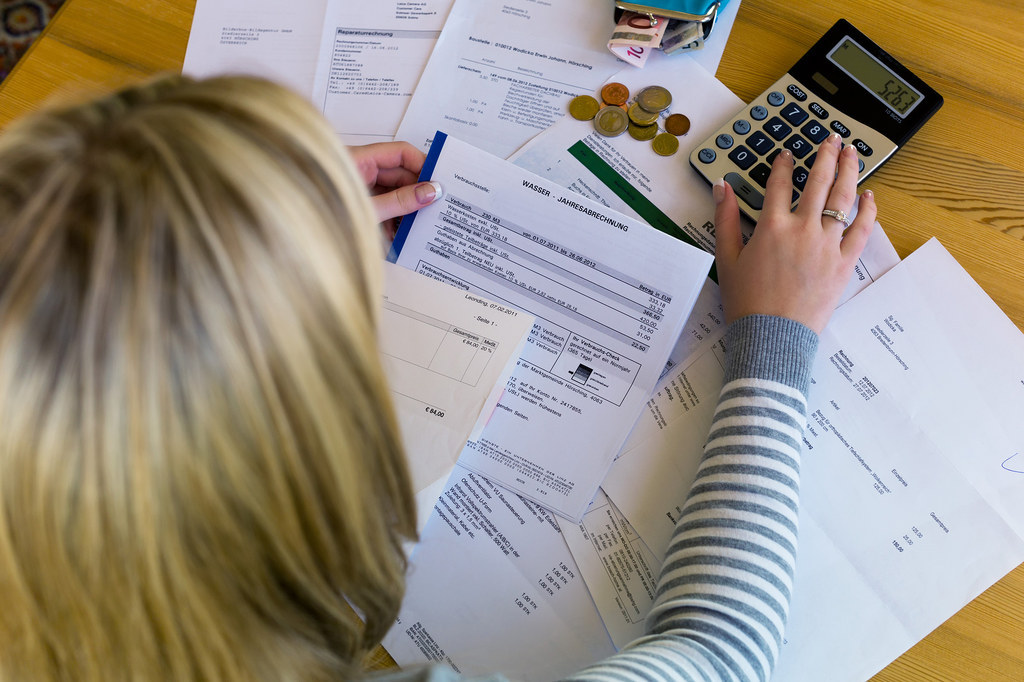

Managing your debt will aid you in stabilizing your financial situation, which will allow you to have cash at the end of the month that can be saved for used for paying off debts. If you want to get rid of your debt and improve your financial situation, here are some of the effective debt management tips you should follow:

1. Begin Budgeting

2. Pay your bills instantly

This is also an important part of budgeting. Everyone has different ways of paying their bills; you might be one of those who pay their bills on their due date or you may even pay late. Bear in mind that late payment of your bills means you have to pay a little extra and may also have a negative impact on your credit ratings. Deferring payment of bills is a costly and bad habit and one you need to eliminate if you wish to save money and reduce your debt. You will be able to manage your money better and know how much disposable income you have.

3. Consider your debt as a whole sum

4. Get rid of high interest debt

Which debt vehicles do you use? Some use credit cards and personal loans while others may also go for overdrafts. The level of interest on your debt can vary, depending on the type of debt you have. An important tip for debt management is to get rid of debts that have a high rate of interest. This doesn't mean that you throw out your credit cards completely. Instead, you need to shop for better products in the market. Rather than opting for a credit card that charges 25% interest, find one that has a 10% interest rate. It is also an option for you to replace a debt charging high interest rate with one that has a low rate of interest. For instance, you can pay off your credit card that has a high rate of interest by taking out a small loan with a low rate of interest.

5. Set up automatic payments greater than minimum amounts

6. Explore the option of IVA

Another useful and effective tip for debt management is to sign an Individual Voluntary (IVA) agreement. This is a legal contract between you and your creditors that enable you to restructure your debt into manageable and affordable payments. An IVA agreement usually lasts for five years and by its end, your debt will probably be repaid so you will have your freedom.

One of the greatest benefits of signing this agreement is that you don't have to fret about spiraling interest charges. This is due to the fact that entering an IVA freezes your interest and charges so your debt will not increase. With this solution for debt management, you are able to avoid filing for bankruptcy and your creditors are also unable to take legal action against you. Essentially, it gives you time to restructure your finances and pay off your debts easily.

These six debt management tips are highly effective and can help you in getting rid of your financial obligations without going crazy.