Recently, I asked the BuzzFeed Community to tell me the small things they realized were actually costing them soooo much money. The replies were frustratingly relatable, but I did feel a little less alone and learned a thing or two about how to save on the small stuff. So, let's get into it:

1. "I was raised pretty frugally where we always ate off the dollar menu, or if we did go out to eat, it was always with a coupon or a deal. While I highly recommend NOT doing that, there were some truths I did eventually realize. Appetizers, drinks, and dessert are all ways a restaurant gets you to spend more money. Even just one of these things can make an outing cost $10–$15 more than what you were expecting."

2. "Credit card debt. If you have a balance of $10,000 on your credit card with an APR of 18%, that card is costing you $1,800 a year in interest alone ($10,000 x .18 = $1,800). This comes out to $150.00 per month or $5.00 per day. You are actually losing $5.00 a day carrying that balance. You are better off skipping the coffee or buying lunch and put that $5.00 towards paying down your credit card balance in addition to your monthly minimum payment."

3. "Definitely buying coffee and a snack at work every day. Where I previously worked, they had a cafe downstairs and every day I would go down and get a coffee first thing before I started, and again on my lunch break. Each coffee was £2.50, and I would sometimes get a cake for about £2, normally about 3 times per week. So about £31 per week. Which in a 4-week month worked out to be £124 per month and a 5-week month £155. Once I figured that out I couldn’t justify it anymore, brought my own coffee and snacks in for the rest of the time I worked there."

4. "A decent spice rack. I know you can buy starter spice racks, but even so, those aren’t cheap. My spice cabinet was an investment that I did not know I had to plan for when moving out."

5. "Towels. Literally no one told me that cheap, full sized towels are still $10–$15 each."

6. "We’re moving right now and EVERYTHING moving related is so much more expensive than I remember it being during our last move six years ago. Boxes are ridiculously expensive! Garbage bags, hangers, tape, movers. We also need a new sofa because ours is not worth transporting to our new home. They are ASTRONOMICAL! I’ve been scoping out Facebook marketplace for any and every affordable used option. But when it’s all said and done, we’ll be out at least $2,000 just for moving and supplies alone. No furniture, deposits, etc."

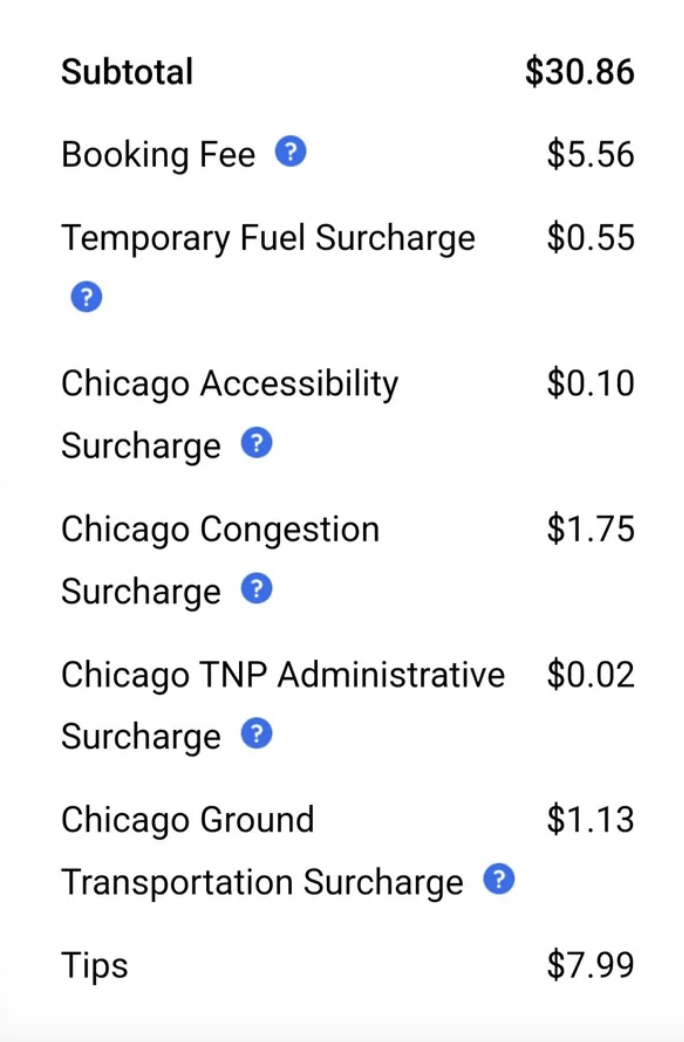

7. "Uber Eats. I LITERALLY have to set filters to find restaurants with the lowest delivery fees and it still hurts my wallet so bad to where I haven’t ordered in over a month."

