We hope you love the products and services we recommend! All of them were independently selected by our editors. Just so you know, BuzzFeed may collect a share of sales or other compensation from the links on this page. Oh, and FYI, prices and rates are accurate as of time of publication.

Making a budget (and actually sticking to it) is pretty standard financial advice for a reason — it works! But if you're newer to budgeting, figuring out how much you can afford to spend on each category can get kinda tricky.

If you're not sure where to begin, the 50-30-20 could be a great jumping off point.

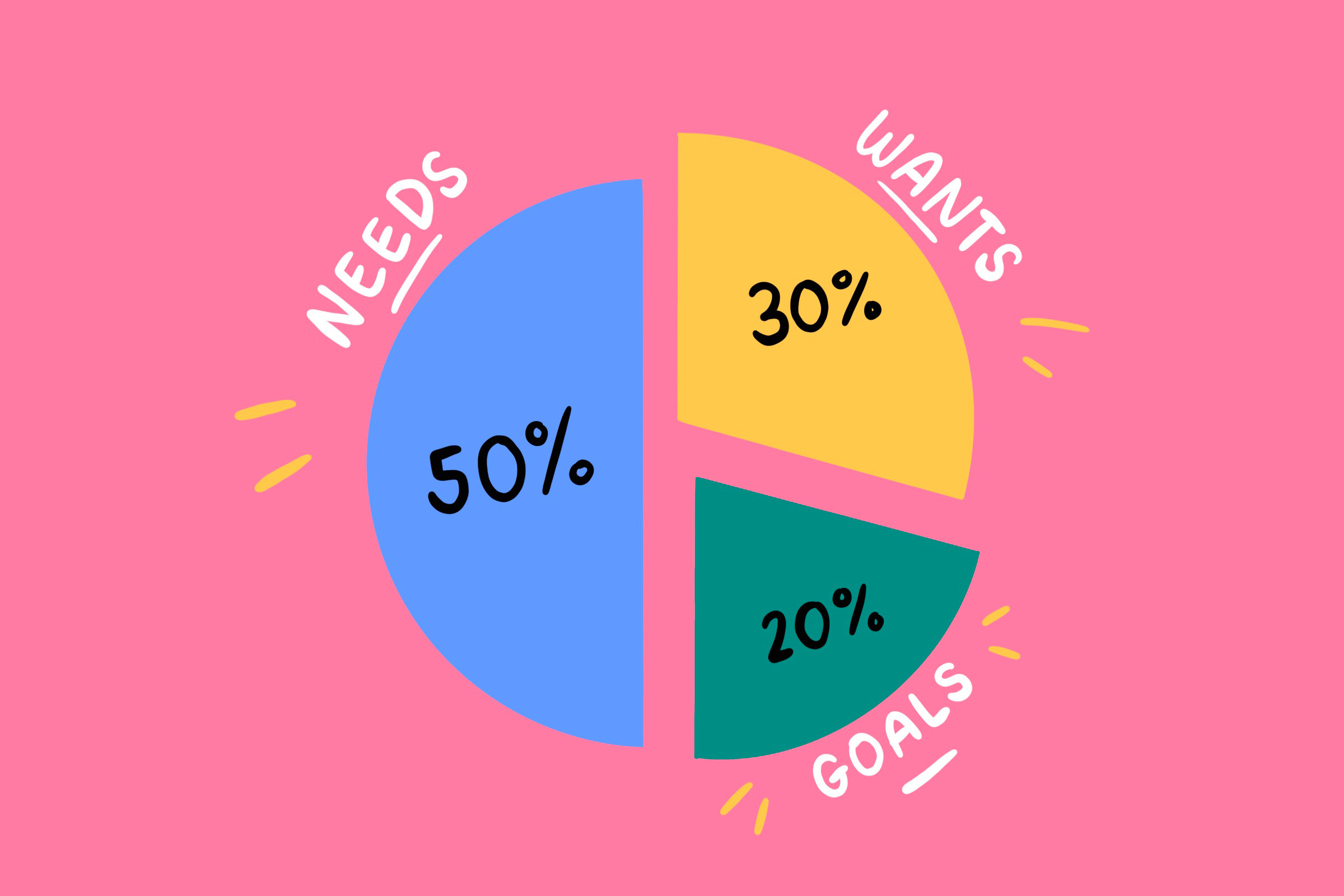

Using this budgeting rule, you'll divide your income into three categories: needs, wants, and goals. Here's how to do it in 4 pretty simple steps:

