We asked members of the BuzzFeed Community to tell us about what it's like to be in debt in their twenties. Here are some of their responses.

1. "The credit card company approved me for a £9,000 limit. Silly people."

During uni I somehow rinsed my overdraft despite working throughout most of it. In my second year, I didn't have a job for about six months but spent like I was working. I remember paying a credit card with a credit card then doing the reverse a week later. I had no safety net. There were times at work where I'd just get bread in the canteen, pretending I was saving money in a really happy, proactive manner, but I'd run out of cash and only existed in credit card land.

When I moved from Sheffield to London for my "grown-up job" after graduation, a nameless credit card company approved me for a £9,000 card limit. Silly people. By December 2014, I was in £14,000 of unsecured debt and paying £990 a month just servicing my debt. Of that, £260 was paying interest and charges in various places. It wasn't fun. I got a new job in December, and a great guy at my bank sorted me out to consolidate my debt into a loan repayable over 18 months. My friends are aware of my debt – it's a joke point between us all – but my family (especially my mum)? Hell no! They're all working professional people but no one has the spare cash around. It's hard to judge the real impact; debt just became my life. My whole adult life I've been carrying bigger and bigger debts, and I saw it as the norm.

Submitted by Martin, email.

2. "Shaving my social life down to the bare minimum is costing me a huge deal of sanity."

I got my yearly statement for how much I owe the Student Loans Company: £15,000. Add to that the £10,000 loan I took out to fund my master's, then consider my graduate salary and how (based on the percentage deduction the Student Loan Company takes) I have only repaid slightly over £200 of my student debt in the last tax year.

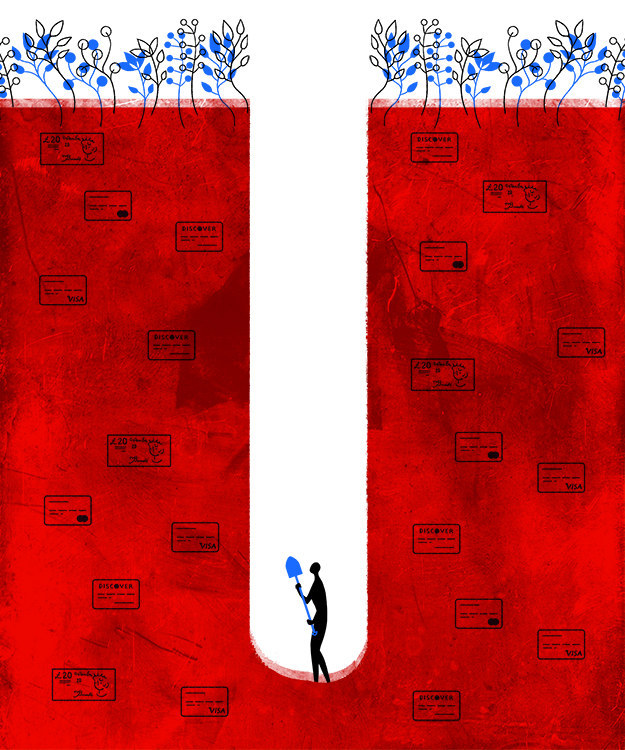

Higher salary requires further education in my field, but a PhD only means digging the debt hole even further down. Living at home to recoup my losses and shaving my social life down to the bare minimum is costing me a huge deal of sanity, but allowing me to slowly crawl up out of the student debt pit. Yippee! So far it looks like we'll be paying back debts from beyond the grave!

Submitted by katherinep451814285.

3. "It's just boring, and tiring."

I went to uni after the student fees rose, and I owe somewhere in the region of £45-50,000 to the Student Loans Company. I don't think of this as "real" debt, because it just gets deducted from my pay every month before I even see it, it doesn't affect my credit rating, and it can't get me kicked out of my house. But it still irritates me to see the deductions every month, knowing that after them and taxes, my £21,000-a-year job has a take-home of just over £16,000.