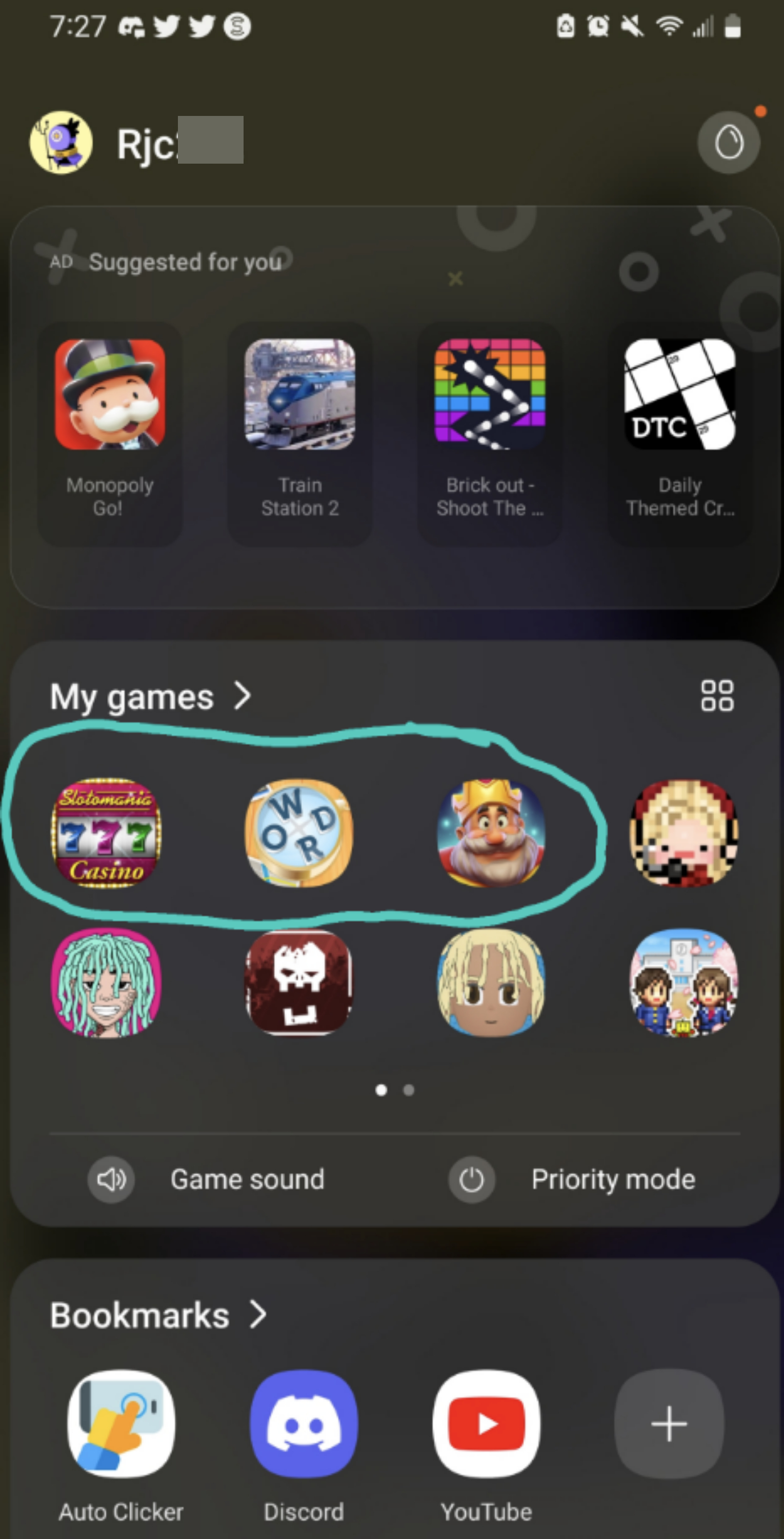

8. "Honestly? Spending money on video or app games on my phone. $1.99 for no ads? Yes, please. $4.99 for tons of extras to help me get ahead? Certainly! Don’t ask me to look at how much I’ve spent on random useless games."

