The Bank of England decided to keep the base interest rate at a historic low of 0.5% on Thursday, but warned that consumer and business confidence in the economy was starting to fall, three weeks after the EU referendum vote.

The bank's nine-person monetary policy committee (MPC), which is independent of the government, voted 8 to 1 to maintain the Bank rate at 0.5%.

The only member of the panel to vote for a cut was Belgian economist Dr Gertjan Vlieghe, who wanted a 0.25% cut. Mark Carney, the bank's governor, who had hinted strongly that his personal preference was for a cut, voted to keep the rate unchanged.

Carney heavily suggested a week after the EU referendum that the bank would cut the rate to provide some stimulus to wavering markets this summer.

But the MPC said in a statement on Thursday that a rate cut was now likely to happen in August, once it had seen more evidence of the effects of the referendum vote.

"Committee members made initial assessments of the impact of the vote to leave the European Union on demand, supply and the exchange rate," it said.

"In the absence of a further worsening in the trade-off between supporting growth and returning inflation to target on a sustainable basis, most members of the Committee expect monetary policy to be loosened in August."

The bank said that already "some businesses are beginning to delay investment projects and postpone recruitment decisions".

The rate has now been unchanged since 2009, when the UK was in recession.

My fave chart on the planet. BOE base rate since 2009. https://t.co/QXp1ErK9GW

Scotia Bank's Alan Clarke accused Carney of "teasing" the market with a prediction of a rate cut at a time when the weakness of the pound made a cut unwise.

"As if the situation wasn't volatile enough, the BoE governor poured petrol on the flames," Clarke said. "This was a completely unnecessary intervention."

Governor Carney "decided to tease the market" - Scotia Bank's Alan Clarke

The Bank previously announced it was relaxing banking regulations so that up to £150 billion can be lent to households and businesses.

OK, but what actually is an interest rate?

The Bank of England charges commercial bodies a set rate for parking their cash in it overnight – this is known as the official Bank rate, "base rate", or just "the interest rate" in everyday language.

Financial institutions, the kind that might lend you money to buy a house, use Bank rate as a guide for the interest they should charge customers for their products, normally expressed as an annual percentage rate (APR).

Retail banks don't have to change the interest rates they charge as a result of Bank rate changing, however.

Why does any of this matter?

Short version: Because it's a way to make the sure the economy is healthy. But the effects of any change (or the absence of change) won't be immediate.

The markets had already priced in a rate cut, thanks to Carney's June statement, so they will have to do some readjusting until August, when a cut is likely.

One group that would have benefited straight away from a rate cut are people with tracker mortgages, which (normally for a limited period) charge an APR based on Bank rate.

The Council of Mortgage Lenders said someone with a mortgage at the average amount of £114,000 would save £15 as a result of a 0.25% cut.

So is cutting interest rates...a good thing?

In some ways, yes. But even if Bank rate goes down in August, it could rebound sharply next year and there is a risk some households won't be prepared for the higher cost of borrowing in future, particularly when it comes to mortgages.

Carney told a parliamentary committee this week that people should consider what would happen – and ask whether they can afford their loans – if Bank rate climbed to a hypothetical 3.5%.

This would mean – if a lender was to pass on the full increase to customers – that monthly payments on a typical mortgage of £191,000 would be £281 higher a month.

Speaking last week, Carney said: "So you want to make sure as a family, as an individual, that you’ll be able to service that mortgage if times are tough; you don’t want to lose your flat, your home."

There's also a risk that cutting Bank rate could further devalue the pound, which reached a 31-year low against the dollar after the referendum.

Accordingly, sterling jumped significantly on Thursday after the interest rate remained at 0.5%.

Look what happened to the pound after Bank of England held interest rate https://t.co/fRdeUUqYCZ

The reaction from business to today's decision was muted, with businesses concluding that the Bank may have already done enough to calm markets after the referendum.