I've also got about £1,000 overdraft, did have £500 on a credit card, and owe another £2,000 to family. That's not counting the number of times I've finally relented and told someone I can't make the rent and they've just bailed me out. Despite having a good, full-time graduate job, I'm still working part-time freelance on the side to try and pay of the debts faster.

Mostly it's just boring, and tiring. You get paid, you surrender to necessities like jeans that don't have a hole in them, you have one night out in a month and that's it. Really boring. But it's the only way. I hope to have cleared my overdraft by Christmas.

Submitted by Misha Ankwell, Facebook.

4. "For the longest time, I would not answer my phone."

I can't really say that I am coping. It feels like I am constantly treading water. I've just learnt how to swim a little better by using tips from Money Saving Expert, planning as far ahead as possible and saying "no".

I am able to keep on top of payments with some debts but not all. It usually feels as though once I have one under control and I'm paying them off, something else crops up, either from family or a really old bill or account I didn't even know I had. For the longest time I used to not answer my phone or open letters that I knew were from various companies chasing me. Even when I was on jobseeker's allowance, I tried to find a way to pay.

My family are in a worse position than I am and haven't been able to help me for a long time – in fact I sent money home and/or paid bills for as long as I can remember, until recently. I don't have an overdraft because despite being really good with my bank accounts, I'm refused one every time I ask. It's frustrating, particularly when you need that buffer. I would love to have a credit card to pay off everyone and then I would be only paying one payment per month rather than multiple payments at various times of the month. It's exhausting to keep up with. It's like a precarious house of cards.

My debt has taught me that sometimes those in debt aren't in it for frivolous spending or bad decisions. Sometimes you inherit it. I've also learnt there are many more resources now to helping us save money and get out of debt faster. I had a meeting with Christians Against Poverty, and they are going to give me a budget, call off my creditors and reduce my monthly outgoings, and even help reduce what I owe with negotiations. I feel like I can breathe again. I am hoping to be debt free by the end of this year. I'm looking forward to hitting reset.

Submitted by Anaïs, email.

5. "My debt is so overwhelming."

At the moment, my debt seems so overwhelming that I feel like I'm throwing drops of water on to a forest fire.

Submitted by Rachel Sedgwick, Facebook

6. "Before I knew it I had three credit cards and two overdrafts."

When I started uni I knew very little about how to handle my finances. It was also long before the recession and banks literally threw money at me. Before I knew it I had three credit cards and two overdrafts. This led to the vicious circle of chasing your tail and by the time I finished my five years in uni I had racked up £12,000 in debt. That does not include my student loan. I'm 28 now and have only just seen a difference. I'm aiming to be a homeowner but my credit rating and years of defaults have set this back massively.

Submitted by charlottew4a31e6c7f

7. "I ended up going to uni at 24 after leaving school at 16."

I've paid it off now but in my early twenties I was in £8,000 of debt on credit cards. I took a loan for a car at 18 when I had a reasonable job, which I promptly dropped and moved to a rubbish-paying one near my boyfriend at the time. I made a lot of frivolous purchases and took a gap of three months (which, looking back, was ridiculous). I moved back in with mum, got a decent job, and ended up going to uni at 24 after leaving school at 16. I'm still with Mum but I've never been so happy to pay those cards off!

Submitted by janeh47784dece.

8. "Just don't ignore it. Your mental health will thank you for it."

Do not apply for a store card! Missing payments and declining the phone calls, will not make it go away. I had a store card with £250 limit on it; the bill ended up at £850 before I took action. After many sleepless nights and ignoring the letters I called them for advice. The customer service advisor on the other end was very nice, I was able to set up a direct debit and paid it off within a year. Now my credit score is in the green and I'm saving for my first home. Just don't ignore it. Your mental health will thank you for it!

Submitted by jennal4b518f018.