9. "Having periods. Pads cost a lot. Especially the heavy-duty stuff I have to use :-(. I didn't even realize how much it adds up to until I moved out. Mine are irregular as hell so I might get them twice a month — add having to change frequently and you spend a *lot* on something single-use."

10. "Cleaning supplies! You budget $50 for household misc., but then you need trash bags, paper towels, detergent, and toilet cleaner all at once."

11. "Setting up a house. We just moved from an apartment to our first house, and I swear every time we turn around, it's another $300 Costco or Home Depot trip. Lawn equipment, cleaning supplies, step ladder, real ladder (why are they SO EXPENSIVE???), power tools, etc. Not to mention all the moving costs, the utility set-up fees, home insurance, etc. At least most of the expenses are one-time fees, but I had no idea how much rugs cost, how much blinds cost, how much lawn tools cost!!"

12. "Goddamn trash cans! A good one is $60–100!"

—Anonymous

13. "Getting cash from a bank I don't have an account at. Sometimes it costs me $5 just to get $20 to pay a friend. I have to drive to the far side of town now because my bank closed all their other ATMs during COVID. Just one of the million things that the pandemic is still costing us."

14. "Rugs! Why TF are they so much money just for me to walk on."

15. "Okay, coffee. I figured out I spent over $2000 at Dunkin' in a year. I really need to cut back."

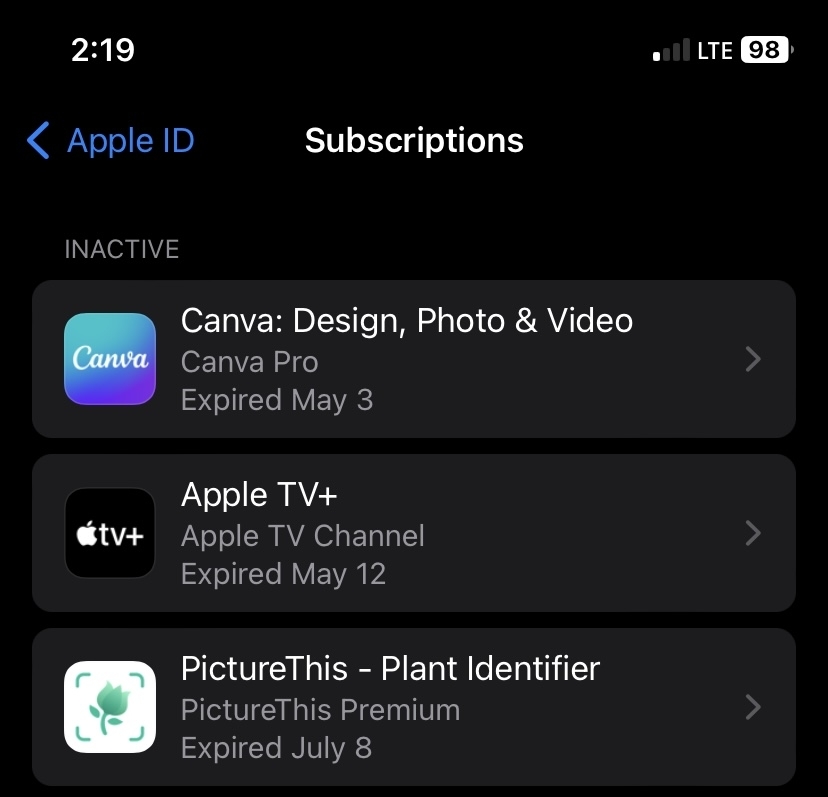

16. "Brand name products! They’re often the exact same product with different packaging. You can save so much by buying store brand."

17. "Subscriptions all add up. All kinds of subscriptions. I'm not just talking about streaming options."

18. "Uber and Lyft rides. I've been having knee pain and walking to the bus stop blocks away hurts. I started taking an Uber every day, and realized I was spending roughly $250 a week. Switching to taking the Uber to the transit center took the cost down to $150 a week, which is still too much. I'm only taking an Uber now if the pain is above a four on the 1-10 pain scale, or if I'd be late to work because of transit issues."

I waste my money on silly things, like constantly needing a little treat ALL. THE. TIME. So tell me, if it's not already listed, what's the small thing that's actually costing you so much money?

Note: Some submissions have been edited for length and/or clarity.