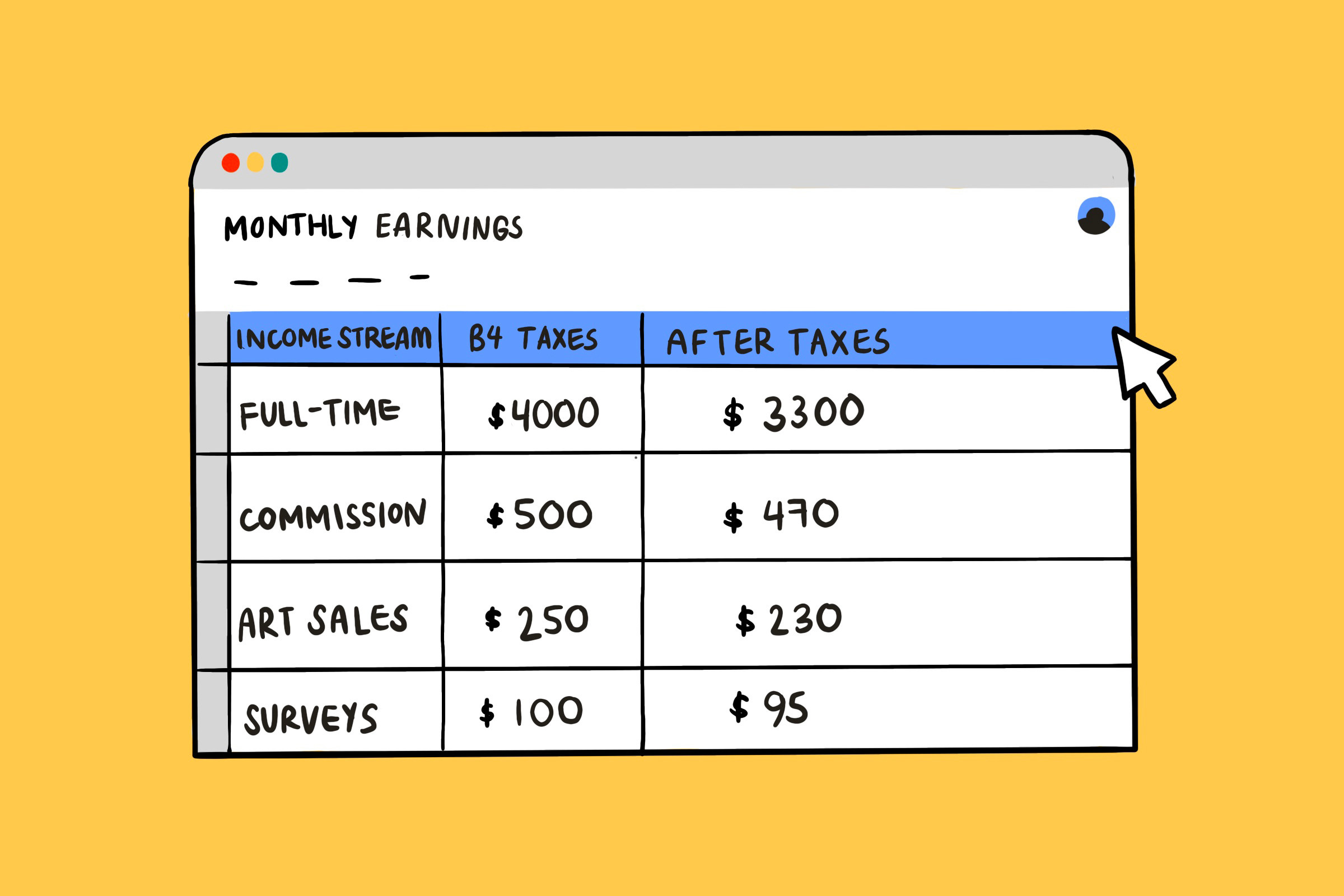

Step 1. Figure out how much take-home pay you're earning every month.