9. "I cannot wait to start my adult life properly."

I took out a loan for £8,000 in 2013 to lend to my best friend who was in a bad situation. That friend turned out not to be one and ended up not paying me the money back. To pay the loan company I got into more debt with credit cards and payday loans until I was in way over my head with more that £9,000 of debt at the start of 2015. I was so depressed.

I contacted [debt charity] StepChange who contacted all my creditors to arrange a payment plan. I now have three creditors left and only two more payments, which means by New Year's Eve I will be debt-free at 23 years old. It was the worst situation I have ever been in but I have learnt my lesson and cannot wait to start my adult life properly next year, when I can move out of my parents' and finally start my life.

Submitted by Emily Brogan, Facebook.

10. "I've just taken out my first store card so I can buy clothes for work."

I'm about to turn 25. I owe £2,000 plus student loans on a degree I am yet to finish. Doesn't sound like much but I grew up with a mum who went bankrupt twice and I never wanted to be in such debt. My parents moved out of London and the only way I could afford to stay was to go to uni (with student loans). I have a lifelong degenerative spinal disease and my disability benefits were cut earlier this year, meaning my rent had to come from my overdraft. I've just secured a part-time job but have no idea how I'll physically manage uni and working, and still won't be earning enough to pay off my overdraft. On top of that I've just taken out my first store card so I can buy clothes for work without the initial outlay, so that's another £100 plus interest I owe.

Submitted by kathleenw420c38eef.

11. "Not enough is done in schools to educate young people about the dangers of credit and loans."

My debt started spiralling in my early twenties. My partner and I both have student loans to pay back, both totalling around £25,000. I don't even see this as a debt. Occasionally a payment will be taken from our salaries if we cover enough overtime but I just see this as a tax. The real problems started after we both started to work full time. I couldn't afford to buy a car outright and because I was living with my parents at the time and working full time I forked out £200 per month over five years on a finance deal I'm now three years into. Then there were three credit cards between the two of us, with about £4,000 maxed out. Then my partner took out a loan when we decided to rent our own place. Then my partner needed a car; another £100 per month.

We were left with a very small amount of disposable income. We took out payday loans to cover our bills and ended up with about four of those chasing us for payments. Although we never received a visit from the bailiffs, we were always suspicious of any knock on the door or unexpected phone calls. We are now a year into a three-year debt management plan but so great was our debt that we still pay out a staggering amount of money each month from our very basic wages. The debt has caused arguments, tantrums, panic attacks, depression, and a lot of stress.

I think not enough is done in schools to educate young people about the dangers of credit and loans and think, had I known what I do now several years ago, I would have never been in the financial mess I am now.

Submitted by harryh492ec6fea.

12. "Uni will put me in at least £50,000 worth of debt."

I'm 19 and just about to start uni, which will put me in at least £50,000 worth of debt. It's something I really want to do but that is weighing on my mind a lot.

Submitted by sophied434a19c4c.

13. "I'm still struggling to get out of my overdraft."

I attended university, but couldn't complete it due to a number of reasons. I incurred three years' worth of student debt and a substantial overdraft with nothing to show for it at the end. It's a year on, and I'm still struggling to get out of my overdraft and I don't think I'll ever pay off my debts. It weighs on my mind every day and contributes to depression and anxiety disorders. I am getting treatment for them and I am improving, but constantly not having money at 24, having to "let" others pay for things I need and not being able to be independent crushes me. I'm terrified of running out of time on my overdraft and my bank hitting me with massive charges, because that would just run me into the ground.

The price of a higher education and life experiences is way too high. What good are all these highly educated, highly qualified people if they all have too much debt to be able to afford to continue with their lives? So many amazingly talented people I knew have had to go and work in dead-end jobs with no prospects whatsoever just to make ends meet, with their hopes of working the job they're educated for slipping further away with every month and year of grind.

Submitted by Tazfox.

