We've all been there — you stroll up to an ATM or log into your bank's site to check your balance only to discover a shockingly, disastrously, horrifyingly small number or even a negative balance. It's a common problem but one that is now easier to avoid than ever. Thanks to FinTech (short for "financial technologies") companies and app developers there's almost no reason for failing to keep on top of your money, maintain a budget, and save some cash overall.

If you're ready to put an end to these balance tragedies once and for all, here are 7 apps you'll want to look into immediately:

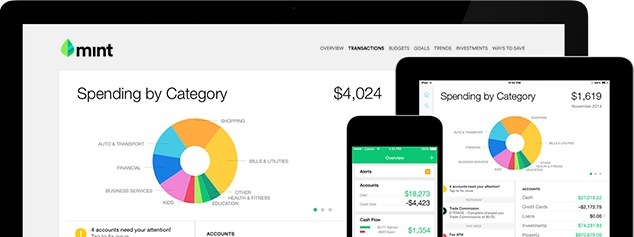

1. Mint

Chances are you've heard of this one as it's among the most popular personal finance apps available. There's good reason for that as Mint is one of the best and simplest ways to create and stick to a budget. All you have to do is plug in your bank account information and the app will break your spending into categories, which you can set individual spending limits for.

For those with multiple bank accounts another great thing about Mint is being able to view all of your balances in one place. There's no doubt that this app can do a lot but it's not alone in the space.

2. Prosper Daily

Formerly known as BillGuard, this app actually has both a free and a paid version. Like Mint and others, the free version allows you to monitor your accounts and analyze your spending. But what sets Prosper Daily apart is the fraud protection it offers for $9.99 a month (or $6.99 a month if you pay for a year upfront).

As you can imagine, if your identity is stolen, your bank balance could be the least of your freak-outs. That's why the app monitors your credit, watches for breach alerts, and comes with a $1 million identity theft insurance policy. Heck they say they'll even help you cancel your cards and replace your ID should you lose your wallet, making that $9.99 sound like quite a deal.

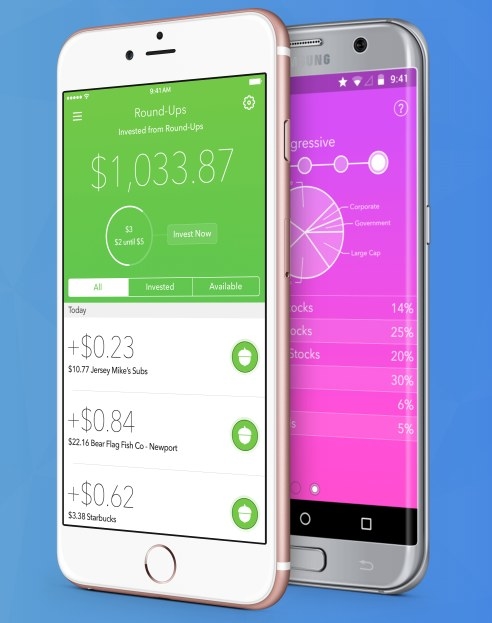

3. Acorns

Setting aside money for savings is great but what if you could actually start investing it as well? While most people think you need to have a lot of extra cash in order to make that happen, Acorns makes it easy. The app funds your account using what they call "round-ups" which equates to the loose change you have from your transactions. For example, if you spent $7.47 on lunch, Acorns would grab that extra $.53 and wait until you have $5 saved up before purchasing a small stake in stocks and bonds for you.

What's cool about Acorns is that you can customize it depending on your tolerance for risk. If you mostly just want to use it as a way to painlessly stash some cash, you can set it to the most conservative investment mix. However, if you have more to play with, you can get a bit riskier and hopefully bring in even more money. You can also cash out at any time just in case your checking account dips a bit too low.

4. Lenny

Sometimes you can do everything right when it comes to reining in your spending, keeping a close eye on your balance, and setting aside savings. Still there may be times when you do need some extra money. That's where Lenny comes in. Sure you could use any regular credit card but Lenny is specifically designed to teach people how to use credit responsibly and raise their credit scores in the process.

Once you're approved for a line of credit through Lenny you can actually transfer the money you need to your bank account, helping you avoid overdraft fees. So, should you find your bank balance to be depressingly low and you have some essential bills to pay, this app is probably a better idea than credit cards or payday loans.

