Recently, Newsweek polled Americans on whether or not they viewed $74,000 as a "middle-class salary." Of the 1,500 Americans polled, Gen Z was the least likely group to view $74,000 as middle class, at only 41%.

The poll prompted many reactions to the findings, including a viral video by Orlando realtor Freddie Smith, which has now been viewed over 12 million times. In the video reacting to the article, Freddie reads, "Gen Z doesn't agree that $74,000 is middle class — no kidding. It's not even close."

Freddie then proceeded to break down what $74k for a Gen Z'er actually looks like if they have a bachelor's degree and they're 25 years old. He clarified, "First of all, $74,000 is much higher than the average income. Most Gen Z'ers are probably making anywhere from $40 to $50k, maybe $60k."

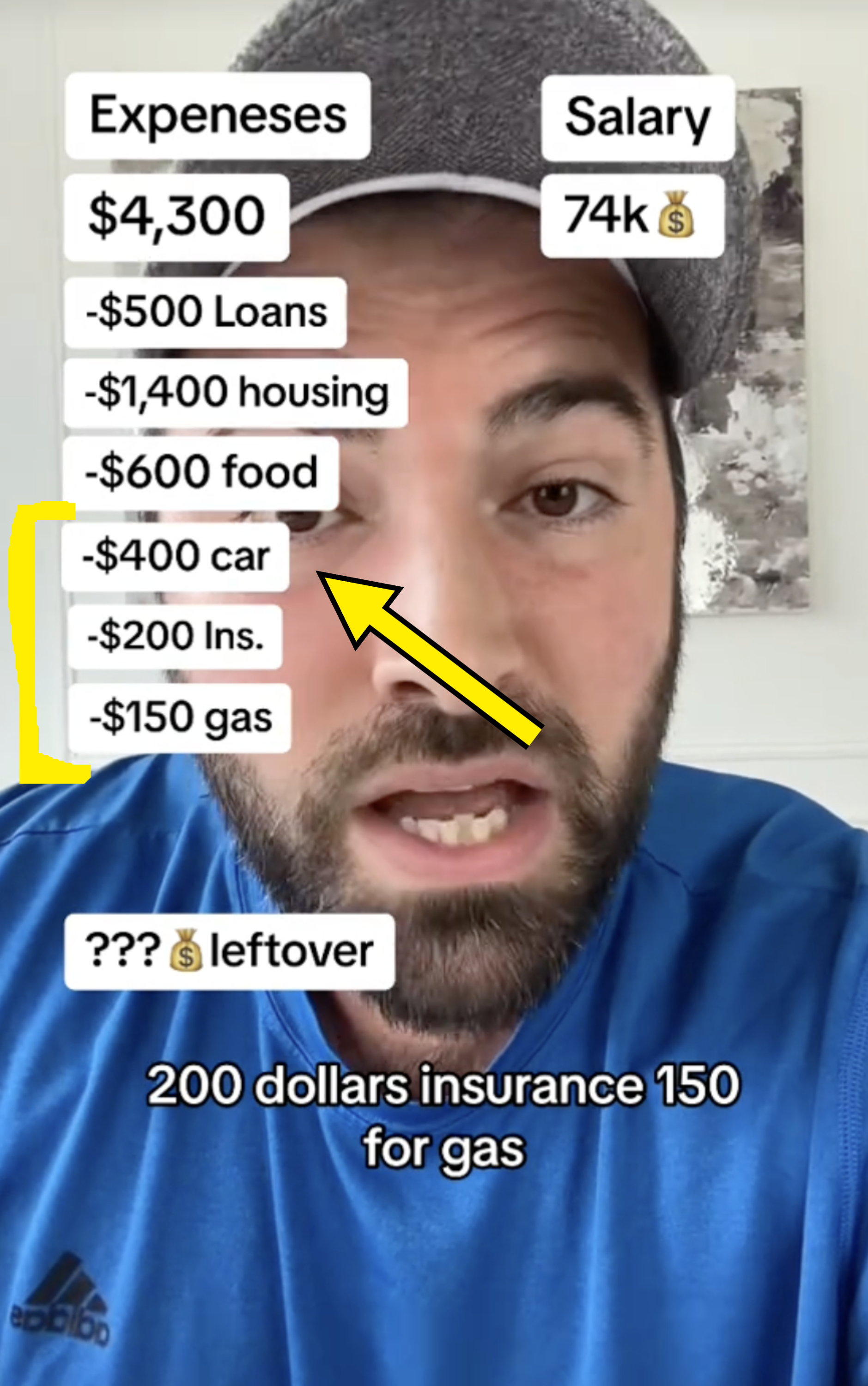

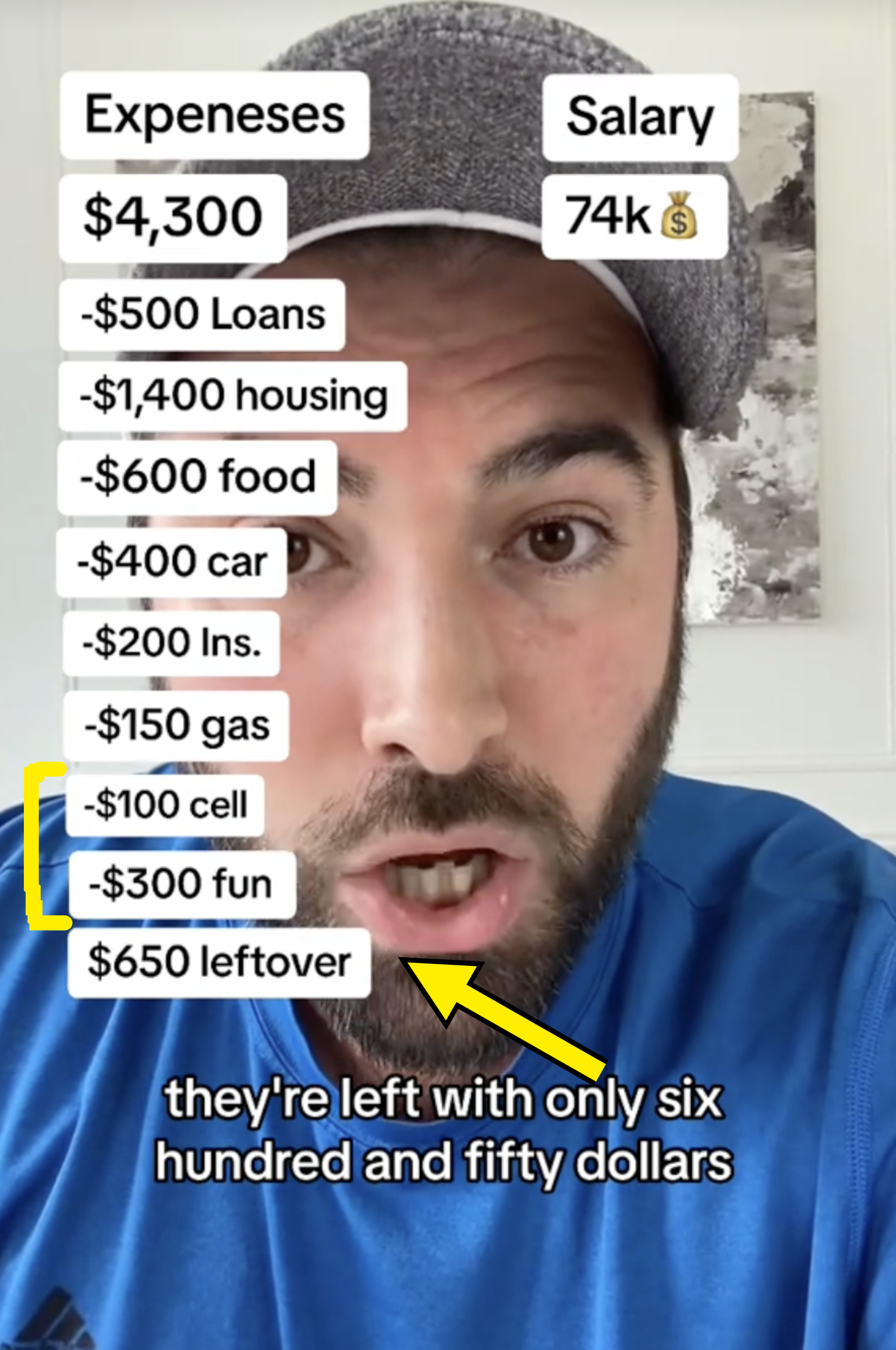

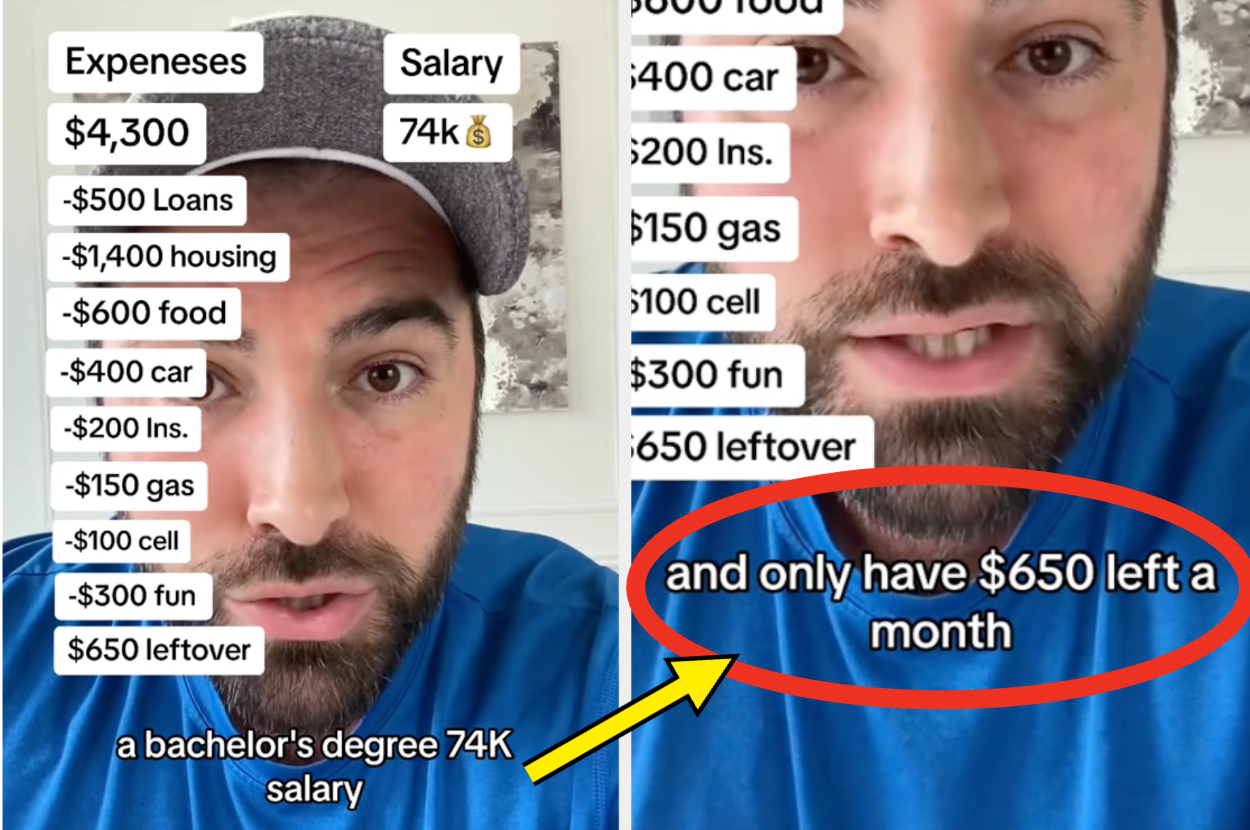

