While things like the cash rate make absolutely no sense to me, what I do know is that everything in my life has been so fucking expensive lately.

It makes sense, then, that people living in Australia's most expensive city — Sydney — would have some ideas about how to save and make money go further. So when Reddit user u/Salbyy asked for advice in the r/Sydney subreddit, I immediately started taking notes.

Not only was advice sought, but they also shared some of the things they were already doing, including "shopping between Aldi, Coles, Woolworths, and a fruit shop", when they used to just shop at Woolworths for convenience, and "taking snacks with [them] when [they] go out so [they're] not tempted to buy unplanned food."

In the comments, Aussies came forward to share their own tried and tested savings advice to cope with this period of inflation and rising cost of living pressures. Here are some of the best tips, strategies, and savings hacks:

1. "Get a higher-paying job."

"It sounds like a Joe Hockey line, but I’m serious. No idea what you do, but there’s a good chance there’s a business out there that values your skill set higher than your current employer. See if you can find them. Making more money is sometimes easier than saving, especially if you’re already disciplined."

"It's not a 'Save money' thing but an 'Earn more money' thing — now is the time to consider if you can make more money by switching jobs. It's an employee's market at the moment!"

2. "Reusing tea bags."

"The extra-strong Yorkshire tea bags are great. And definitely stretch for two cups if you need to."

3. "Instead of a home internet plan and mobile (living on my own), I just have a 5G phone plan with a big data allowance."

"It works out cheaper per month, and there is no lock-in contract. I just tether everything to my phone. Been working okay for three months. I do online gaming, watch a lot of YouTube, and work from home — and it's been good so far."

"Price-compare all providers — phone, internet, utilities."

4. "Wearing my puffer jacket at home and keeping the heater turned off for longer each day."

"I use a blanket on the couch, which means less time using the heater."

5. "Getting smart about grocery shopping."

"Aldi or independent greengrocers, or end-of-day specials at Coles/Woolworths. I got two pork loin steaks and a boneless chicken roast for $2.13 the other day — sorted dinners for a few nights!"

"Smaller, more frequent shops lead to less wastage. Plan what's needed for the next two to three days so you're less likely to change your mind."

6. "Buying in season! This is a huge one — you can save so much by buying fruit and veg that's in season. Sure, you'll have to change recipes a bit, but it's worth the cost savings."

7. "Facebook Marketplace is great."

"I’m also trying to check there before buying stuff for the house or the kids."

8. "Going out less and socialising with people at home."

"Drinking less, going to the gym straight after work (less inclined to give in to temptation and go to the pub), trying to finish all the 'back of the cupboard' food before buying new stuff, selling old stuff on Gumtree/Facebook Marketplace, stocking up when T2 is on sale so I don’t go out and buy café tea, and walking to get takeaway instead of getting food delivered."

"Drinking at home is a much cheaper option. I did it all through COVID and saved a tonne."

9. "The lost art of growing your own veggies."

"Obviously you need a patch of grass for this one, so not convenient for most renters."

10. "Driving less."

"Also, trying to drive less aggressively — coast more, engine braking, etc. Don't use toll roads, AC on only when needed, windows up to reduce drag when possible, and be cheeky and increase tyre pressures slightly to reduce rolling friction.

"Utilise public transport wherever possible — ideally, off-peak times."

"Walking everywhere I can."

"Cycling more often rather than driving — or taking public transport for those shorter trips."

11. "Cutting my own hair."

12. "Cancel unnecessary and/or duplicate subscriptions."

"For example, cancel roadside assistance if it's already included in insurance. If you can't cancel all streaming services, just choose one per month and cycle through them. Find free forms of entertainment — walks, bicycle rides, YouTube, local library, etc."

"I've cancelled subscriptions if there is nothing to watch."

13. "Funnelling your income into an offshore trust in a tax haven."

"Shares are cheap! So it's time to stock up on those franking credits.

"Negatively gear property by gold-plating your future PPOR [principal place of residency], your holiday home and ski chalet.

"Best way to save money is to make money — direct your 'blind trust' (hehe, *wink, wink*) family office to invest in a portfolio of start-ups and high-risk junk bonds, balanced with hard commodities like gold and some blue chips.

"Borrow against your equity for spending rather than selling assets or paying tax on 'income'."