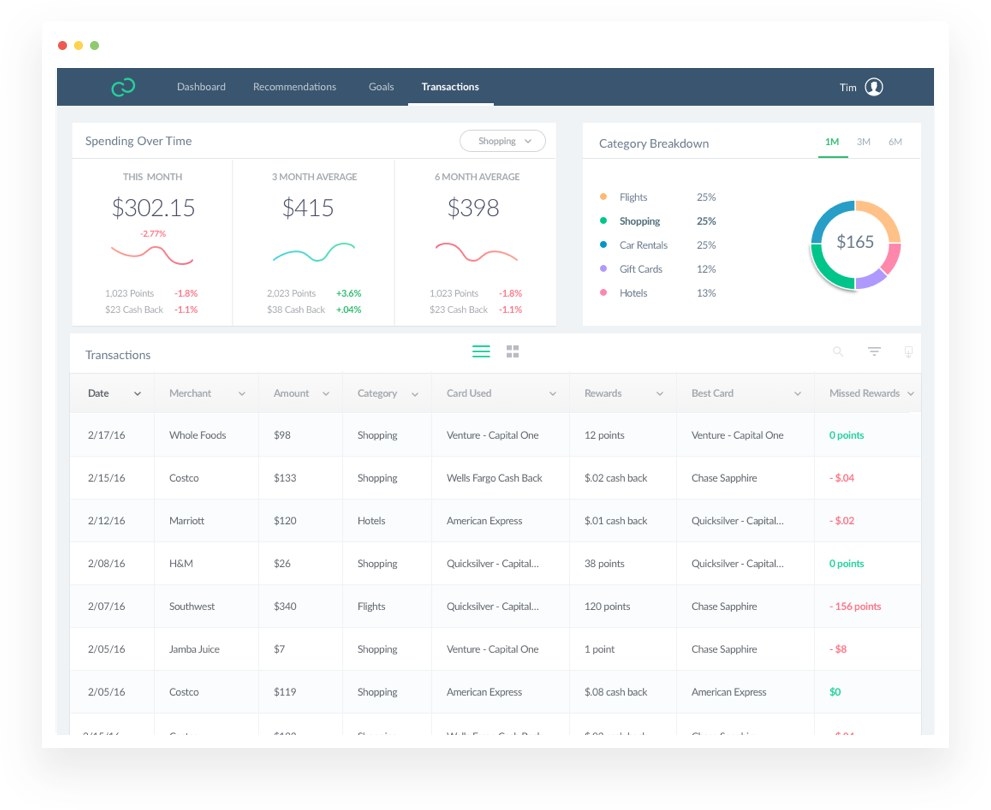

5. Birch

Speaking of credit cards they actually do hold some advantages if you use them correctly. Several cards offer rewards and cash back but all of them have different terms and bonuses that can make it difficult to know which is best. Birch aims to help you make the most of these rewards by analyzing your purchases and telling you which card would be the most beneficial for your purchases.

Admittedly, while it is pretty awesome, this won't exactly help you prevent balance shock — but free stuff is always a win! Sadly this isn't a mobile app yet but the website is still worth checking out.

6. Splurge Alert

One of the biggest causes of bank balance freak-outs is splurging. That's why Ally created what is easily the most clever (read: silly) app on the list. Splurge Alert utilizes your location and a list of your spending weaknesses to warn you when you're in range of a tempting retailer, a subtle reminder for you to steer clear.

Lacking self-control? You can also set up the app to alert your friends so they can pester you into running away. The app is a "limited release" but you can find more info about it on Ally's website.

7. Walmart’s Savings Catcher

Yes — even the retail behemoth Walmart is getting into the FinTech game with the introduction of Walmart Pay. That feature on the company's app will allow you to pay with your phone by scanning a QR code at the register. While that won't really prevent you from overspending or save you any money, the Savings Catcher — which is built into the same app — probably will.

When you scan or submit your digital receipt to the Catcher, Walmart will automatically search for lower advertised prices and give you the difference on a gift card if they find one. It's definitely not your typical personal finance app but it is still pretty cool.

Overdraft fees are dumb, credit cards are expensive, and payday loans are just a horrendous idea. Instead, trying one or more of these FinTech apps can help you keep your bank balance above water while also learning to budget, spend wisely, and even invest. There are no more excuses for bank balance freak-outs so don't let them happen to you.