1. Respect Money and Money will respect you

Don’t let money control your life or business. If you are reckless with money, it is highly likely your business will not last. Be diligent, put money aside for raining days and pay your bills on-time.

2. Make better business decisions

3. Source Cheaper Money Transfers Services

Using payment services like PayPal to pay remote staff or contractors can become expensive when exchanging into different currencies. Seek alternatvies with fixed priced payment options like OrbitRemit to save on transaction fees and more competitive exchange rates.

4. Put Tax money into a separate bank account

Never spend the tax man's money. That can get you and your business into a whole world of trouble. Set this money aside on a regular basis, after each deposit is best.

5. Register for G.S.T if you fit into this bracket

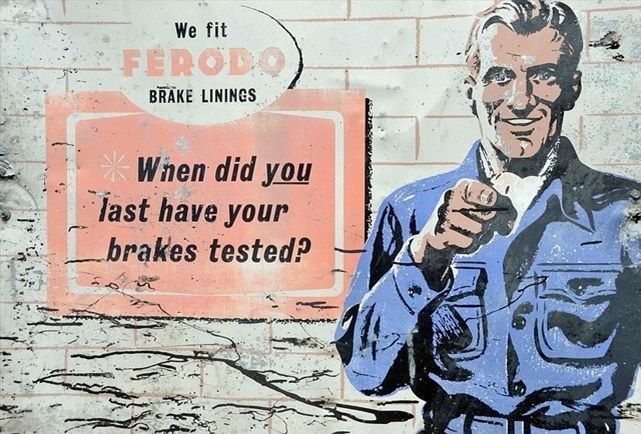

6. Piggyback Advertising

7. Leverage Customer Ambassadors

8. Help a Reporter

9. Befriend a Creditor

You never know what’s around the corner. Business is tumultuous, be prepared and have back up plans for those tough times. Find a trusted company that provides working capital.

10. Say 'no' to Cash Advances

Creditors love offering businesses cash advances, because the interest they can charge are, extortionist.

11. Make saved cash work for the business

Put business savings into a high interest savings account. Typically these accounts earn the business 2% on every dollar.

12. Don't Pay Bills until there due

Good cash flow management relies on good planning. You should know when you bills are due. If you’re paying bills early, one you’re losing possible interest earnings and two you may run out of cash for other bills and acquire a late fee. Stagger payments by splitting them into different tiers. Tier 1: Everything you must pay, such as rent. Tier 2: Important bills, like insurance and utilities. Tier 3: Flexible bills, these are sent from wholesalers and contractors who usually will be flexible due to long term relationships and importance of maintaining your business to sustain their growth.

13. Negotiate Early

14. Choose your clients wisely

When planning your business you should have a clear idea around the types of customers you would like to attract. Always take into consideration whether your customer can afford the product or service. Acquiring customers that cannot afford your services will only cost you money in the long run. Check customers credit score before bringing them on-board.

15. Know when to fire bad customers

16. Make your Customers Fall in Love with your brand

17. Create a separate Bank Account for Payroll

18. Outsource where it makes sense

Hiring in-house employees is more expensive and they are legally harder to get rid when things go pear shaped. In-house employees cost more because you need to pay super, taxes and insurances.

19. Hire Commission Only Sales Staff

Create either an affiliate program or hire commission only sales contractors. This will help your business in two ways, attract quality sales talent who believe in your product and relieves pressure from the business cash flow, due to sales being paid on results.

20. Murphy's Cash Reserve

Rule is if it can happen it will. When your business is experiencing a money surge put cash away into a reserve fund, ready for times of crisis. Most business adviser's will tell you before you begin a business you should always have a cash reserve of at least 6 months operating costs. This will give your business a buffer to survive the tough times.

21. Budget and Perform Sales Forecasts

Understand the ebb and flow of your industry. You need to be prepared for drops in sales or increases in experiences due to season or market trends. Map out your quarter or yearly sales in advance. You can then put sales targets forward for staff and managers.

22. Track Cash Flow Live

Accounting systems today allow businesses to connect with most payment systems and banking platforms. This functionality allows your business to track sales performance in real time. This means you can daily measure profit and loss, providing more refined optimisation of business systems and discover ways to improve profit and cash flow.

23. Provide Clear Payment Terms from the Start

Lack of communication about your payment system will only end in tears. Making your customers aware of business payment policies early, will ensure there are no hidden surprises later on. Many companies enforce late payments fees; this is obviously one term that should be made clear before payments are made.

24. Offer Customers Alternatives ways to make Payment

Put technology to work for your business. Setup eCommerce functionality on your website, so customer can make payments online using either, credit cards, debit cards, PayPal and even Bitcoin if it makes sense for your business. The more ways your customers can pay the more likely you will be to attract and receive payments.

25. Send Invoices on Thursday

26. Train Staff to Use Free Software

27. Buy Recycled Cartridges

28. Create a Paperless Office

29. Buy Second Hand Computers

Huge saving opportunities here, typically your business can save 60% by purchasing pre-loved computer equipment. Often these machines come with warranties and free software.

30. Split Advertising costs with Partners

31. Trade Services with Other Businesses

Find businesses they sell products or services your business needs and offer a product or service unique to your business. Explain the benefits and whether they would be interested in bartering.

32. Don’t be afraid to ask for help

33. Put Tax into a separate Bank Account

Never spend the tax man's money. That can get you and your business into a whole world of trouble. Set this money aside on a regular basis, after each deposit is best.