Raise your hand if you or someone you know uses their phone to manage their finances.

Money management apps help us take control of our budgets, spending, debt, and even retirement (no professional needed). But since there are so many to choose from, we asked members of the BuzzFeed Community — and consulted experts — to find out which finance apps are actually worth your time.

Here are their picks:

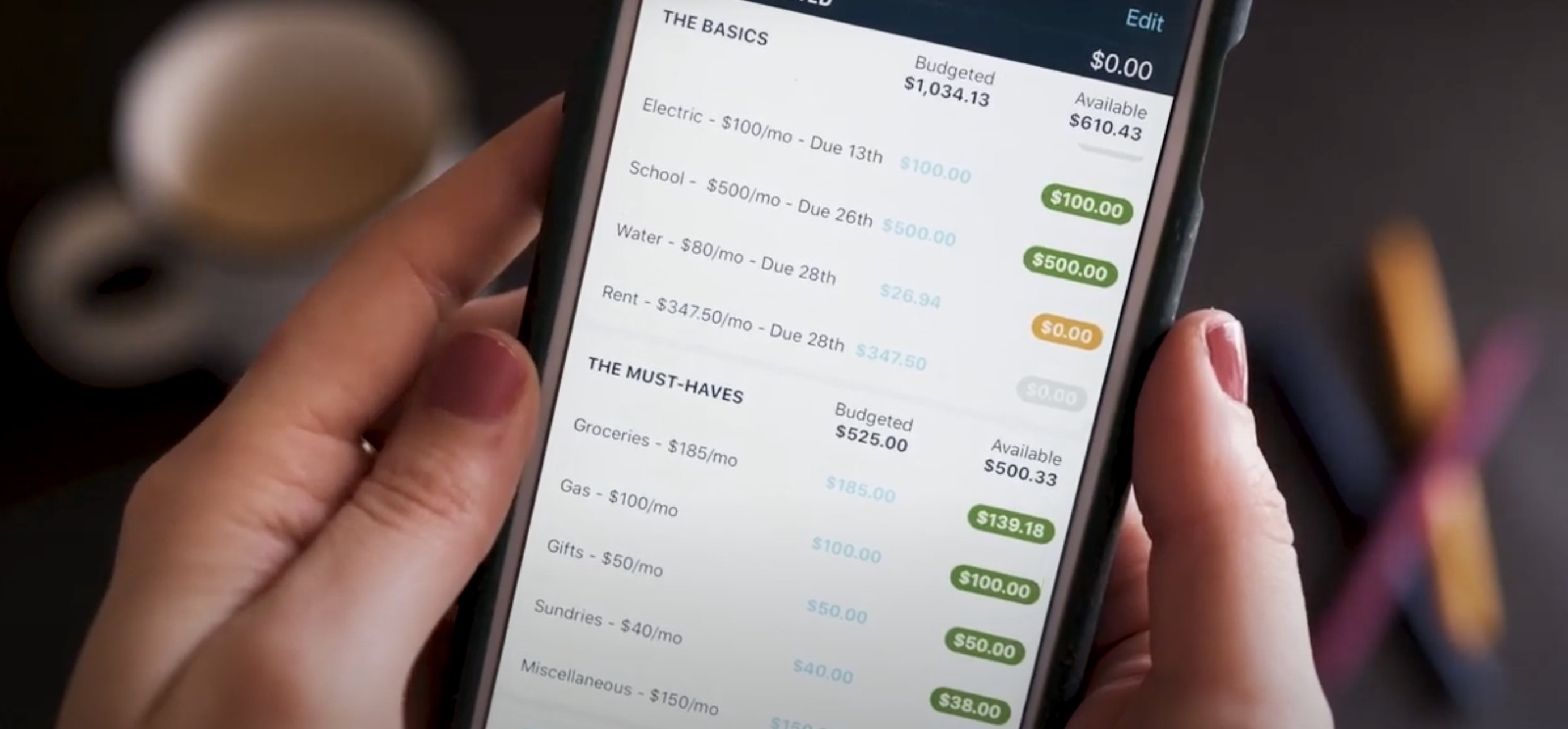

1. YNAB (You Need A Budget) helps you create monthly budgets based on the money you have available in your accounts.

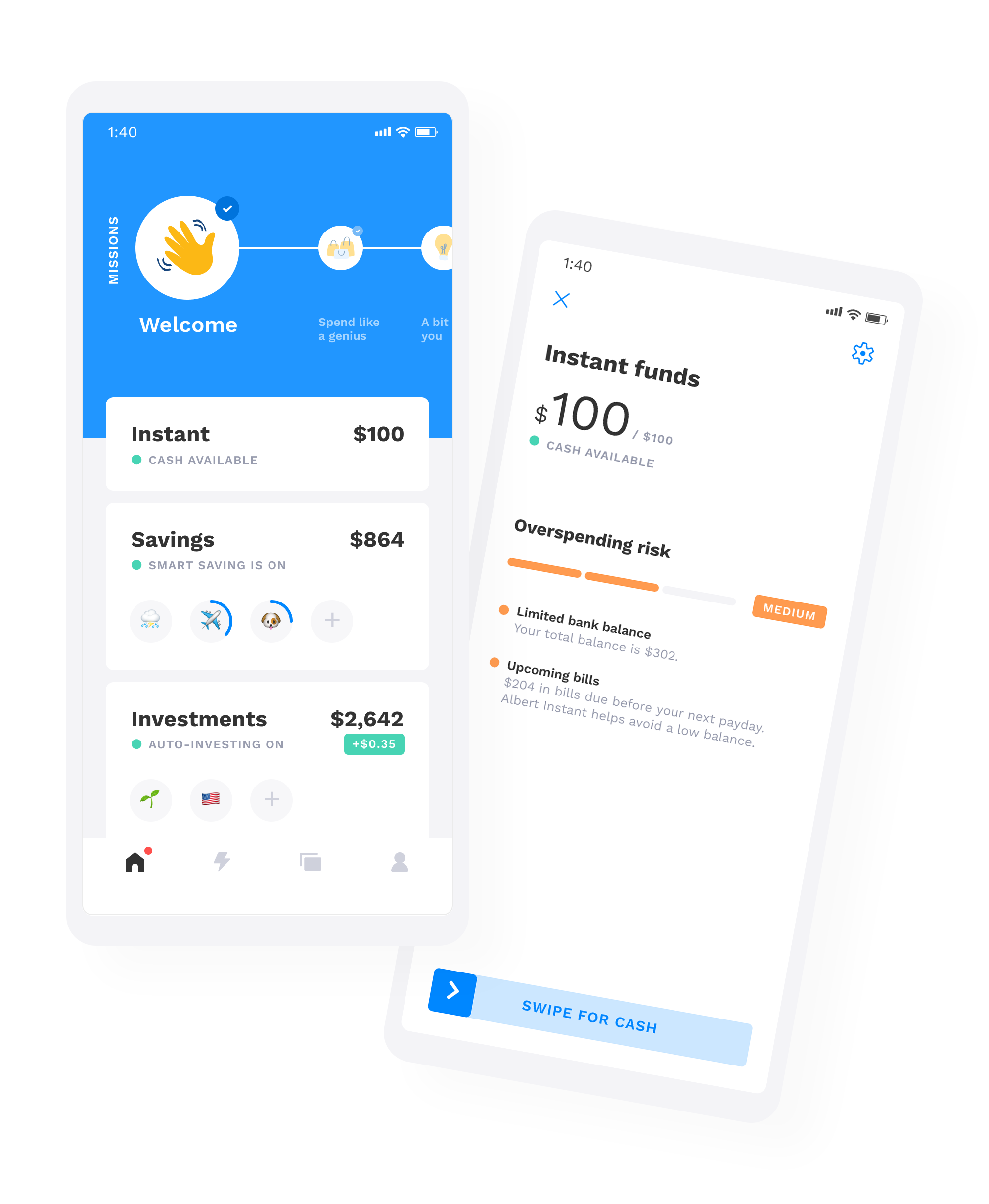

2. Albert keeps an eye on your account balances to make sure you don't overspend. You can also use it to automate your savings — and you'll get an annual cash bonus out of it!