Miles Gibson, head of UK research at property firm CBRE, said: "Following the referendum result, the Bank of England had already made reassuring noises to the market so the MPC may have felt nothing more was required for now, especially given the stimulus effect of a devalued currency.

“It is likely that the bank wants to wait for more hard data on how the economy is performing before taking action. "

Nancy Curtin, chief investment officer at Close Brothers Asset Management, said: "Increased political clarity has lessened the immediate need for the Bank of England to leap into action, as markets have calmed. Clarity over the next prime minister has already soothed markets, and further signs of action should have a similar effect."

But what do the experts think about the state of the economy generally?

Not great. What most experts agree on is there will be a slowdown in GDP growth in the next 12 months.

Scott Corfe, director of the Centre for Economics and Business Research, said the immediate economic picture was gloomy and that it was unlikely interest rates would rise back to where they were in the 1990s and 2000s.

"The bank rate is going to remain low for a very long period of time," he said. "Even when rates do start to rise, the pace of increase will be very gradual. In our view, in 10 years time, the new normal is going to be something like 2%, much lower than what you saw before the [2008] financial crisis."

"The economy is going into very uncertain times. We think growth is going to slow dramatically in the short term and grow by 0.5% next year. Further afield the effects of Brexit are more debatable but certainly over the next two years I expect a weak economic environment."

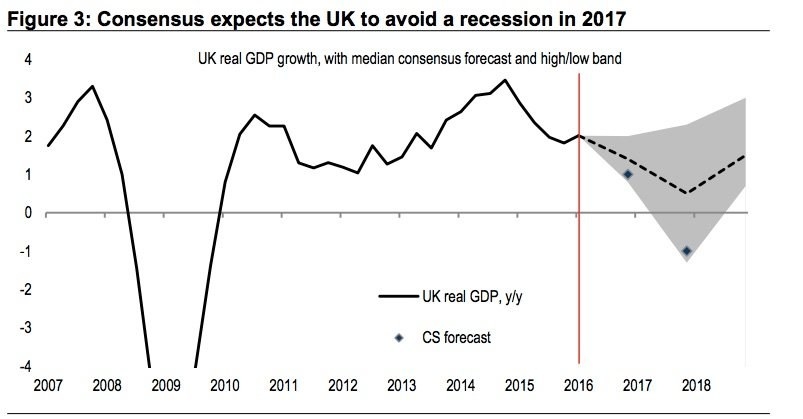

The investment bank Credit Suisse said on Wednesday that GDP would shrink by 1% in 2017. The bank said that the consensus view among analysts – that there will be 0.5% growth – was too optimistic.

Credit Suisse said the growth in job vacancies and survey data from big private sector companies "were already consistent with a mild recession".

But whether this happens is determined by the actions of domestic and foreign investors, as well as individual households. As Carney puts it: "One uncomfortable truth is that there are limits to what the Bank of England can do."

Will there be a housing crash?

Everyone who owns a house is hoping not, but the figures are suggesting a big fall in prices sometime soon.

The MPC said on Thursday, when announcing the rate freeze: "Regarding the housing market, survey data point to a significant weakening in expected activity."

The Royal Institute of Chartered Surveyors said on Thursday – in one of the first signs of a post-referendum property slump – that prices would dip in London, the South East of England, and East Anglia this year.

Data | 12-month house price expectations lurch into negative territory: https://t.co/e7I4hQxeQt #RICSresi #UKhousing

Of the RICS members who took part in a survey, 45% reported fewer properties being put on the market in June this year compared to June 2015, the sharpest fall since 1998. And 36% said the number of inquiries from new buyers had dropped, the biggest decrease since 2008.

The inherent risks in the housing market are significant. Ratings agency Moody's pointed out on Thursday that if house prices fall by one fifth, 9% of the country's mortgage holders would fall into negative equity – meaning their home would be worth less than the outstanding value of their mortgage.

Homeowners in the north of England are the most exposed to this risk, according to Moody's analyst Steve Becker.

London house prices may be inflated, but the real problem is what happens in the north if prices fall - Moody's