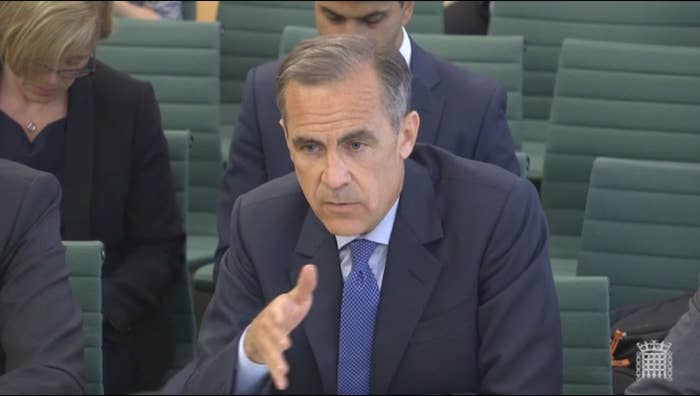

Mark Carney, the governor of the Bank of England, has defended warnings he gave in the lead-up to the EU referendum of the impact a Leave vote would have on the economy.

Appearing before the Treasury select committee on Tuesday morning, Carney rejected accusations that he had been "peddling phoney forecasts" and "scare stories" after many on the Leave campaign had accused the Bank of being biased during the referendum.

Carney's colleagues pointed out to MPs that many of the central bank's post-Brexit forecasts had subsequently played out as markets, households, and businesses suffered what Carney has previously called "a form of economic post-traumatic stress disorder".

In a heated exchange with Tory MP Jacob Rees-Mogg, who has previously called on the governor to resign, Carney said: "I think those who cast [our impartiality] into question should consider their motivations and their judgments."

But Rees-Mogg said: "Like Caesar's wife, the BoE should be above suspicion."

Committee chair and Conservative MP Andrew Tyrie said two former Tory chancellors and two former party leaders – Lord Lamont and Lord Lawson, Iain Duncan Smith and Lord Howard – had accused the bank of "startling dishonesty".

Tyrie added: "I think this allegation is a very serious one. The allegation, in a nutshell, is there has been a deliberate attempt to frighten the voting public by the bank with a political motive.

"If this is true it seems to me that is pretty much the end of the bank's independence we've had since 1997 and it certainly can't be recovered by this governor and it probably can't be regained by the Bank of England for many years.

"It is the duty of this committee to substantiate these claims or to demonstrate that they need to be set aside."

MPs were keen to find out what conversations Carney had with chancellor George Osborne in the build-up to the referendum and whether he was influenced.

Carney disagreed that he was being influenced, saying: "It's important the chancellor and the governor should have private conversations." However, after a prolonged line of questioning, he agreed to share notes from private meetings with Osborne before the referendum with the committee.

On whether he was being influenced, the governor said: "Have there been efforts to influence me in my roles as governor of the Bank of Canada [his previous job] and the Bank of England? No. There have been efforts to inform me in those roles."

Carney said: "The views are not based on whim and prejudgment but on careful analysis and assessment. We have an obligation to make these assessments. If we view something as the biggest risk to financial stability, we have an obligation to parliament and to the people of the UK to make that clear.

“You can debate whether we made the right assessment, that’s a different discussion, but not whether we should have made an assessment.”

During the session, the Bank of England governor also urged households to make sure they have enough money to survive a hypothetical rise in interest rates.

Interest rates have been at 0.5% for the last eight years, and could be cut to 0.25% on Thursday following the referendum vote last month. But economic experts have already predicted that interest rates could rise in the longer term, if inflation rises or a housing crisis is triggered and people want to take their money out of the banks.

Carney said: "Think about a stressed interest rate 3 percentage points higher than it is today and think about your ability to service debt if that were to happen.

"Now, we recognise in this environment it seems relatively unlikely, but it's a good way a good way to think about a potential shock to income or disappointment on future income. Just have enough headroom to ensure that if times become more difficult they are comfortable with that."

On a typical mortgage of £190,000, monthly payments are currently £922. If interest rates hit 3% the homeowner would need to find an extra £281 a month.

The committee wanted to know whether the Bank of England would be giving strong financial forecasting at the next general election like it did before the vote last month, but Carney said the EU referendum was a much bigger event than an election.

He admitted that the current financial hits – which have seen the pound plunge against the US dollar and shares on banks and housebuilders drop – are short-term and it will be up to the government to implement changes to affect the economy in the long term.