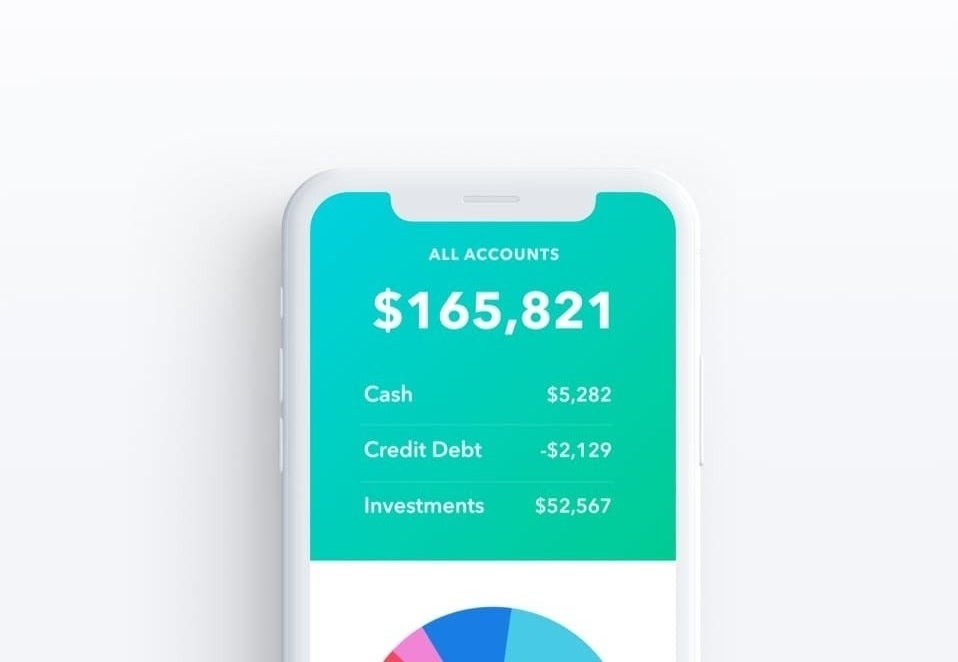

3. Mint tracks your spending, reminds you of upcoming bills, and provides personalized tips based on your habits. It's kind of like a personal assistant just for your finances.

4. Zeta helps couples manage their finances together. At the same time, it also lets each individual keep track of their independent spending (so you won't need another app to keep some of your budget separate from your partner's).

