Before we begin...

It is important to mention that the PEGCC is the official lobbying group for the private equity industry. However, knowing the way they obtained their data, it's an unbiased collection, especially when the Association for Corporate Growth (ACG), an advocacy organization which has also called out the PE industry on its failures, has worked with the PEGCC & data providers to churn out the results.

Ok, let's get to it.

The data...

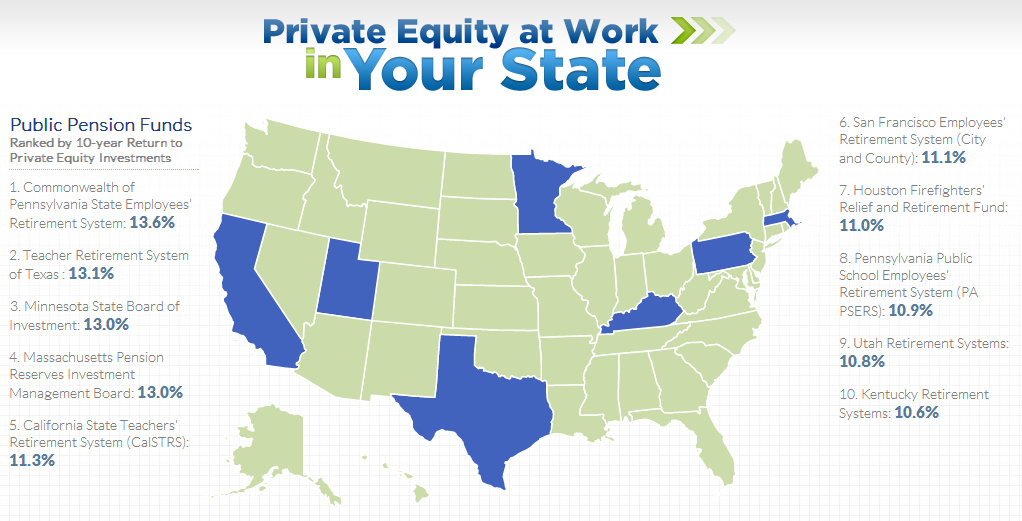

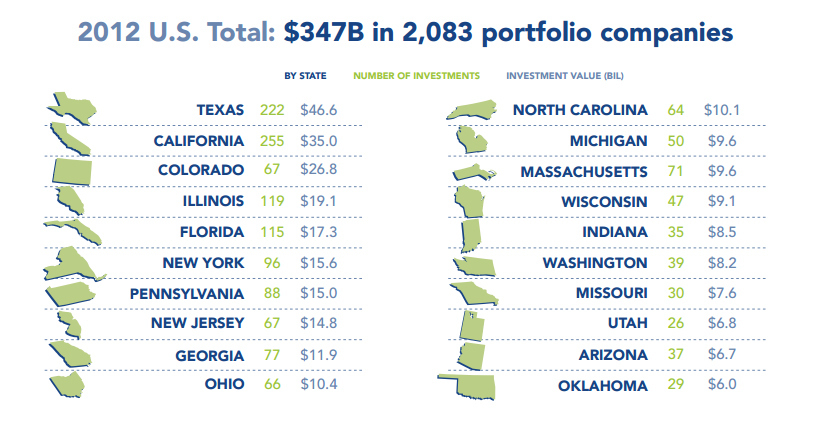

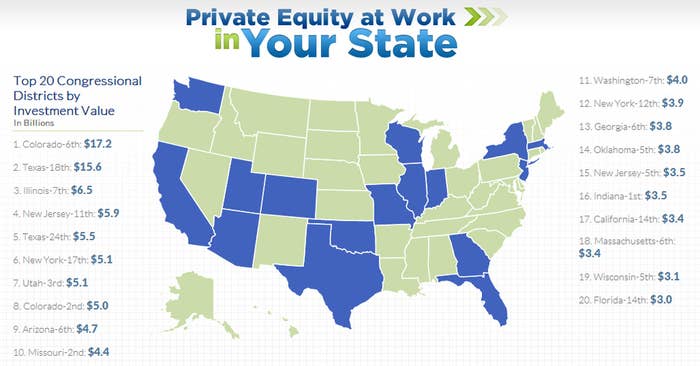

The PEGCC's State-By-State breakdown combined data from private equity data aggregator Pitchbook to analyze the performances of private-backed companies. From facilities and employment data to pension returns and congressional district performance, it's pretty detailed.

The bigger question about what this data means is looking at the political parties that control the districts and states. For example, looking at the Congressional District data above, Democrats occupy 10 of the Top 20, with the following ranks in Billions of Dollars in Investment Value:

#2 - Sheila Jackson Lee ($15.6B)

#3 - Danny Davis ($6.5B)

#6 - Nita Lowey ($5.1B)

#8 - Jared Polis ($5.0)

#11 - Jim McDermott ($4.0B)

#12 - Carolyn Maloney ($3.9B)

#16 - Pete Visclosky ($3.5B)

#17 - Jackie Speier ($3.4B)

#18 - John Tierney ($3.4B)

#20 - Kathy Castor ($3.0B)

That's $53.4 billion in overall investment value from private equity alone.

Election Season ≠ Politics Season

Why am I focusing on Democrats to start with? When Romney and Bain came into the picture last year, Obama's campaign hit Bain Capital and the private equity industry hard. While members of the campaign walked back part of their statements (e.g., Stef Cutter saying they were focusing on Bain and not the private equity industry in general), the anti-private equity fire still got fueled.

Then again, Democrats aren't entirely to blame for the backlash. A handful of Reupublicans for some odd reason blasted the industry during Romney's Primary. Rick Perry was the original coiner of "vulture capitalism" (which became a lightning rod buzzword for both parties) and Newt Gingrich even took shots.

Looking at state pension performance through private investments comes to prove how hypocritical Governor Perry is by trashing PE...