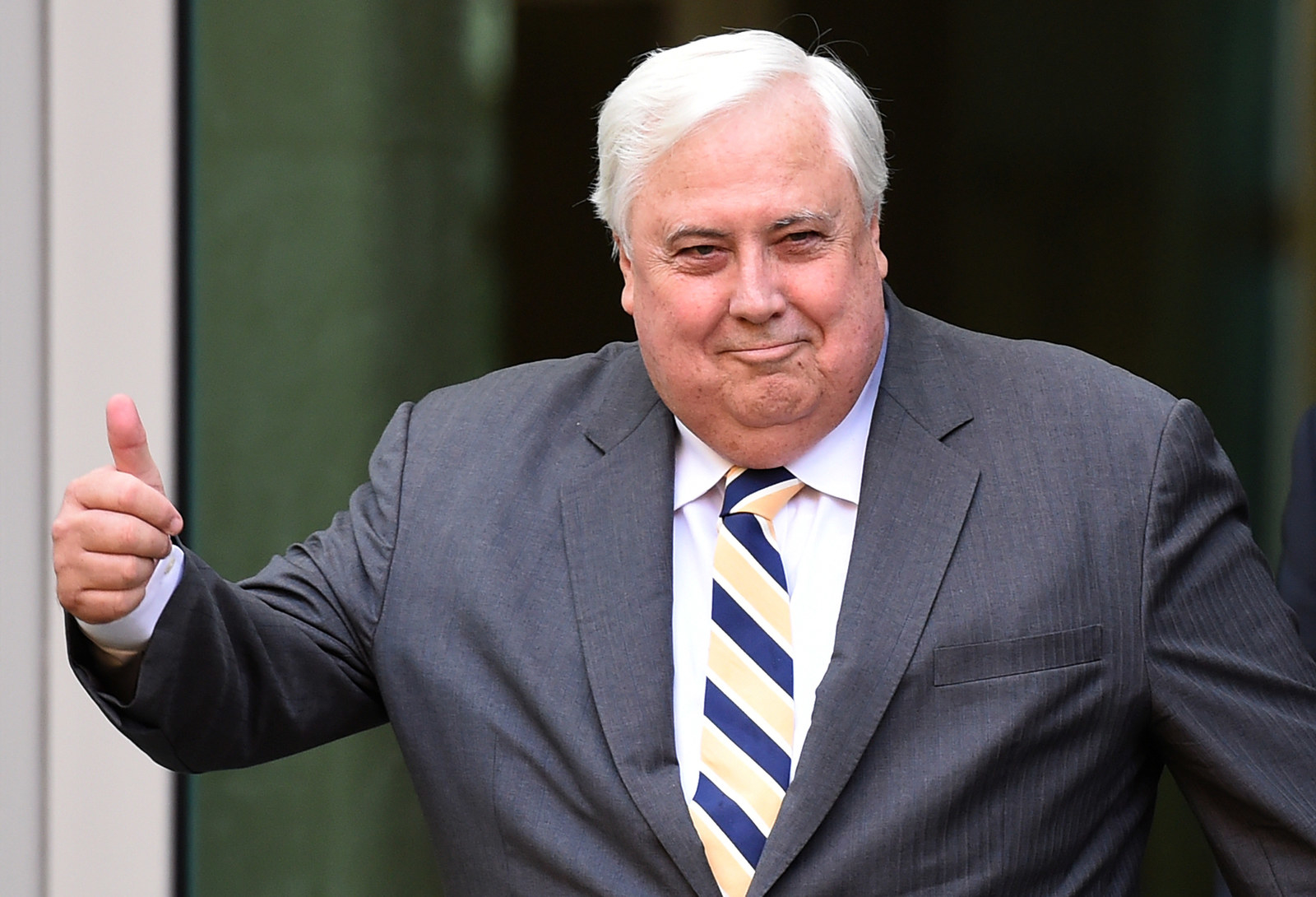

Former federal MP Clive Palmer arrived to testify at Brisbane's Federal Court on Monday with much fanfare, pushing and yelling at members of the media who he claimed had caused his wife to fall down a flight of stairs at the court on Friday.