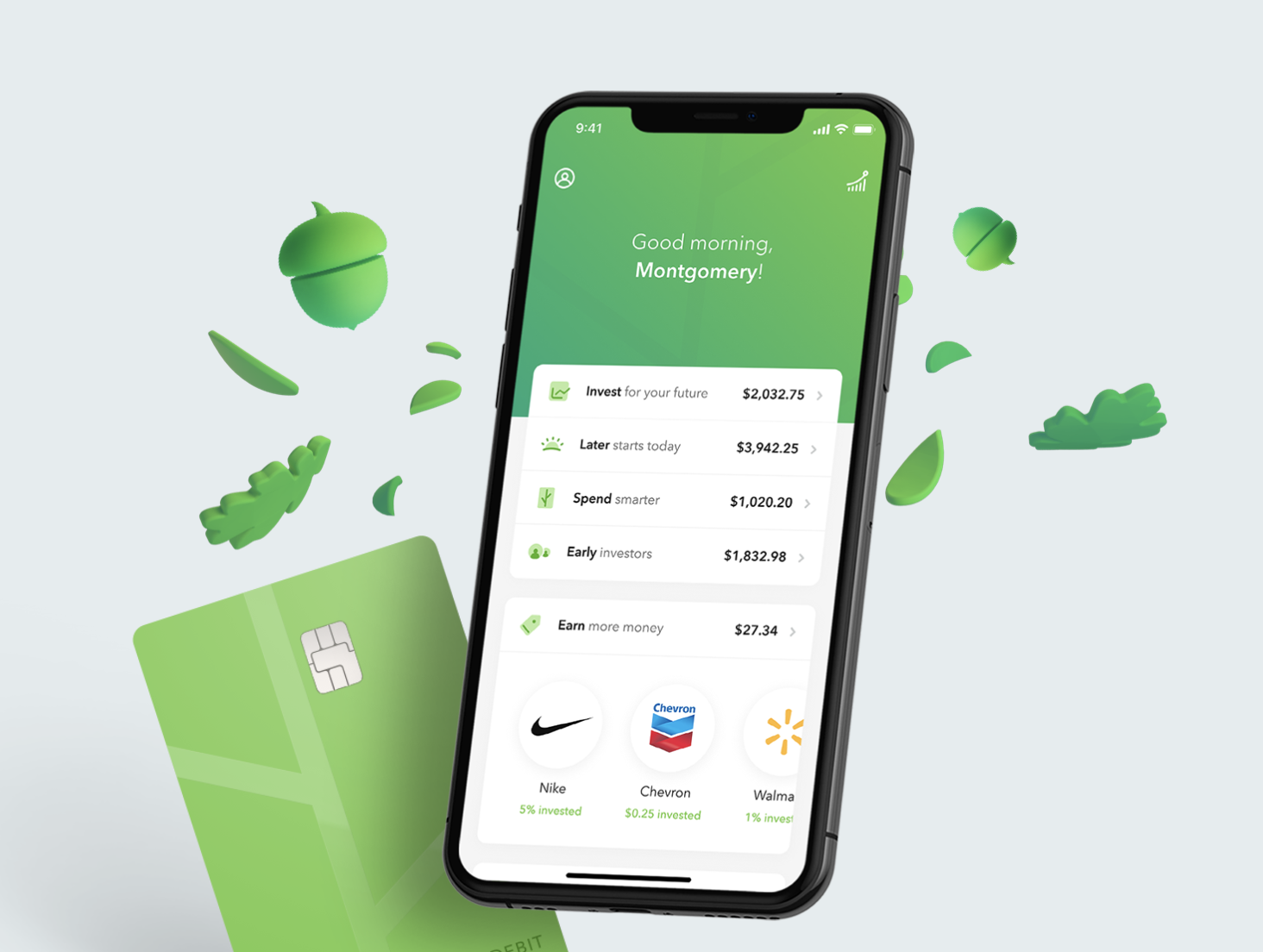

5. Acorns makes investing money less intimidating and more passive. It puts your spare change from everyday purchases toward stock portfolios, so you can watch those nickels and dimes grow.