14. "Wishing I'd made better choices is a constant feeling."

I'm in about £15,000 of debt. I don't count my student debt in this (I daren't think about how big that is). About £7,000 of my debt is credit cards, built up largely through working minimum-wage jobs, having two redundancies, and trying to maintain independent living. The other £7,000 is a course fee for a postgrad course I signed up to do but couldn't secure funding for. I didn't tell them in time and so they want me to pay half of it (it was £5,500 but has risen to £7,000 because of interest). They've taken me to court and I'm waiting to see what the outcome of that will be.

I range from feeling totally helpless, crying myself to sleep, and wondering if it would just be easier if I wasn't here. (I never think too hard about that last one, it's more "gee, I can kinda understand why people do that when they're in mountains of debt".) Other times, I think that it's OK. No one can put me in jail because I can't pay so I'll just do what I can and keep on living. Wishing I'd made better choices is a constant feeling – and the worry that I'll never be able to have kids because I won't be able to afford them. Debt does suck.

Submitted by sophiel41c9284ae.

15. "It seems to me that most people I know owe debt."

I hate being in debt. I never imagined myself in debt. I'm only 20 and recently moved into a rental property with my partner after getting a new, full-time, better-paid job. Yet, living at home, paying what I think now was a pittance of £50 a week, seemed so much back then. But now I have bills falling out my ears, and an unwanted yet much-needed overdraft on my bank account that seems to be constantly extended. I live beyond my means.

I struggle to cut back on all the things I love. I constantly borrow money off my mother, pay it all back, and then borrow it all over again. It's a never-ending cycle. I hope that I will be able to get out of my debts, but I see no way out. Even if I tried, I'd still owe money back for quite a while. It's constantly on my mind. But it seems to me that most people I know owe debts; maybe it's a part of life.

Submitted by rachelh43789223c.

16. "I don't think the older generation understands that it was mostly out of necessity rather than greed."

I just paid off my overdraft almost 10 years after I first went into it. I still have another overdraft and credit card that I am slowly chipping away at. My parents don't know how high my debt is because I don't think the older generation understands that it was mostly out of necessity rather than greed. I don't even think of my student loan as real debt because there's no light at the end of that tunnel!

Submitted by frankiek42c8c8133.

17. "We're stuck in a vicious circle of high interest, high borrowing, and a long road ahead."

My then fiancé (now husband) received a letter out of the blue saying he owed his old bank £5,500 for an account he thought had been closed seven years previously. Apparently it hadn't been closed properly and there were charges on charges on charges. We had to take a loan with our new bank to pay it off, at a high interest rate, which we're still paying off now. We can't get a cheaper rate because our borrowing is already too high, with (necessary) overdrafts, car finance, and a credit card. If we could consolidate with a lower-rate loan we'd be able to pay it off faster and have more money at the end of the month, but as it is we're stuck in a vicious circle of high interest, high borrowing, and a long road ahead until we can afford to pay it off.

That's before I start on our student loans, and there is no way we will afford a mortgage any time soon. There is definitely a lack of education when it comes to borrowing, with young people being given credit far too easily before they need it, with no understanding of how it can affect their future long term.

Submitted by CasaDeTurtle.

18. "I honestly can't think what I've spent on."

My husband paid off my £2,300 by taking my balance to his card as it was 0% interest on balance transfers. But I'm back to being £700 in debt again, which he doesn't know, and he would go mad if he knew. I honestly can't think what I've spent on. I'm a very bad spender and use my actual wages to buy stuff I don't need, and then use my credit card to save me at the end of the month when I need petrol or I need to buy some daily essentials. Every month it's always "this month I'm on a budget" and days later my budget is out the window.

Submitted by Nilufar87.

19. "Debt sucks and I regret everything – apart from law school."