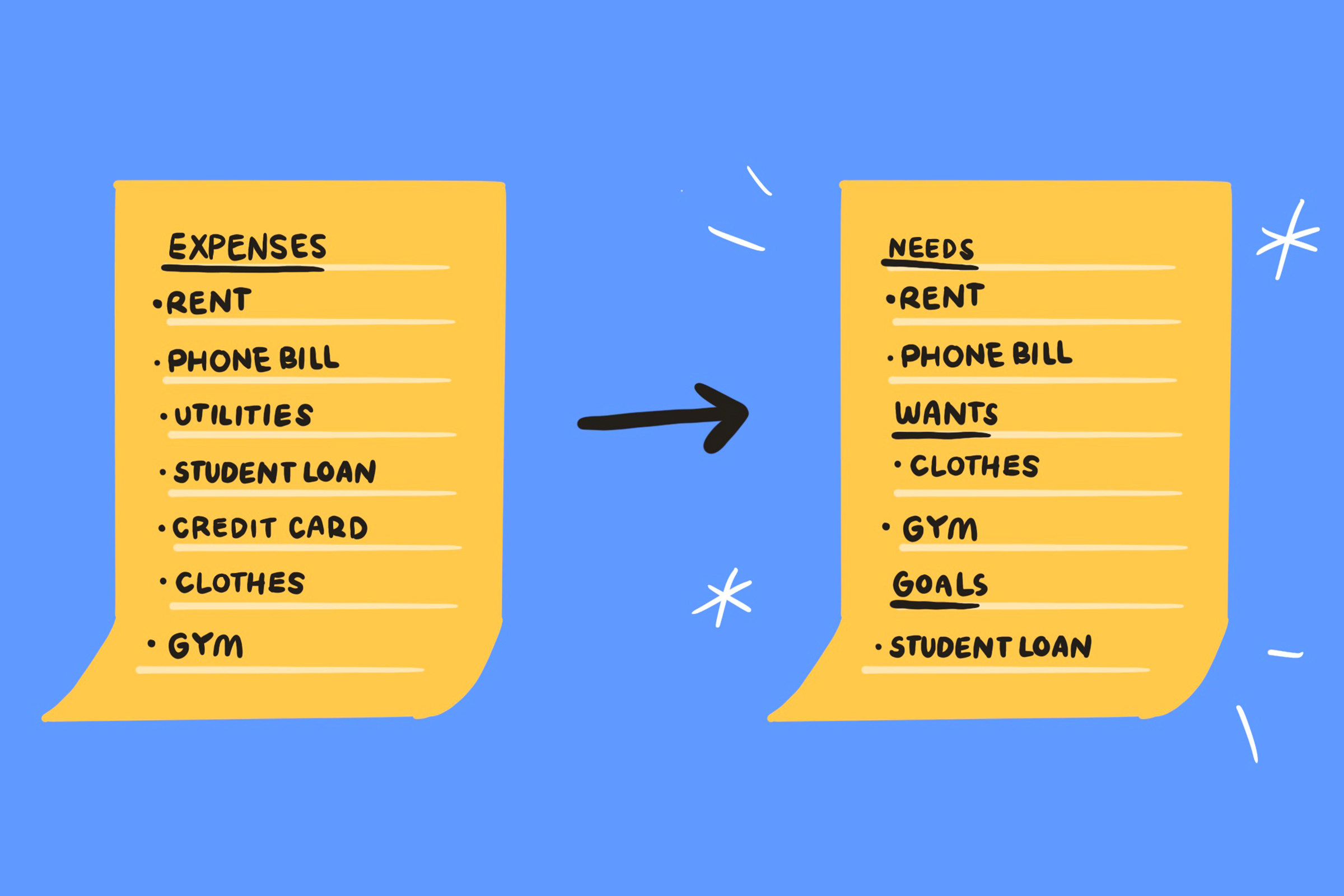

Step 2. Make a list of your expenses and divide them into needs, wants, and goals.

Step 3. Divide your income into three buckets, putting 50% toward needs, 30% toward wants, and 20% toward your goals.

