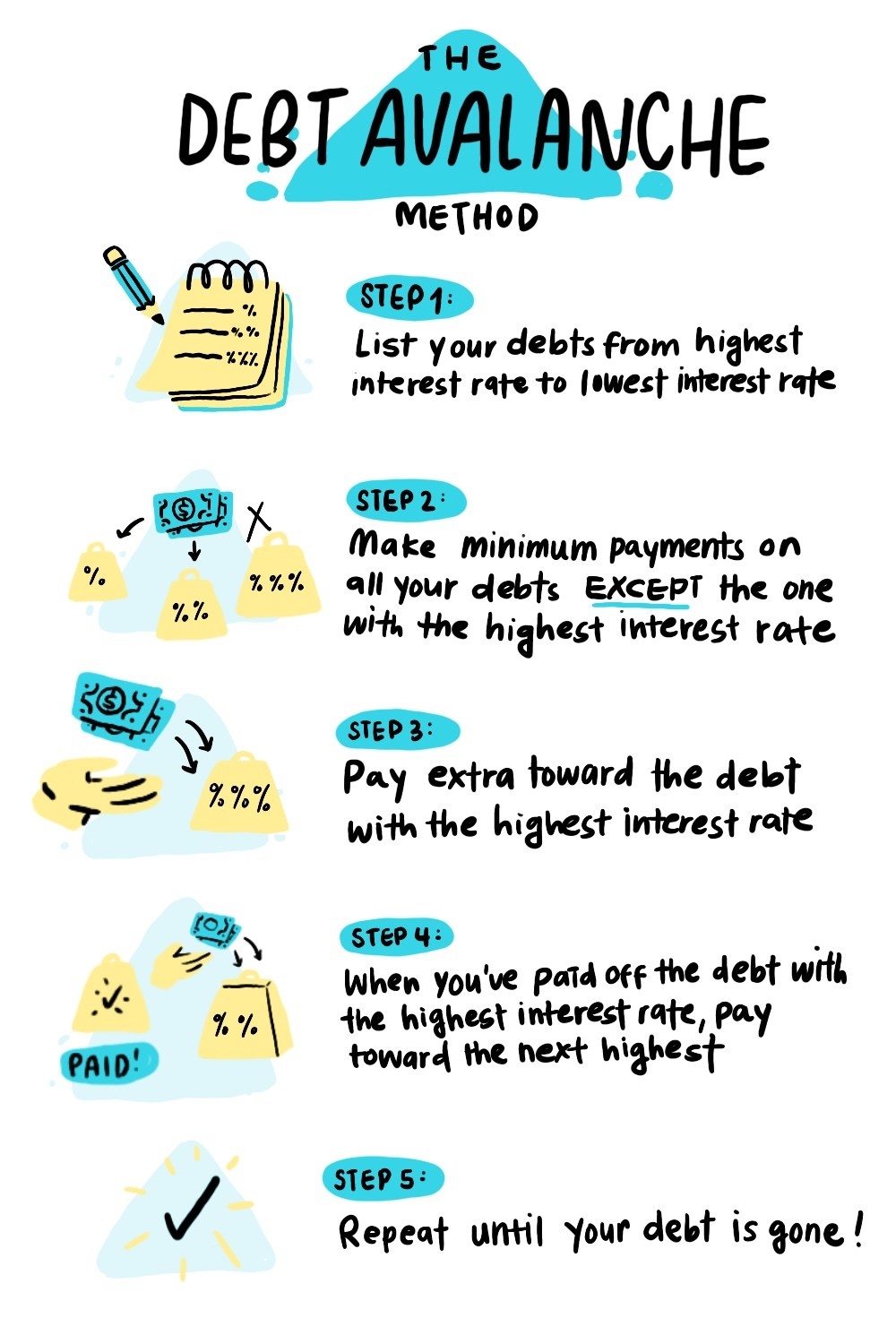

The debt avalanche method is almost exactly like the debt snowball; except instead of prioritizing your debts by amount, you'll tackle the one with the highest interest rate first.

Similar to the snowball, you'll start your avalanche by making a list of your debts. But this time, instead of ranking them by amount, list the interest rate on each and rank them from highest to lowest.

Let's say you're working with those same three debts, but this time we're ~interested~ in interest. Here's how your list might look:

1. Credit card: 20% interest, $60 minimum

2. Car loan: 6% interest, $150 minimum

3. Medical bill: 0% interest, $100 minimum

And just like the debt snowball, you'll add up your minimum payments and look at your budget to see how much you can afford to put toward debt each month.

To keep things easy, let's say $400 again.

But this time, you'll tackle the debt with the highest interest rate first. I'm looking at you, credit card.

So you'll pay the minimum on your car and medical bill and put $150 (that's the minimum payment plus the extra $$ you budgeted for) toward your credit card debt.

And once that debt is paid off, it's time for the avalanche to wipe out your debt with the next-highest interest rate, and so on.

It can take a little longer to completely eliminate one of your debts with this method, BUT tackling high-interest debt first means that you'll end up paying less in the long run to get debt-free.

The debt avalanche method can be a powerful plan to knock out debt; but just like the debt snowball, it has positives and negatives.

Whatever debt repayment method you choose is totally up to you. If spending less on interest charges sounds good, then the avalanche might suit you to a T. Or if you (like me!) need the extra motivation of seeing one of your debts disappear sooner, then the snowball could do the trick.

Do you have a genius tip for getting rid of debt? Tell us all about it in the comments below!

And for more money tips and tricks, check out our other personal finance posts.