Raise your hand if you're kinda sick of being told to cReAtE a BuDgEt to get a handle on your finances.

We know, we know. But this age-old advice isn't for nothing. When done thoughtfully, a budget can actually help you be more aware of where your money is going, so you can save and spend more on what you actually love. Now that all sounds good in theory, but the truth is there are sooo many different ways to budget, and many of them can easily feel confusing or time-consuming.

That's why we rounded up some tried-and-true budgeting methods that you might want to try out if you don't have time for anything too wild or frilly.

Important to note: if you find yourself spending too much money on stuff that you don't really need or even care about, then making a budget will definitely open up new ways to save more and manage your money more effectively. On the other hand, if you're stretched really thin just trying to cover basic bills, you might not find as much wiggle room, but it still can be worthwhile to take an honest look at your income and expenses. A budget might not solve all of your financial problems, but even small positive changes, like saving $5 a week, can add up over time.

1. The envelope system might come in handy if you prefer to do things the old-school way and divvy up good, 'ol cash.

Once you've got your spending limits in place, you'll want to head to your bank or ATM to withdraw cash to fill all your envelopes. You may even consider withdrawing your entire paycheck.

Now, you'll want to fill the envelopes with the amount of cash you decided to budget for each. So if you planned to spend $250 on groceries, you'll put $250 into that envelope. The idea here is that when you run out of cash in your envelopes, you don't "borrow" money from another envelope. You'll be done spending until the next month. Of course, you may sometimes run into the scenario where you really do need extra money for an essential, like food. In this case, it's fine to get extra money from somewhere else. In fact, if you're noticing a trend of having to find extra cash for certain categories, it may be a signal that you need to budget a little more for that category.

2. The multiple accounts method is a no-fuss way for you to *digitally* separate your cash.

Of course, you can adjust these numbers to align more with your circumstances (if you live in a high-cost area, you're likely spending more than 50% of your income on necessities).

Bottom line: This method can feel like you have a little more freedom with your spending — what's better than giving yourself an entire checking account just for spending on the things you love???

To make this method even easier, if you get paid via direct deposit, you might be able to have your paycheck automatically split between your accounts. Check in with your employer's payroll person to find out more.

3. The zero-based budget lets you maximize your saving and debt payoff by accounting for every. Last. Dollar.

Even though the ultimate goal each month is to give every single dollar a job so you use up your entire paycheck, it helps to start by looking at how much you're paying for necessities each month.

You can also revisit last month's bank statement to see how much you spent on wants, how much you used for paying off debt, and how much you saved. Then, depending on how much is left over after your last payday, you might be able to throw the extra at other goals or purchases.

4. Orrr, you might want to try the no-budget budget if you want a much more laid-back method for tracking your money.

It's not exactly a set-it-and-forget-it method, but it's the next best thing. To stay on top of your cash flow while using this method, you'll need to get in the habit of checking your bank balance every morning.

Adding this step to your daily routine can make you more aware of where your money's going. Plus, being aware of your balance can keep you from accidentally overspending on something you can't really afford. Keep in mind that this method may not be best for you if you struggle with controlling your spending or if your income is a bit unpredictable.

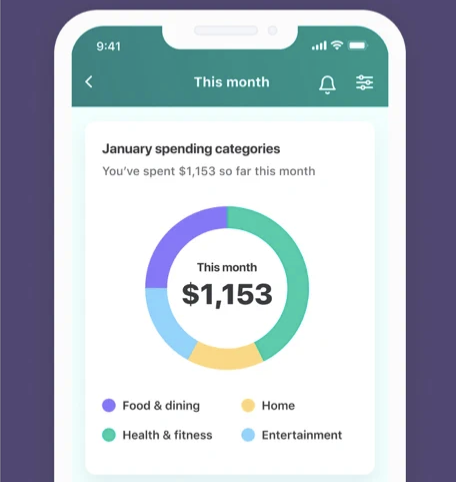

5. Use a budget app like Mint if you want a method that basically shoulders all the hard work of creating a budget for you.

Over time, Mint tracks your spending and suggests budgeting goals based on your actual expenses and habits.

So if you're a total budgeting newbie, this feature might help you get customized advice on your goals. Of course, you can also create your own spending and saving goals.

6. The pay-yourself-first budget can help you prioritize your saving and investing goals so that you can reach them a little faster.

Keep in mind that this method is not an excuse to ignore your necessary expenses.

it just helps you strike a balance between saving and spending so that you don't feel like your savings goals are constantly being ignored because of your rent payments and grocery bill.

7. The values-based budget allows you to spend and save consciously while considering your lifestyle goals.

To get started, you can grab a piece of paper and write down up to five personal core values (you can have fewer, but three to five would be ideal).