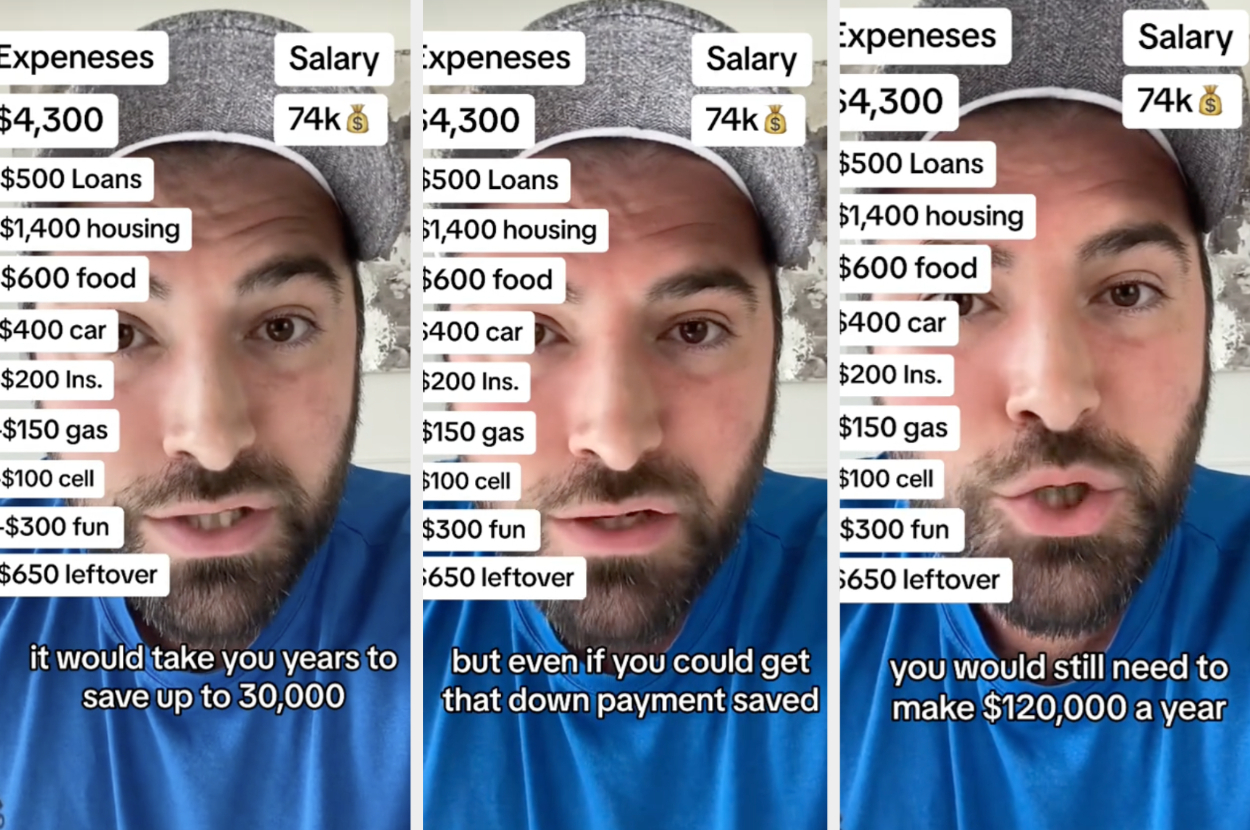

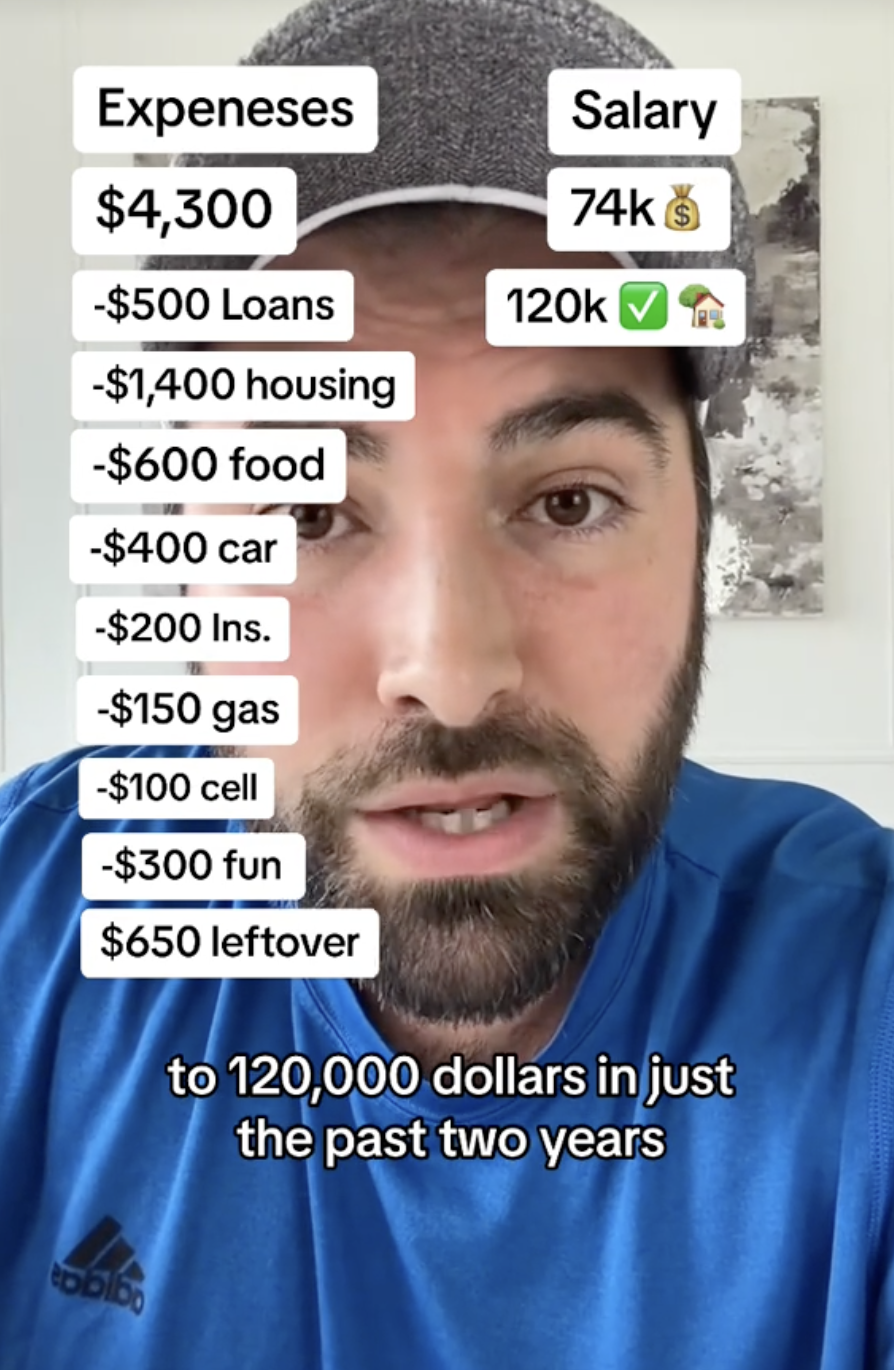

He continued, "But let's use 74k." First expenses aside, "The take home after taxes, 401k, and health insurance is $4,300."

Second, "The average college monthly payment on a loan is about $500. You're down to $3,800."

In regards to living costs, Freddie took a conservative estimate. He said, "Let's say this person is financially responsible and decides to split a two-bedroom apartment in a medium sized city, like Orlando, so that their payment is $1,200 a piece, $200 for utility, so $1,400."

For food costs, Freddie gave a more generous estimate, "Now unless they're gonna have Lucky Charms and peanut butter and jelly, their groceries are gonna cost about $600 if they're trying to get chicken, beef, and some healthy stuff."

Then, he listed car costs (presuming this person has a car). He said, "You have a $400 car payment, $200 insurance, $150 for gas."

And lastly, "$100 for a cellphone leaves you $950. This is no savings, no investments, no emergency fund. Let's give them at least $300 to go on a couple dates, or hang out with their friends for the month so they can enjoy life a little bit. They're left with only $650."

Freddie said, "A bachelor's degree, $74k salary, you are splitting a two-bedroom apartment with a friend, and you only have $650 left a month."