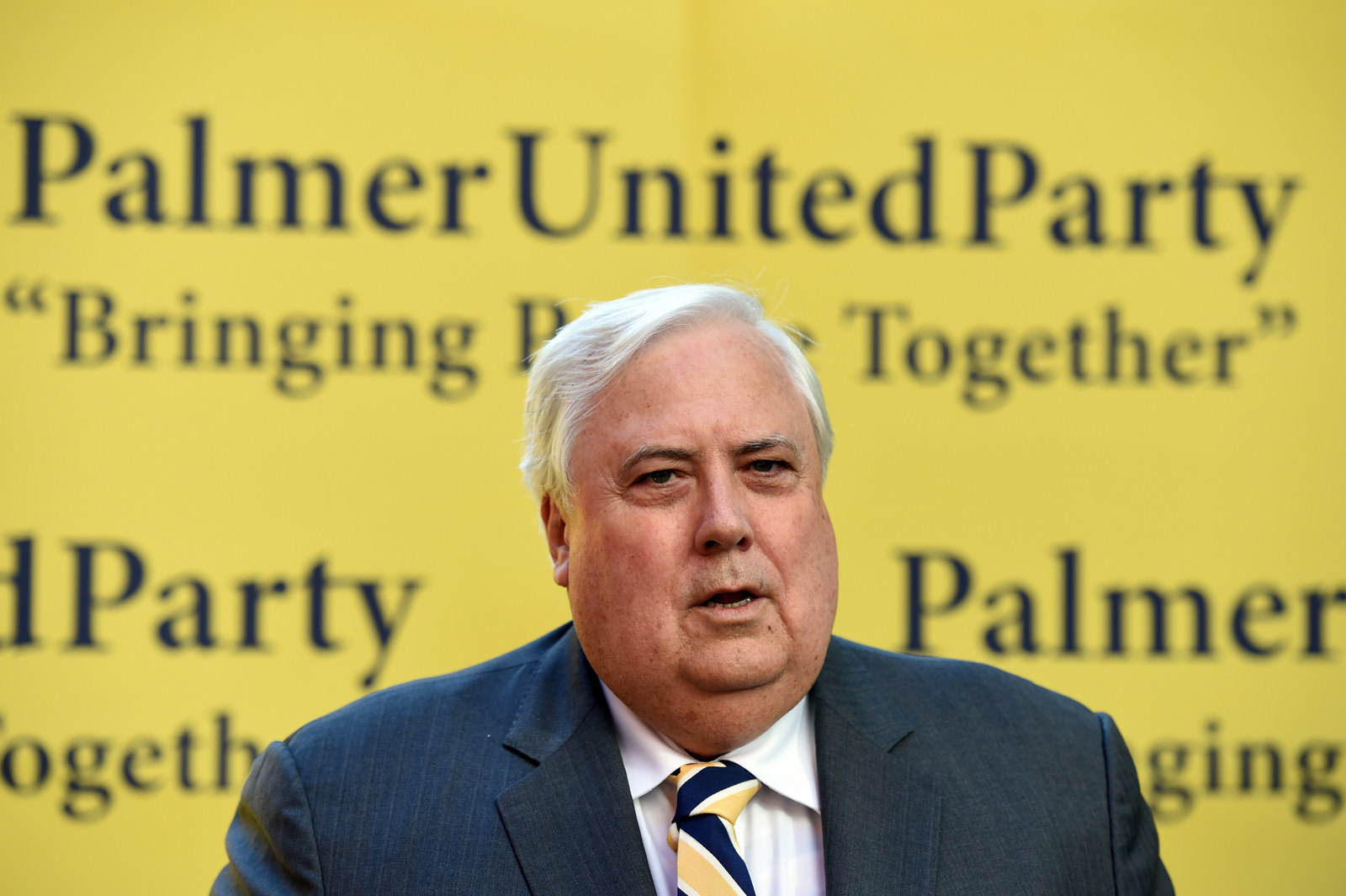

It isn't hard to see why Palmer dislikes the media - it has documented every misstep taken by the billionaire since he bounced into Australia's political scene in 2013 and established the Palmer United Party.

