Current students and people who have graduated since 2012 may have to repay up to £300 a year more on their student loans under proposals currently put out for consultation by the government.

During his summer budget speech, George Osborne announced a little-noticed measure "on freezing the loan repayment threshold for five years". In practice, this is a plan to reduce the balance of student debt by increasing the amount most students will repay each year.

The government's analysis suggests students on average wages will repay thousands more under the changes, while higher earners may pay back less in the long term.

The Department for Business, Innovation, and Skills has put the plans out to a public consultation, which closes on Wednesday.

How the system works now

A student who does a three-year degree is likely to graduate with around £43,000 of debt, assuming they take the loans on offer, under the current £9,000 fees system, which they have to repay over 30 years. Any balance left after that time is cancelled.

At present, students start repaying their loan when they earn at least £21,000 – paying 9% of everything they earn above that level. This means a graduate who is unemployed or in low-paid work needn't worry about repayments, while a graduate with a high-paying job will make sizable repayments.

As an example, a graduate earning £22,000 will repay £90 a year, while one on £30,000 will repay £810.

Because interest is charged on the loans, it's graduates on good-but-not-amazing salaries who repay most: Someone who earns an average of £50,000 a year over their 30 years will repay much more than someone who earns £100,000 and pays their loan off more quickly. (There's a much longer explanation of this here.)

Why repayments will increase under government plans

When the last government introduced top-up fees, it said that the £21,000 threshold where repayments start would increase over time, in a similar way to how the point at which you start paying tax increases.

The government's new proposals involve a U-turn on that principle, suggesting instead it's frozen at £21,000 for five years. The change sounds a technical one, but quite quickly means most graduates will be repaying a significantly higher amount each year, as the proposals themselves show.

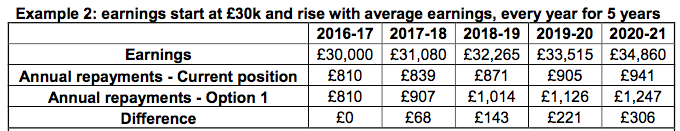

In the example above, a graduate on £30,000 would repay an extra £68 a year versus the current system in 2017, rising to an extra £306 by 2020.

While everyone earning above the threshold will pay more each year under the changes, in the long-term graduates on moderate incomes are harder hit than high earners.

This is because graduates who would eventually pay off their loans – such as those earning £50,000 on graduation, which then increases in line with average wages – pay them off more quickly, and so pay less interest.

For others, like those graduating on £30,000, the change just means they will repay more: under a five-year freeze, an extra £6,100. If the government in five years' time decided to freeze the threshold again, that amount would increase even further.

This plan would affect 900,000 graduates when introduced, rising to 2.1 million people by 2020. The government is also consulting on only applying the freeze to students starting their courses from September 2016, rather than changing the terms for those who've already started – or even finished – their degrees.

A third option in the consultation, of sticking with the status quo, is referred to in negative terms: "This does not help to meet the current fiscal pressures that the government faces," it states in bold font, "and will cost the taxpayer more."

The National Union of Students has called the plans a "betrayal" by the government.

"This is yet another betrayal by the government and part of a long list of political measures that will disadvantage students," NUS vice president Sorana Vieru said in a statement to BuzzFeed News.

"Freezing the repayment threshold won't just affect new students but those who started studying in 2012, and will have a real impact on the income of graduates, particularly the most disadvantaged.

"Our research shows that student debt is a huge concern, with 43% of £9,000-a-year graduates believing their standard of living would be affected by the cost of repaying their student loan. It's a regressive move that means students will have to pay more, and will have a massive impact on students from widening participation backgrounds."

Martin Lewis of MoneySavingExpert has also written a blog post encouraging people to contact their MPs over the plans.

You can respond to the government's consultation proposals here until 11:45pm on Wednesday 14 October.