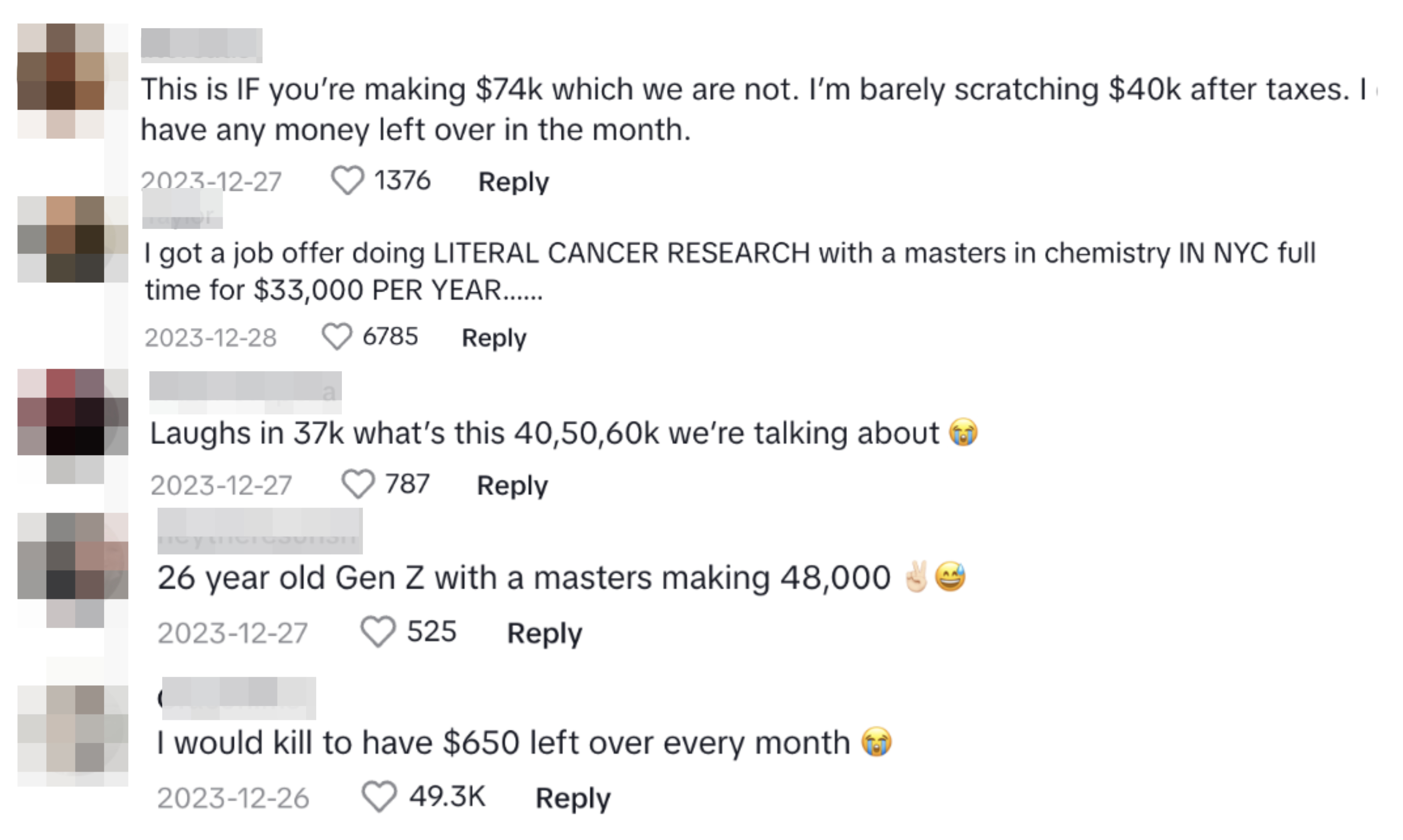

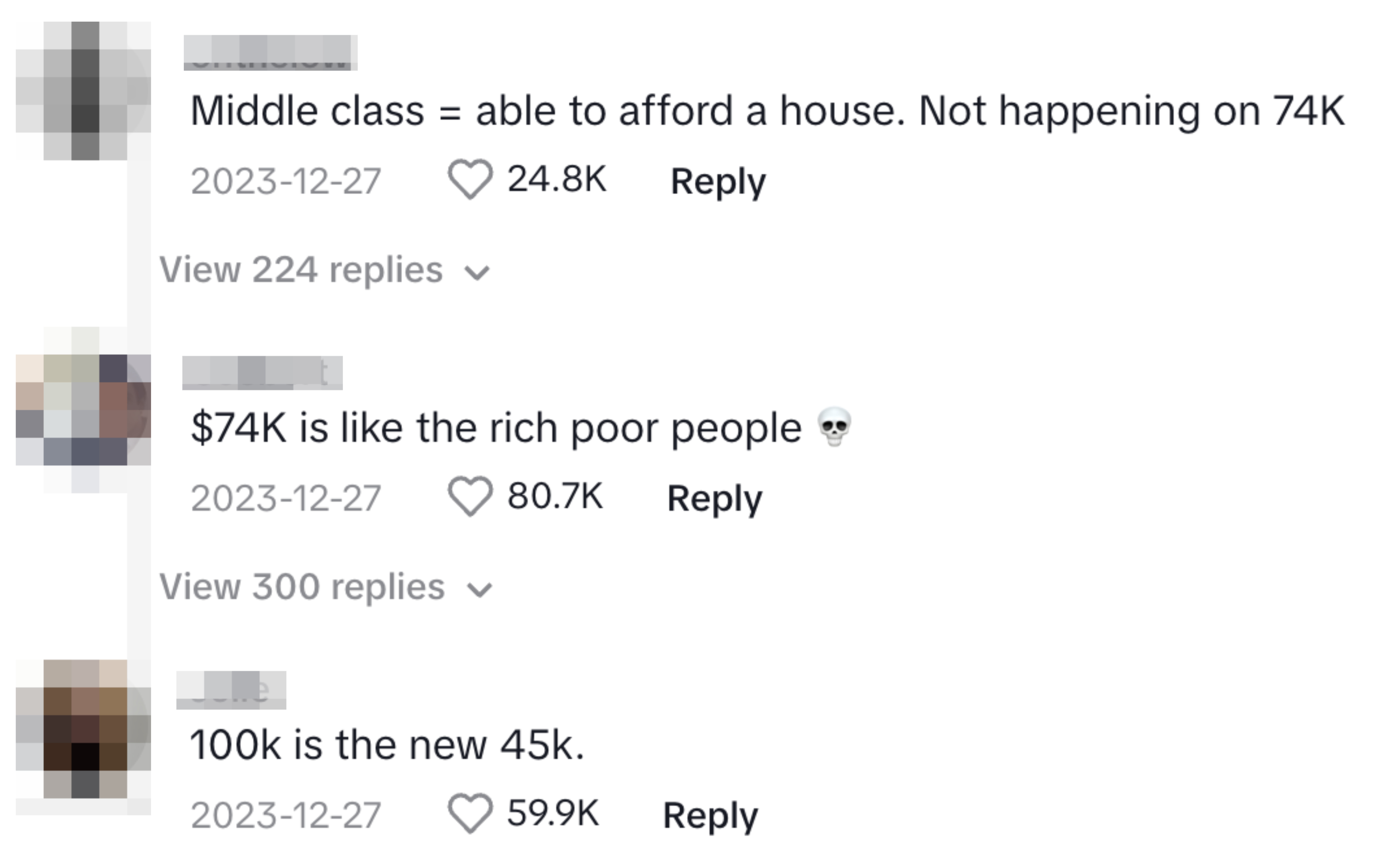

Many people agreed with Freddie, and pointed out other costs Freddie didn't mention, like medical insurance, internet bills, and subscription services.

And others agreed that $74k isn't even close to what Gen Z makes, with some Gen Z'ers mentioning they wish they could save $650 every month.

And while some people argued that $650 is still a lot of money, Freddie said, "I agree $650 is. BUT. They are splitting a two-bedroom apartment with a friend. Somebody making $74,000. How can $74,000 be middle class if you have to split an apartment with a friend in order to survive? Because if you live on your own for $2,000, that $650 is gone, and now you don't have any extra money leftover."