The worst thing I ever did was apply for a credit card. From the first one it was a downward slope to being £12,000 in debt. Now I can barely make the minimal payments because the interest is so high. On top of that I have a loan which I used to pay for law school. As a result of my debt and my fiancé's equally high credit card debts, we live with family and probably will continue to do so even after we get married next year…if we can even afford to pay for a wedding! Debt sucks and I regret everything apart from law school. It's not worth the sleepless nights.

Submitted by karens4fcaf5ec0.

20. "I'm in debt because basically I'm an idiot."

I'm in debt because basically I'm an idiot. I didn't go to university; instead I began working and have since worked my way up in business, but my debt has also crept up. When you turn 18 you think you're invincible and you have your whole life to be responsible. Um, no. Reality check: Four years later, I'm still in debt and while my friends are all saving for cute little flats and cars I'm still struggling to pay off numerous debts while still trying to be young and sociable. It's hard. Don't do it!

Submitted by elliee45e4d80af.

21. "I panic if I have to have a credit check for work."

After my grandmother (who raised me) passed away, I got depression and spent a lot on my credit cards and overdraft. I was paying them off fine, and then I got a new job which fell through. I was struggling to make ends meet on jobseeker's allowance, and ran my cards up. The banks let them get to £3,000 each before they stopped me using them. I had also taken out a phone and internet contract which I had to default on. All in all I ended up with about £11,000 of debts. That doesn't include the £26,000 of student loans I have. I'm almost 30 now and have paid off a credit card and my overdraft, I still have about £5,000 to clear, and none of my student loans have been paid off.

Spending your twenties in debt is hard. I panic if I have to have a credit check for work. A family member put a car on my driveway for two hours and there was a note put through my door saying they were repossessing it. Of course that was sorted as it wasn't my car, but it was still scary. I can only take the blame for spending the money: Yes I did it, but I wouldn't have been in as bad a situation if the banks had kept to my credit limit. I would have owed about half of what I did. I was a stupid kid and if I could go back, I would. Having this over my head has ruined most of my twenties.

Submitted by Chelle Milne, Facebook.

22. "I'm not that stressed out."

Because I've come from a poor family I've been given the full set of loans and grants possible. I got a £3,000 grant in my first year, meaning I only owe money to Student Finance England and not to a bank as I don't have an overdraft. Money is going to be taken from me only after I'm earning £21,000, so I'm not that stressed out. I think I may end up owing £44,000 by the end of all this but I'm OK with that. I know that at the end of the day, no matter what happens, I'm going to be OK. It's just a case of making my degree count.

Submitted by Naomi Stennett, Facebook.

23. "I still struggle to stick to a budget."

I currently have debt of over £12,000. It will take me over two years of paying about £400-£500 a month to pay it off in full. Debt came from many sources: I bought a house two years ago (I was lucky enough to get an inheritance from a grandparent, and my parents helped me with the deposit) and then had to do a lot of renovation that went over by a few thousand pounds. I went through a break-up with a horrible bloke and decided to celebrate by spending money.

I have one personal loan and two balance transfer credit cards with 0% interest for a fixed time. I got these through my own research but my boyfriend, who is a mortgage broker, has really helped me with setting a budget and trying to stick to it. He also helped me with reducing bills like gas and electric, and getting things on direct debits.

Even today I still struggle to stick to a budget because I just love impulsive shopping and cannot even go a month without buying some new clothes. It's almost like an addiction to just spend money. I know there will be plenty of people out there who will be in more debt than me and for more extreme reasons, but I am one of those normal everyday kinds of people where debt sneaks up and makes life difficult. Just a shame I don't have a lot to show for what I've spent my money on!

Submitted by LJ, email.

24. "All I know is I want to hide under my duvet."

All I know is that all these questions made me want to hide under my duvet with my phone, so I can use my banking app to extend my overdraft.

Submitted by Shoni Robertson-Finn, Facebook.

The National Debtline is a free, independent and confidential debt advice service run by the charity Money Advice Trust.

These posts have been edited for length and grammar.