The Charges

The CFTC has charged Intrade and theTrade Exchange Network with allowing U.S based customers access to trading specifically Gold and Oil contracts. Nothing to do with the political markets that the exchange is widely known for. These contracts do not influence the price of Gold or Oil in the U.S. The contracts traded are merely predictions on what the price will be at a future date, similar to options.

The CFTC began an inquiry in December 2011, into whether or not Intrade and TEN were being compliant with a settlement the CFTC and Intrade agreed to in 2005. The results of the inquiry are as follows.

" 30. ... Specifically, after the entry of the 2005 Order TEN offered for trading to U.S. customers, and solicited and accepted orders (and funds) from U.S. customers to trade, contracts related to the price of gold, the U.S. unemployment rate, and the U.S. gross domestic product, among other options contracts.

31. TEN also failed to comply with the 2005 Order by failing, during the Relevant Period, to provide "pop-up" notices or other indications on its websites informing users that it was unlawful for U.S. customers to trade cetiain of the commodity and financial option contracts then offered on the websites. Specifically, after entry of the 2005 Order, U.S. customers trading contracts related to movements in the price of gold, changes in the U.S. unemployment rate, and/or changes in U.S. gross domestic product figures, among other options contracts, were not provided with the notice required by the 2005 Order"

Why the Charges Are Bogus

The pop-up that is required by the 2005 order is right there in the screenshot I took today from my home here in Florida. I have been seeing that pop-up since the first time I tried to make a trade in this market. I have been trading on Intrade for over 4+ years now and I have not been able to do so.

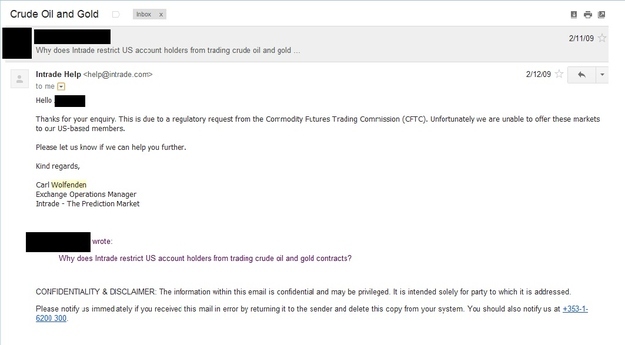

Intrade has been blocking U.S users by IP address since at least 2009 (Pic Below). So I'm really confused to why they say U.S users are able to complete the trades they are alleging have been made.

Whomever took it upon themselves to check whether or not Intrade allows these trades did not do a good job or figured out a way to route his IP address to a location outside the U.S. And who on earth is going to do that for a market that is pitifully small.

The amount of money that has been exchanged for the entire year of 2012 for Gold contracts totals $3,470! The CFTC wants to charge Intrade with a $130,000 fine for every offense of a U.S user buying one of these contracts. I don't think they'll find any, but that's just ridiculous compared to the amount of money in these markets that they are suing over.

Is this the result of too much regulation and bloated government? Bureacrats and lawyers sitting at their desks with nothing to do? What is the CFTC trying to do? Kill off Intrade?