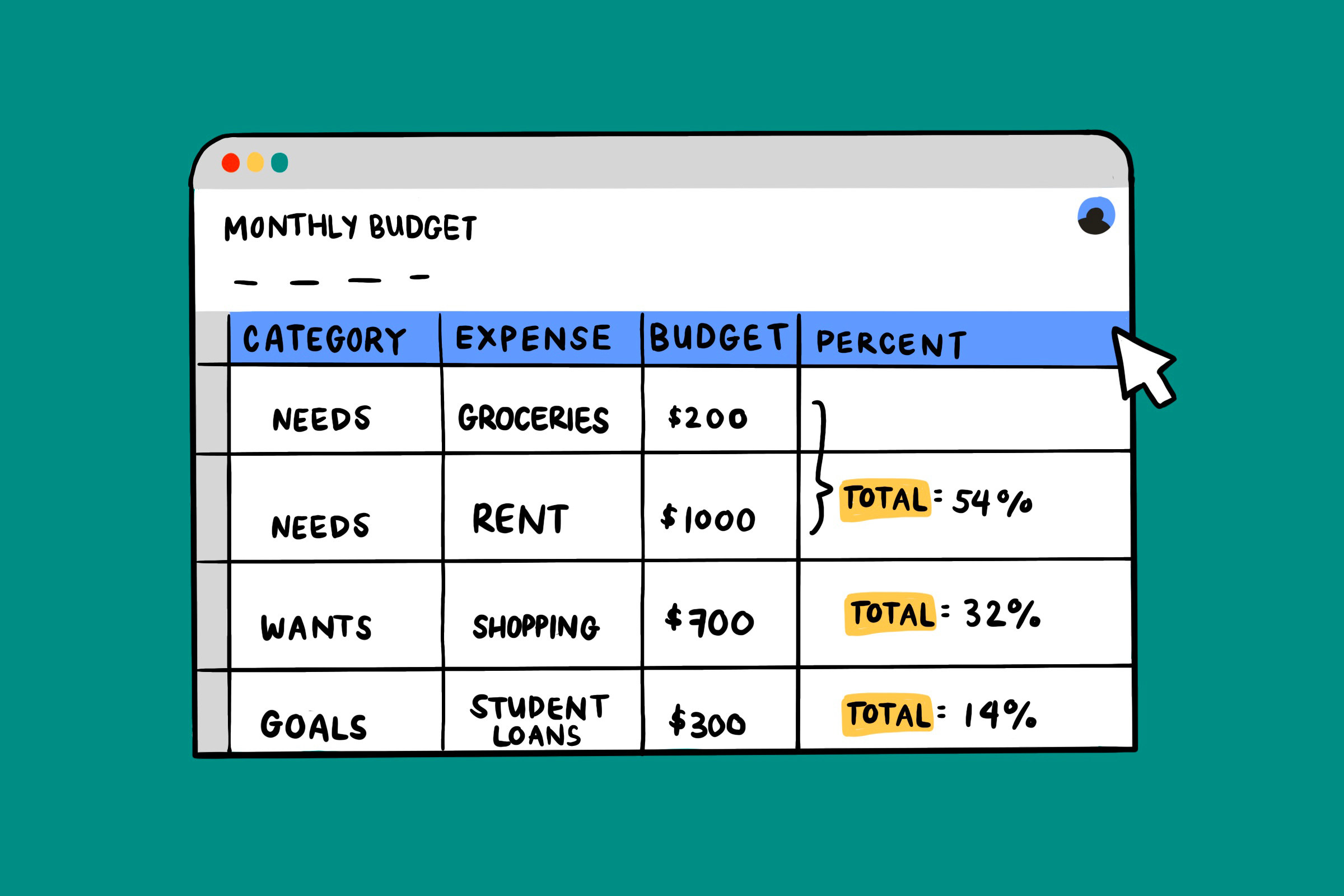

Step 4. Add up your expenses in each category, check them against the totals for each bucket, and adjust the percentages if you need to.

One great thing about the 50-30-20 rule is that it works with tons of different budgeting tools. Whether you use a budgeting app like Simplifi, plug your numbers into a spreadsheet, or write it out on some scratch paper, it's a super easy framework to help you get started.

Have you figured out a budgeting system that works for you? Share how you make a budget (and your tricks for sticking to it) in the comments below!

And for more money tips and tricks, check out the rest of our personal finance posts.