His planned construction of a replica of the Titanic has been delayed indefinitely. A voicemail of him telling Chinese businessmen to "pack up all your fucking gear and get back to China" was leaked. Two of his key party members - Tasmania's Jackie Lambie and Queensland's Glenn Lazarus - defected and forged their own political careers, and in May Palmer retired from politics altogether.

"Is it fair to say your stint has been at best an embarrassment and at worst a disaster?" TV host Lisa Wilkinson asked him in February.

But retirement from politics might not leave much time for lawn bowls and croquet as the 62-year-old had hoped, because his demise as a politician has run parallel to the collapse of his Queensland Nickel refinery and subsequent court case in which he is this week testifying.

Here are all the crucial details of the legal battle.

In 2009 Palmer bought Queensland Nickel and the then soon-to-be-closed Yabulu nickel refinery from BHP, saving the jobs of the workers there.

Business was booming so Palmer gifted 50 of his employees Mercedes-Benz cars and used his profile as a job-saving hero in Townsville to kickstart his political party and run for election as a federal MP in the Brisbane seat of Fairfax.

The Australian Electoral Commission records show Queensland Nickel bankrolled the Palmer United Party to the tune of $15.2 million during the 2013-2014 financial year, and his other company Mineralogy donated an extra $8.2 million.

It's complicated, but important to note that Palmer himself isn't the only shareholder in the company and Queensland Nickel incorporates multiple enterprises.

The company's good fortune then turned the same way as the declining nickel price - rapidly downwards.

Basically it was costing more to produce the nickel than the company was selling it for; it sells at just over $US4 a pound but nickel producers need about $US10 a pound to make a worthwhile profit.

But after Queensland Nickel Group showed a loss of $55 million in 2014, it apparently made a marvellous recovery to record a profit of $453 million for the next financial year, boosting its net assets from $562 million to nearly $2 billion.

It turns out the glittering figures were courtesy of a flattering accounting style; so the balances looked healthy but cashflow was actually in the red.

Counting his money #auspol @abcnews @ABCNews24

To make matters worse for the nickel company, in 2014, it was charged with six counts of environmental breaches after tens of thousands of litres of toxic sludge overflowed from the business' storage dams on the edge of the Great Barrier Reef.

Palmer threatened the reef's marine park authority with a $6.4 billion compensation claim if it tried to limit his refinery's actions.

His court bid to force his former business partner, the Chinese company CITIC, to pay millions in what he claimed were outstanding iron ore royalty payments failed.

Palmer's company then allegedly tried to ask the Queensland government for $25 million which didn't work out either.

In January this year the company entered voluntary administration. In March 550 workers were sacked and in April creditors voted to liquidate the company.

In July the Australian Securities and Investments Commission launched a formal investigation into Queensland Nickel to look into why the company collapsed, the details of donations made to the Palmer United Party and how the business reported the state of its finances.

Administrators at FTI Consulting issued a damning report which found the company had been treated as a "piggy bank" from which Palmer - or entities associated with him - withdrew $201 million.

Almost 800 ex-workers are owed $74 million in unpaid entitlements.

The federal government has so far paid $70 million in entitlement payments owed to workers under the fair entitlements guarantee.

The case currently before the courts will see liquidators PPB Advisory attempt to recoup the money on behalf of taxpayers who have effectively paid out the billionaire's sacked workforce.

On Monday Palmer blamed the federal and state governments, who he said were "determined to put Queensland Nickel out of business", for the refinery's collapse.

On Friday Palmer dismissed suggestions he had been "heavily involved" in the inner-workings of Queensland Nickel in 2015 as "absolute rubbish".

But the court heard emails sent from an address with the pseudonym "Terry Smith" showed he was regularly asked to approve contracts for the business that year, and was in effect acting as a shadow director of the company.

Meanwhile, the sole appointed director of the company, Palmer's nephew Clive Mensink, has gone AWOL and doesn't seem to have any plans to testify at the hearings.

"I think he's somewhere between Helsinki and St Petersburg," Palmer said on Monday.

The hearings continue.