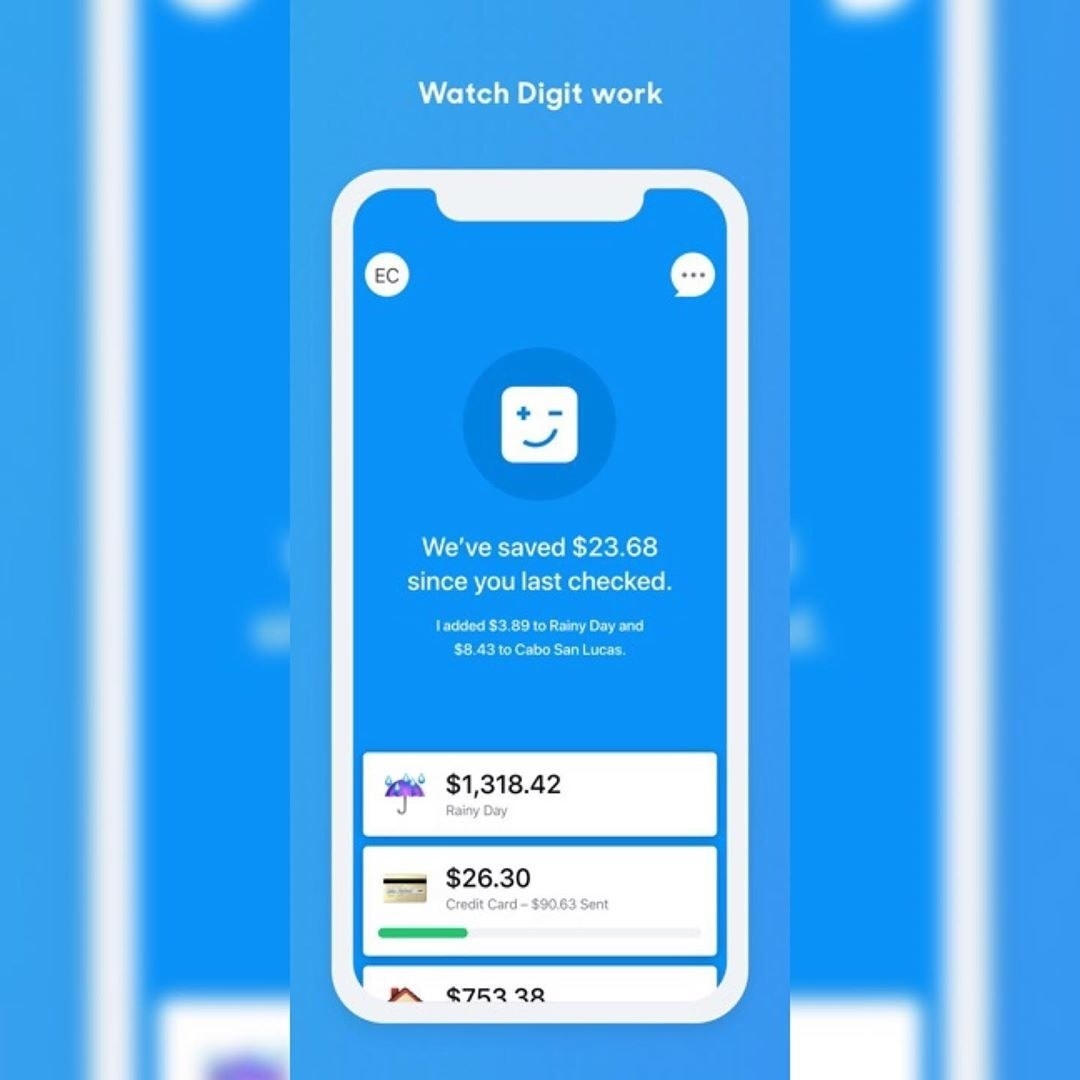

6. Digit squeezes every available dollar out of your account and puts it toward your savings goals. So if you've been telling yourself "you can't possibly save anymore money," Digit will help you find some spare cash to tuck away.

7. PocketGuard combines the automatic saving powers of Digit, the expense tracking pros of YNAB, and the account linking advantages of Mint.

8. Betterment basically gives you a robo adviser in your pocket that helps you invest, plan for retirement, and save money.

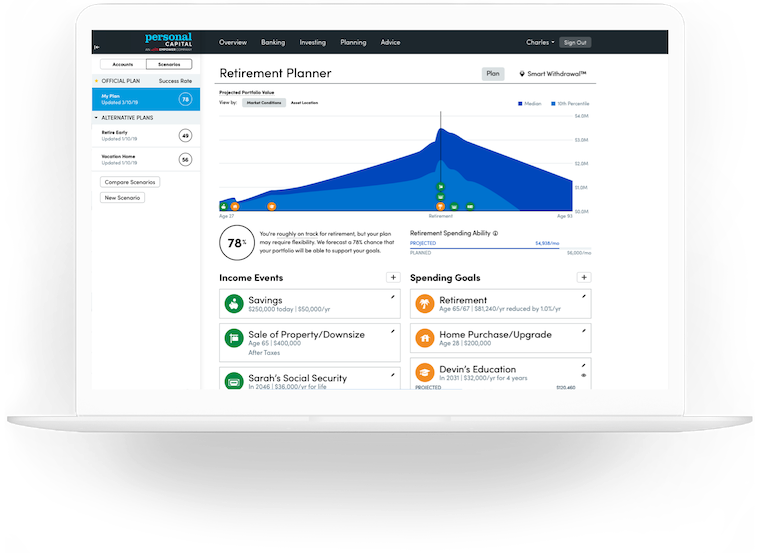

9. And, Personal Capital essentially gives you a bird's-eye view of your finances so you can stay in the loop (and thus, stay in control of your money).

What are your favorite money management apps? Let us know in the comments below!

Note: Reviews have been edited for length and/or clarity.