1. Use a different web browser

Google generates huge profits in the UK. But despite an $18 billion turnover between 2006 and 2011 it paid the equivalent of just $16 million in taxes to the UK government.

In June this year Margaret Hodge, the chair of the House of Commons Public Accounts Committee, said: "Google brazenly argued before this committee that its tax arrangements in the UK are defensible and lawful. It claimed that its advertising sales take place in Ireland, not in the UK.

"This argument is deeply unconvincing and has been undermined by information from whistleblowers, including ex-employees of Google, who told us that UK based staff are engaged in selling."

This is about as stern as it gets from a politician. And coming from a politician whose family company pays just 0.01% tax on £2.1bn of business generated in the UK it's pretty damning. Or not, depending how you look at it.

2. Drink different coffee

In June this year, Starbucks paid £5m in UK corporation tax - its first payment since 2009. The company has only reported taxable profit once in 15 years in the UK.

It only announced it would pay more corporation tax after a public outcry and an investigation by MPs. Better latte than never. Sorry.

The firm used a veritable mixed blend of tricks, among them transferring money to a Dutch sister company in royalty payments, buying coffee beans from Switzerland (what?) and paying high interest rates to borrow from other parts of the business.

3. Don't buy stuff on the Internet, pretty much

Because this is easy to do, obviously. Just use one of those Chinese wholesaler sites or something.

In May we learnt Amazon's UK subsidiary paid £2.4m in corporate taxes last year, despite making sales of £4.3bn. And in 2011 Amazon's sales in the UK were £2.9 billion but they only paid £1.8 million in corporation tax.

How? In 2005, Amazon rented a huge five-storey building in Luxembourg's Grund quarter. By setting up in Luxembourg, and channeling sales through its units there, it could minimize corporation taxes.

4. Continue not to buy stuff on the Internet

Luxembourg's a busy place when it comes to tax avoidance. Which is good for those living there because there's nothing to do other than eat cheese and visit museums - but not so good for the rest of us.

Last year we learned eBay, like Amazon, channels payments through the country. This means it pays barely more than £1m in corporation tax, despite generating sales of almost £800m in the UK in a year.

Using a group-wide profit margin of 23%, UK profits would have been £181m in 2010. At the time this would have produced a corporation tax bill of £51m.

