The governor of the Bank of England has given the strongest indication yet that interest rates could be cut next month as the fallout from the UK’s decision to leave the EU continues to take hold.

Mark Carney also called on politicians in Westminster to stop bickering and start coming up with some plan for the future to help investors and households understand what the impact of a Leave vote will mean for the country in the years to come.

He said:

“All this uncertainty has contributed to a form of economic post-traumatic stress disorder amongst households and businesses, as well as in financial markets."

His comments sent the FTSE 100 up to a 10-month high, but this is thought to have more to do with the fact most businesses in the index are focused overseas, trade in US dollars, and do not use the UK as their main business hub.

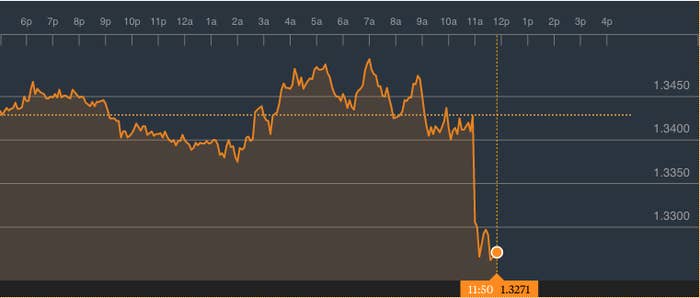

The FTSE 250, which has more UK-focused businesses, did rise too, but is still 6% down on pre-referendum levels. One pound is worth $1.32 – it was $1.50 a week ago.

Carney added: “In order to have confidence and plan for the future, financial institutions, like the rest of us, desire certainty.”

Interest rates are currently at 0.5% but the suggestion is that these could be cut to 0.25%. Carney added: “In my view … the economic outlook has deteriorated and some monetary policy easing will likely be required over the summer."

He said: “In the coming weeks we will estimate the extent of the deceleration as we formulate our August projections.”

This could also include printing more money to pump into the economy (quantitative easing), in the same way the central bank did after the financial crisis in 2008.

He did not say Britain would slip into a recession – something several banks have suggested – but he was particularly gloomy on what is to come, comparing the economic fallout to 9/11, the Arab Spring, and an outbreak of conflict in Ukraine.

However, Carney did attempt to calm the markets by reminding institutions that all the rules governing banks remain the same as they were before the referendum.

He said: “Nothing in financial regulation has changed as a result of last week’s referendum. It will not change until the process of the UK’s withdrawal from the European Union is complete, until the UK is no longer a member of the EU, and until EU law ceases to have effect in the UK. The law is the law. Rules are rules.”

Warning that the slowdown had already started before last week's referendum result, he pointed out that several parts of the economy are suffering.

Even before 23 June, we observed the growing influence of uncertainty on major economic decisions. Commercial real estate transactions had been cut in half since their peak last year. Residential real estate activity had slowed sharply. Car purchases had gone into reverse. And business investment had fallen for the past two quarters measured…

It now seems plausible that uncertainty could remain elevated for some time, with a more persistent drag on activity than we had previously projected.

Mark Carney once again talking down Britain

Before the referendum, Carney had been attacked for being too pessimistic about what the fallout from a Leave vote would be, but on Thursday he said he believed the severe consequences he predicted would play out.

He added: "Over the coming weeks, the Bank will consider a host of other measures and policies to promote monetary and financial stability.

"In short, the Bank of England has a plan to achieve our objectives, and by doing so support growth, jobs, and wages during a time of considerable uncertainty.

"Part of that plan is ruthless truth-telling. And one uncomfortable truth is that there are limits to what the Bank of England can do."