BHS, one of the biggest names on the high street, has gone into liquidation after a two-month search to find a buyer for the business failed.

Eleven thousand jobs at the retailer are now likely to go, the administrator announced. Eight thousand of these are BHS employees, and a further 3,000 are employees of concession stores within the company.

The chain fell into administration in April after being sold by Sir Philip Green – whose retail empire, Arcadia Group, includes Topshop, Miss Selfridge, and Dorothy Perkins – to former racing driver Dominic Chappell for £1 last year.

The administrator, Duff & Phelps, had hoped to find a buyer but the search failed and staff were informed today that although multiple offers were received, none were able to complete a deal to secure the future of the company.

The news marks the end of an 88-year history for BHS, which will now disappear from the high street as all 163 stores are closed and sold off.

Philip Duffy, managing director of Duff & Phelps, said BHS was "another victim of the seismic shifts" in retail.

He thanked the employees and said: "The tireless work and goodwill of the existing management team and employees of BHS with the support of my team were not enough to change the fortunes of the company."

Chappell purchased BHS, which was founded in 1928 and bought by Green in 2000, in March 2015 through an investment vehicle called Retail Acquisitions.

Chappell was, at the time, a little-known investor and former racing driver who had been bankrupt three times. After poor Christmas trading, Chappell called in administrators in April 2016, leaving BHS with a £571 million pension deficit and 11,000 jobs hanging in the balance.

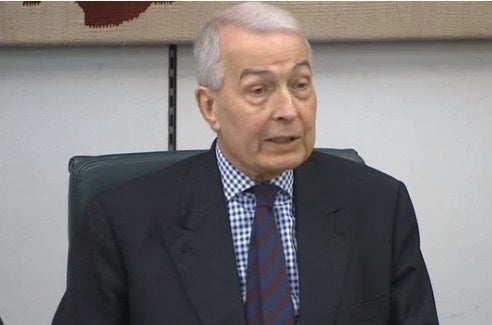

The collapse of BHS has already faced intense scrutiny from MPs as part of a joint inquiry by the the business, innovation, and skills and work and pensions committees, led by Frank Field MP and Iain Wright MP.

The committees launched the inquiry last month, hauling several BHS and Retail Acquisitions advisers, as well as the BHS pension trustees and the Pensions Regulator, to parliament for questioning.

Over the course of several hours of questioning across three sessions it emerged that Arcadia Group finance director Paul Budge had been made aware of Chappell's bankruptcy but that the business believed there was a "credible" business plan.

Investment bank Goldman Sachs also said it had warned Arcadia there were "risks" attached to the proposed sale to Chappell before it went ahead.

Lord Anthony Grabiner, chair of Arcadia owner Taveta Investments, was also questioned by MPs after he admitted he had not been central to key meetings discussing the sale of BHS, though he insisted he had acted as a responsible chairman.

Questions were also raised over plans by Arcadia to halt a pension restructuring scheme in 2014 before selling the business to Chappell.

MPs Iain Wright and Frank Field grill BHS advisers and staff over the collapse of the business.

As part of a proposal called Project Thor, BHS had planned to restructure the pension scheme in a bid to give workers a more attractive offer than if the scheme was bailed out by the Pension Protection Fund.

But these plans were put on hold indefinitely in September 2014, before Arcadia announced the sale of the business.

The sale of BHS is also the focus of a separate investigation by the Pensions Regulator, which told MPs it only heard about the sale of BHS "in the newspapers" – something Arcadia Group denies.

The regulator, which faced having to cough up £275 million to plug the deficit, is going through 70,000 documents as part of an anti-avoidance case that seeks to establish whether there was proper provision in place for the pension, and whether it can call on Green to contribute to the bailout.

The collapse of BHS is also the subject of an Insolvency Service investigation and an examination by Serious Fraud Office, which is looking into the case but has not at this time announced a formal investigation.

The saga will continue next week when Chappell is hauled before the committees. Two property tycoons who loaned Chappell the funds to purchase the business will also face questioning for their part in the purchase of the company.

And Sir Philip Green is set to face a grilling from MPs later this month on 15 June.