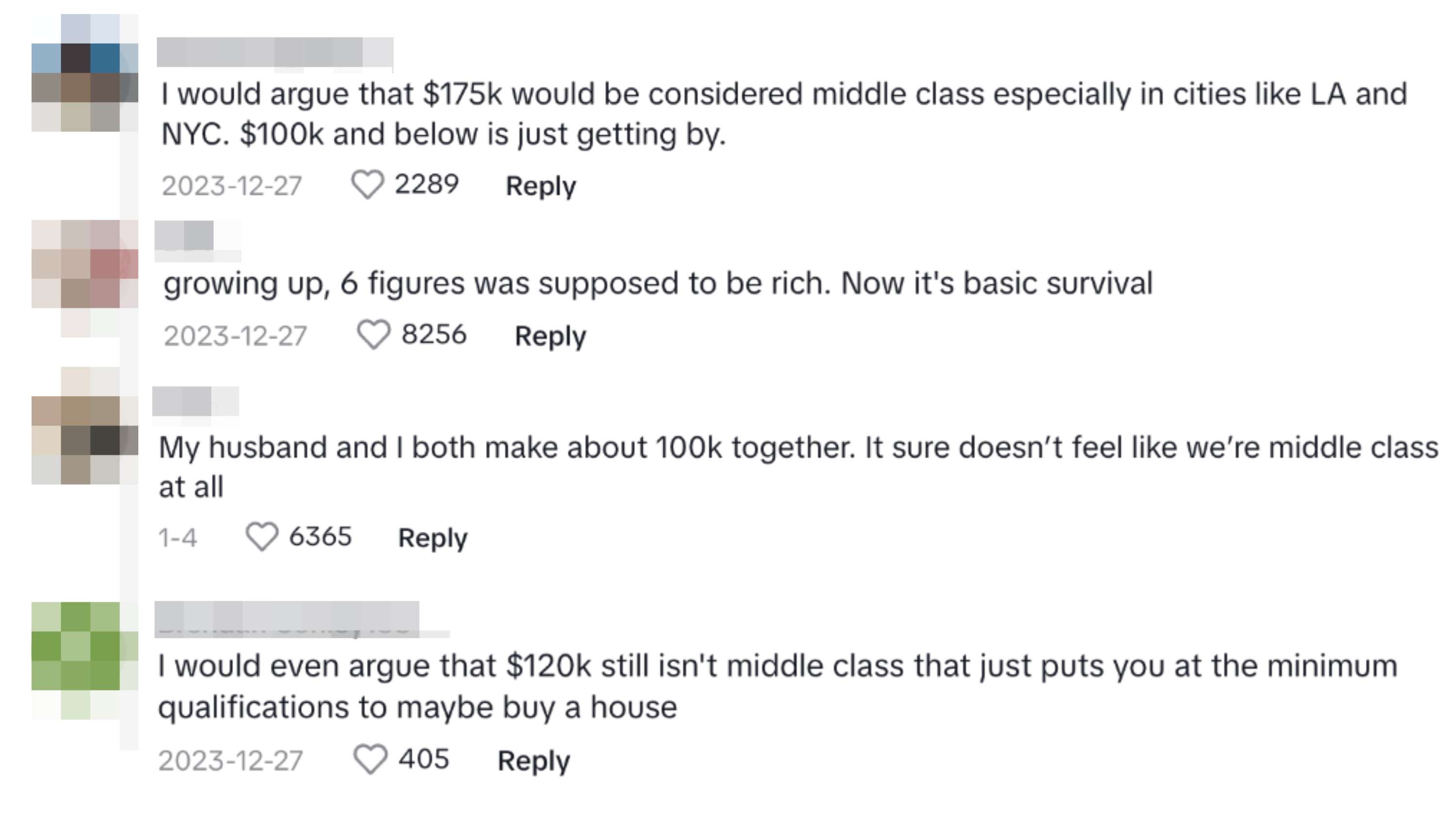

Freddie continued to say that by only saving $650 a month, "It would take you years to save up to $30,000 that you would need for a down payment on a house with the closing cost. But even if you could get that down payment saved, you would still need to make $120,000 a year to be considered for a $400,000 loan."

Even for what might have formerly been called a "starter home," the average cost of a home is over $400k, and loan interest rates are currently just under 7%. As a result, Freddie told BuzzFeed that "most young people have been priced out of the housing market in most metropolitan areas."

Freddie clarified two scenarios that someone might be in to qualify for the $400k homeowner's loan. Scenario one: "You need to put down 20% ($80,000), have no debt, and earn about $85,000 a year to have a shot at qualifying." Scenario two: "You put down just 3% (which is only $12,000), but if you have debt (college, credit cards, and car), you may need about $120,000 in salary to be considered for the loan."

But the reality is, neither scenario is really realistic for most young people. Freddie said, "The biggest change we have seen with past generations, in most cases, regardless of interest rates, the average American family could qualify for the average home. Today, a large percentage of average families cannot qualify, which is forcing them into renting."

As a result of all this, Freddie said, "The middle class, the goal post, has been moved from $70k to $120,000 in just the past two years."

Overall, while many said $74k is more than they make, they agreed with Freddie that it's nowhere near what's needed to be able to afford a house and live comfortably.

Some argued that $100k–$120k still feels like the bare minimum.

If you are a young person hoping to buy a home someday but feeling a bit discouraged (like me), Freddie did impart some wisdom.

He told BuzzFeed, "I recommend young people to speak with a mortgage lender and learn the process of what it takes to qualify, like what loan options, down payment options, and specific programs could be available to help them get their foot in the door. Once they make a road map, it'll be easier to work toward that goal."

And while it all feels a little bleak, Freddie did conclude with a bit of a positive note. He said, "Though housing has changed, it doesn't mean it's impossible. Success comes in many forms outside of homeownership."

He added, "I know it can be challenging, but staying optimistic, being creative, and continuing to learn will help you navigate not only the housing market, but your lives. We cannot underestimate the power of 140 million millennials and Gen Z'ers who can come together and truly make the world and economy a more balanced place."