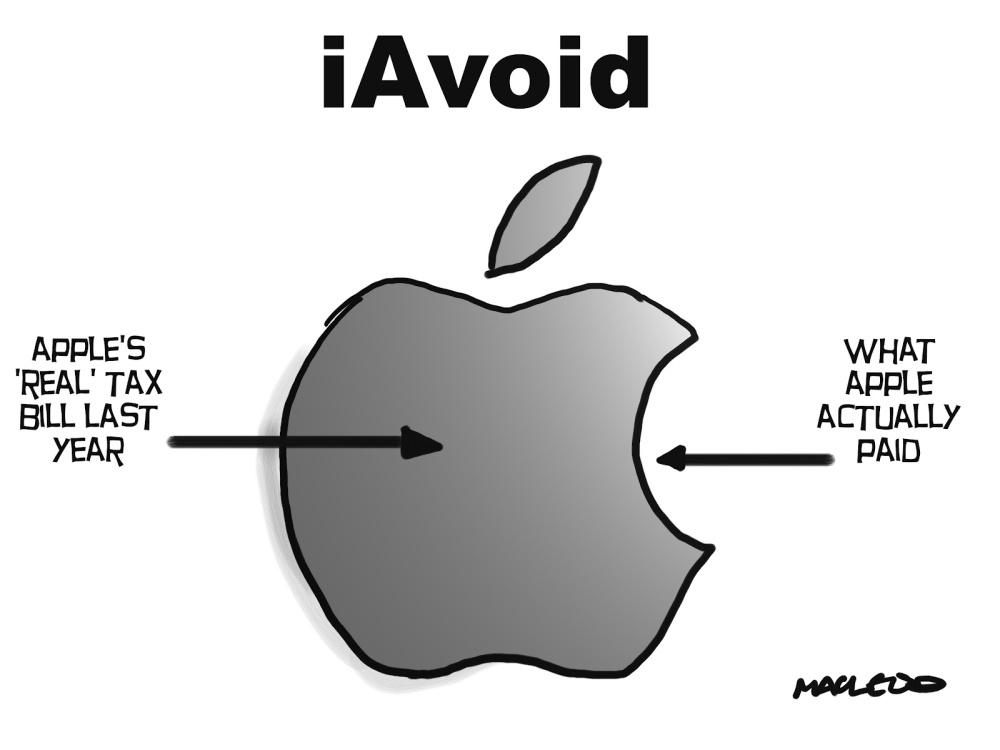

5. Use a weird mobile phone

Last year we'd just about recovered from the news that the company was using child labour when we learned Apple paid less than 2% corporation tax on its profits outside the US. Then the new iPhone came out and we all bought it because it had a bigger screen.

The company paid $713m (£445m) in the year to 29 September on foreign pre-tax profits of $36.8bn, a rate of 1.9%. The company channels many of its profits through the Republic of Ireland.

Carl Levin, chairman of the US Senate Permanent Subcommittee on Investigations, says sending valuable intellectual property rights offshore - together with the profits that follow those rights - is at the heart of the company's tax-avoidance strategy. Unlike more tangible assets the value of these property rights can be transferred to other countries in a matter of seconds.

6. With a different tariff

This is a tricky one because ever since EE came into existence unless you're with this lot or Orange it's been basically impossible to get decent phone reception unless you're hanging out of the window of a tall building overlooking Oxford Street.

Two months ago we learned Vodafone paid no UK corporation tax for the second year in a row. The company had sales of £5bn in Britain in the year to March and made an operating profit of £294m, according to its results. Vodafone has been dogged by allegations of tax avoidance for years, with MPs criticising a deal with HM Revenue & Customs to settle tax claims of £1.25bn.

7. Stop smoking

Cigarettes might be bad for you, but they're not all that great for the Chancellor either. British American Tobacco (BAT) - producers of Benson and Hedges, Rothmans, Pall Mall and others, has a base in Southampton. It increased its operating profits last year to £5.97 billion according to its latest financial results. But the cigarette giant doesn't pay a single penny in corporation tax in the UK.

The company claims any profit it makes through its UK subsidiary is cancelled out once the operating costs for its headquarters and other offices are taken into account. Which is exactly what Starbucks claimed, until they backed down. You might have suspected that when you slope off at 11am to have your morning coffee and fag you're contributing literally nothing to society, but here's the proof.

8. Change your bank

HSBC, the UK's largest bank, has been targeted by the campaign group UK Uncut for its links to tax havens and its role in facilitating tax avoidance. It uses tax havens more than any other UK bank, with 496 subsidiaries in tax havens (only two other companies on the FTSE 100 have more links to them).

The bank has also been rocked by major tax avoidance scandals, with a Swiss subsidiary alleged to have helped UK tax payers evade £200 million as well as running thousands of offshore accounts in the tax haven of Jersey. Which is presumably what they mean by the world's local bank.

9. And your energy supplier

Earlier this year we learned npower paid almost no corporation tax between 2009 and 2011. The energy giant used a Maltese company to transfer funds between it and its parent firm, RWE.

The fact that npower put up its prices by 9% in November didn't help at a time when millions are in fuel poverty. It's been said, by some cynics, that this was in part faciliated by Volker Beckers, a non-executive director for HM Revenue and Customs at the time the Maltese arrangements were put in place.

Guess which energy company he was working for as chief executive at the time? Well done: you win a rise in your gas bill.

10. And use sweetener

Tate and Lyle made £379m last year, but like Starbucks and British American Tobacco before it, claimed it was making a minimal operating profit on its UK operations. So it paid...wait for it....sweet nothing.