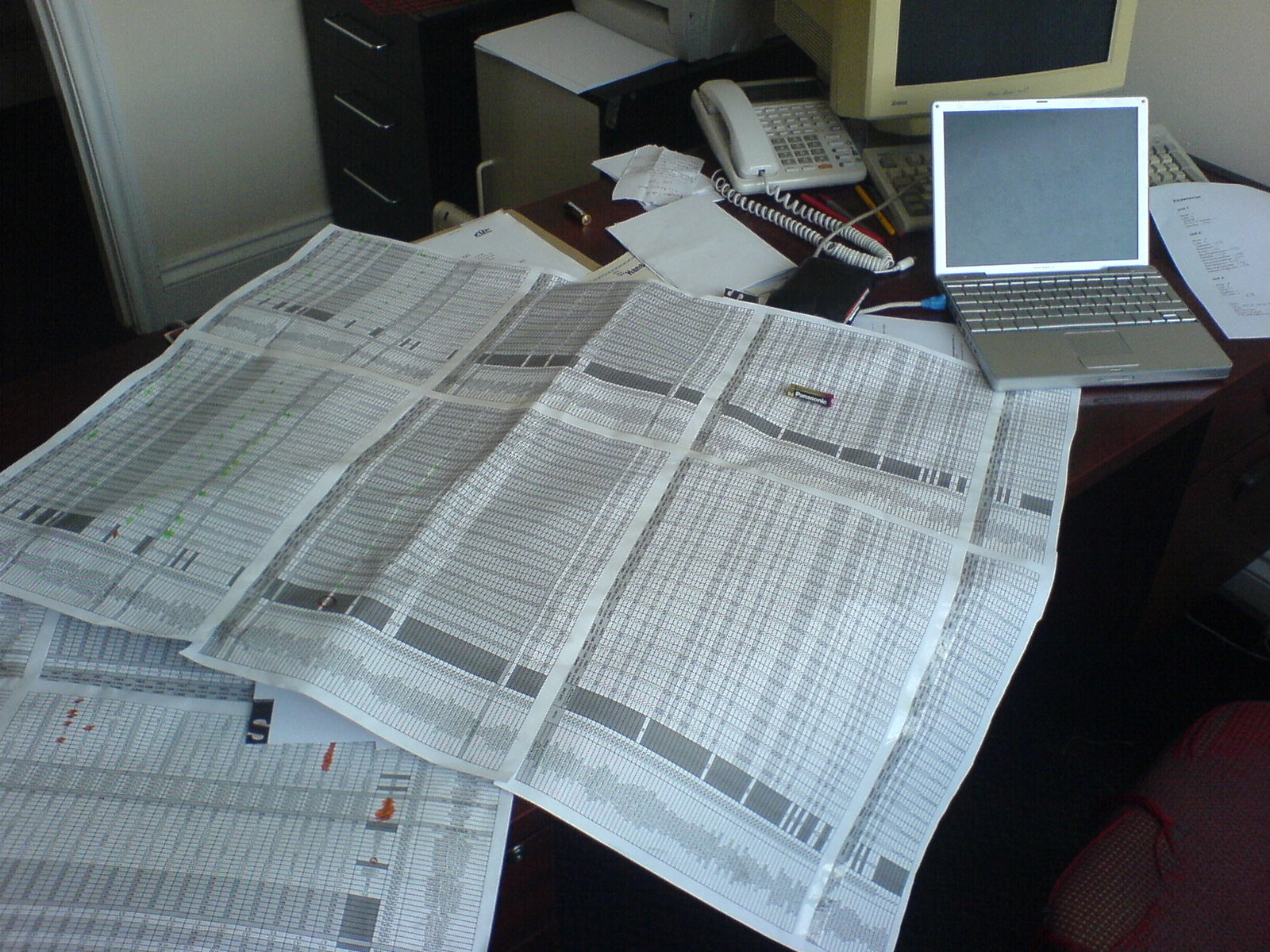

14. Finally, "Having a spreadsheet to keep track of my monthly spendings and comparing it with my monthly income. Making sure I'm in the green by a set margin at the end of each month."

We'd like to hear from you, too! If you've got any tips for saving cash (or making more), let us know in the comments!

Note: Some responses have been edited for length and/or clarity.