In 2012, The Institute for College and Success published new research stating the average student loan debt per person was $29,400. When most students say they are paying for college on their own, why is the average so incredibly low? Being almost $30,000 in debt sounds like a large amount, but in comparison to tuition rates, this number is deceivingly low.

The average four-year university falls below $20,000 a year, but most people forget to take into account the cost of living in particular states, and mandatory fees every college student accrues.

At The University of California Los Angeles, tuition is reported at a reasonable, but still pricey, $12,692 for state residents. This amount is the base price to enroll in the university and show up for classes. In no way does this amount reflect the $14,454 bill to live on-campus or even the inevitable amount required for purchasing expensive textbooks.

According to Forbes, "We've all heard the screaming headlines of graduates with crippling debt of $100,000 or more, this is the case for only about 1% of graduates. That said, 1 in 10 graduates accumulate more than $40,000." Meaning, only 10 percent of graduates are reported to have student debt amounting just one year at a four-year university? The numbers do not add up.

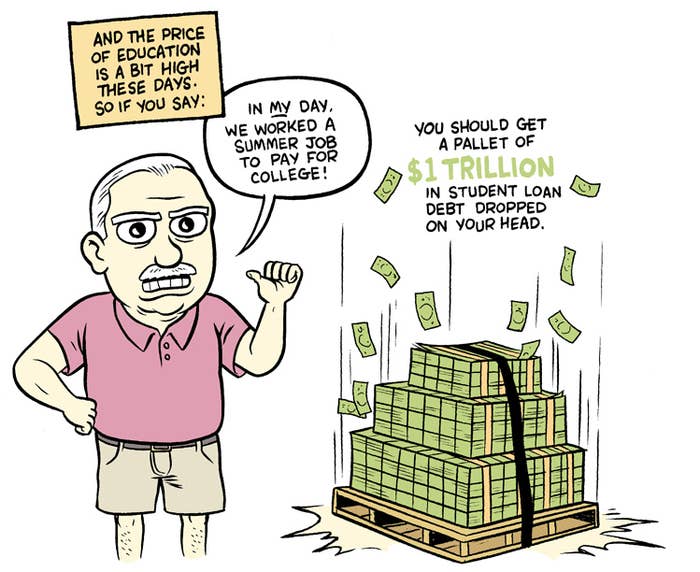

Granted, students are finding ways to pay their way through college without loans through scholarships and part-time employment. However, scholarships are often need-based and exclude the middle-class or require a minimum GPA which can be hard to maintain if the student is balancing coursework with a part-time job. Many students become stuck, choosing the only option left available to them -- loans.