Facebook UK’s newly released accounts reveal a rebate of more than £11.3 million, due to a tax break on employee share options, BuzzFeed News can reveal.

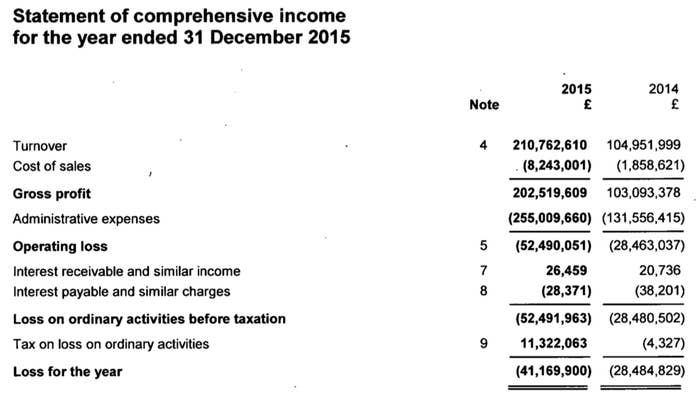

The company’s UK outlet was criticised last year when figures revealed it had paid just £4,327 in UK tax in 2014. The same line in the company’s accounts this year showed no tax, but instead a credit of £11,322,063.

The credit does not mean Facebook will receive a cash refund from the Treasury. Instead it means the company will be able to use the credit to cover tax due on any future profits.

Shadow chancellor John McDonnell told BuzzFeed News it appeared Facebook was not paying its fair share in tax.

"To ordinary taxpayers this looks like multinational companies playing by different rules to the rest of us," he said.

"The Tories have dragged their feet for years on tackling tax avoidance, which has created a climate where multinational companies think they can do what they want and not pay their fair share in tax."

Jolyon Maugham QC, a senior tax barrister at Devereux Chambers, told BuzzFeed News the accounts suggested Facebook's stance on tax had not changed much.

"To me, there’s nothing in these accounts that demonstrates any interest in doing other than paying the legal minimum amount of tax possible,” he said. "There’s a sort of sensitivity to the political ramifications of paying no tax, but that sensitivity is expressed in terms of words as opposed to the actual handing over of tax.

"So their messaging is getting cuter but they’re not actually getting the chequebook out.”

Last year Facebook’s UK structure came under attack from MPs and tax campaigners as a legal tax avoidance structure.

Following this sustained criticism, the company announced in April 2016 it would book revenue from major UK clients into its UK company – making any profit from those customers eligible for UK corporation tax.

This year also saw MPs criticise the deal Google reached with HM Revenue and Customs to pay £130 million in backdated UK taxes.

In her keynote speech to the Tory conference this week, prime minister Theresa May warned international companies who treat tax laws "as an optional extra" that "this can't go on any more".

Facebook's 2015 accounts show it recorded £4,168,609 in corporation tax in 2015.

Its rebate is a result of the generous share options given to many of its 600-plus UK employees. These bonus awards totalled more than £71 million in 2015, the accounts showed, allowing Facebook to more than offset the £4.1 million bill.

The company registered a total £25 million UK tax reduction through these share bonuses. Its accounts explain this is because Facebook UK will be able to claim a future tax break when these share options “vest” – when employees can cash out.

This means the value of the shares at the time of the deduction is the critical figure – if the shares are worth much more then, the deduction can be still bigger (and vice versa if Facebook shares fall).

Maugham added that if Facebook’s share price rose sufficiently faster in future than the revenues the company allocates to its UK subsidiary, it could potentially pay little or no UK tax for years to come.

"But it’s certainly not necessarily the case that it follows from the fact that they’ve recognised this tax asset that they will at some point pay some tax,” he said. "The asset is quite substantial and so may take a few years to exhaust, even if the share price remains the same."

The accounts further clarify that the company has logged the tax deduction in its accounts because it now expects to make some future taxable profits in the UK, due to its April decision to book UK revenue in the UK. In 2014 the company did not log the future deduction due to “uncertainty” there would ever be UK profits to make the tax deduction against.

Facebook's 682 UK staff received an average of £242,557 in total compensation (pay, social security, and share options) in 2015, up from £238,384 each in 2014. The company also increased its overall headcount by more than 300 over the year.

In 2015, Facebook booked no direct sales through its UK operation, instead defining its UK operations as “providing sales support, marketing services and engineering support to the Facebook group” – essentially working as an administration centre.

This structure meant Facebook UK registered an overall UK loss of £41.1 million on revenues of £210 million. Globally, Facebook made $3.7 billion profit on $17.9 billion in revenues.

Richard Murphy, an accountant and tax campaigner, told BuzzFeed News he also had questions over the £4.1 million in corporation tax Facebook UK did register.

He noted that if Facebook’s £71 million in share payments to staff was added to its £52 million paper loss, that left a profit of around £19 million, which would roughly equate to the £4.1 million corporation tax in Facebook’s accounts.

"The odd thing is that’s roughly 10% of the UK turnover of £210 million, 10% of its sales. That feels like they’ve come to a policy they’ve got to declare taxable profits of 10%.

"But in the US accounts the equivalent profit rate is 21%. So it does still appear there’s significant tax avoidance going on the in UK. They’re understating their sales, they may be understating their profits, it could be tax avoidance. But do we know that for sure? No, because these accounts are just so opaque. There’s hardly enough information in here to note what’s really going on."

Murphy blamed the UK’s accounting rules for the lack of transparency, saying that the accounting community and government should raise the requirements to make accounts show what really goes on within UK companies.

“We need proper accounting rules in the UK, so we’re not left groping in the dark wondering if we got the best deal or not."

Asked for comment, a Facebook spokesperson said:

“We are proud that in 2015 we have continued to grow our business in the UK and created over 300 new high-skilled jobs. The UK is now home to some of the most innovative technologies in the world including our investment in a high-tech solar-powered plane centre in Somerset that will help bring the internet to remote areas of the world. We pay all the taxes that we are required to under UK law. ”

McDonnell added to BuzzFeed News: "The Tories should adopt Labour's Tax Transparency and Enforcement Programme, which would stop the dodgy deals and finally put an end to tax avoidance.

"There is nothing less patriotic than trying to get away with not paying your taxes."

The Treasury has also been contacted for comment.