So let's say your three values are community, relaxation, and quality time with loved ones. Think about how your expenses fall into these categories. You might exercise your community value by donating monthly to your favorite organization or spending money on gas to commute to a volunteer site. For relaxation, you might purchase a cabin by a lake not far from your primary residence so you have a place to go every time you want to escape the hustle and bustle of everyday life. Or you might spend on monthly spa treatments or your favorite bottle of wine. And for quality time, you might plan a monthly family dinner at a restaurant and pick up the tab. You get the idea.

This budgeting tactic is designed to also help you figure out if you're spending money on something that doesn't align with your values (so you can cut it out and have more money to spend on what matters to you!).

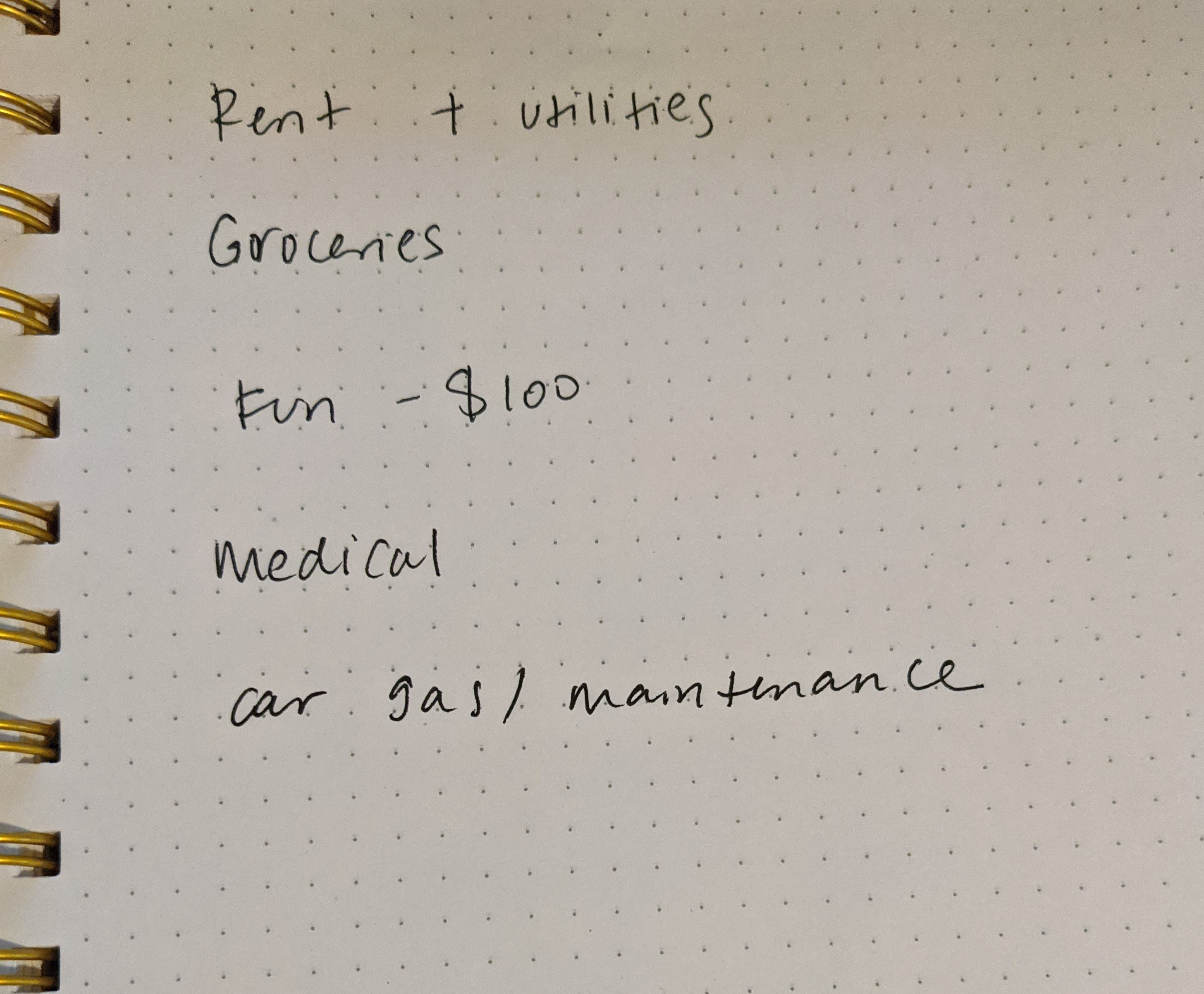

8. Or create a simple, easy, handwritten bare-bones budget with pen and paper.

What's a budgeting method you swear by? Let us know in the comments below!

And if this sounds like music to your ears (and wallet), check out our other personal finance posts.