Andrea Leadsom's decision to quit the Conservative leadership race received an immediate and positive reaction on the markets.

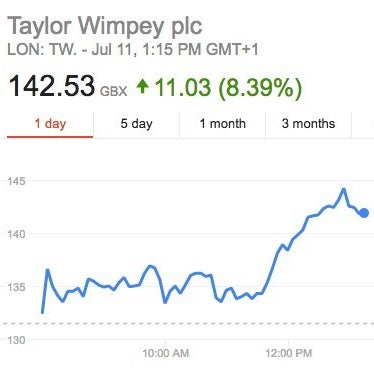

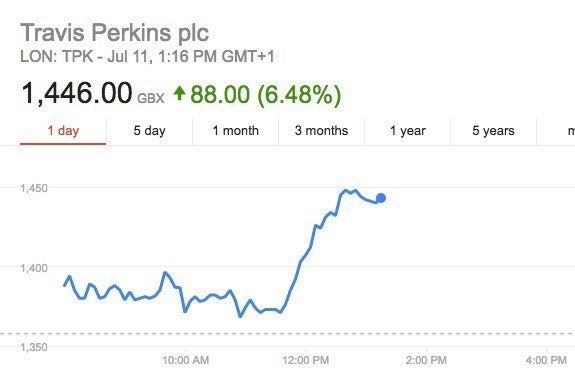

Housebuilders in particular have suffered since the result last month, but by lunchtime on Monday some of the UK's biggest building firms had seen their share prices climb.

Can you guess when Leadsom decided to withdraw...?

The pound also rose against the US dollar, with £1 now worth $1.30 – although this is still way off the $1.50 you could get before the referendum result.

Sterling now up 1.5 cents versus dollar in wake of Andrea Leadsom withdrawal

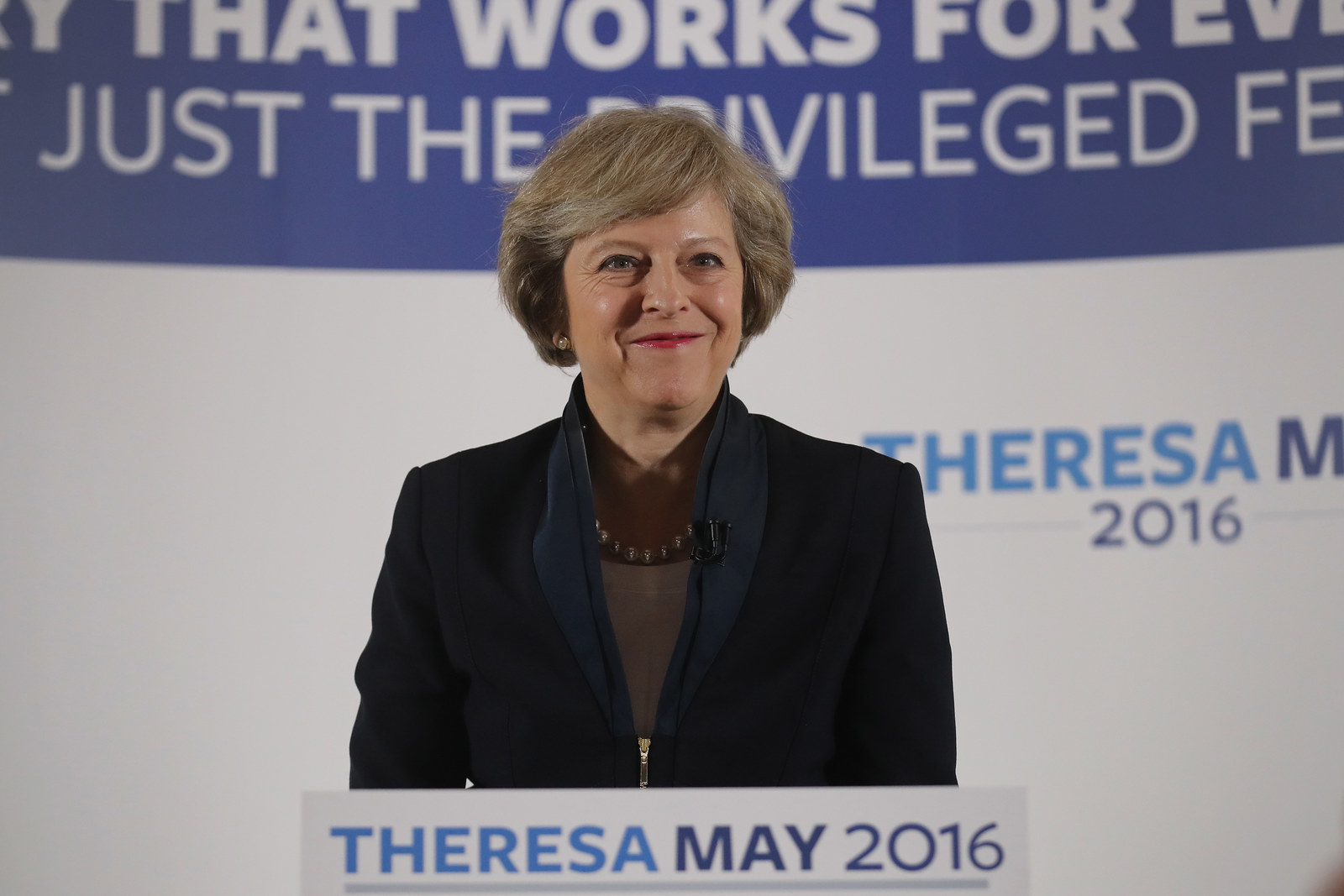

With Theresa May now set to become the next prime minister, investors are taking confidence from the fact that they will no longer have to wait to find out who will lead the country until September, the original deadline announced by the Tory party after David Cameron resigned.

Connor Campbell of Spreadex explains:

Theresa May is clearly the market’s preferred choice for Britain’s top job, as evidenced by the reaction that greeted Leadsom’s stand-down statement.

May’s lack of interest in rushing to activate Article 50 and her relatively less contentious relationship with the EU when compared to her (now long gone) rivals, as well as the general cheer at the mere fact of the UK once again having a PM, is arguably responsible for the rise from the FTSE and pound, both of which improved on their morning performances.

Most pension funds are linked to the performance of the companies in the leading FTSE 100 index, although housebuilders are just a small part of the top-tier index.

The FTSE 100 has actually performed well since the referendum result came in on 24 June. But experts have pointed out that it is a poor measure of the UK's economy.

I find it deeply depressing how few people grasp that value of FTSE100 is mechanistically inflated by collapsing £ https://t.co/54SxmzLVhO

Please stop looking at the FTSE100. It's full of companies that dig up stuff in Africa, price it in dollars and sell it to China.

The FTSE 250 of smaller companies, which has more UK-focused businesses, rose even higher than the FTSE 100 after Leadsom quit.

FTSE 100 up 0.88%. But FTSE 250 up over 2.5% after Leadsom quits @BBCNews @@BBCWorld

The FTSE 100 is actually at an 11-month high, which means bigger bonuses for executives because much of their bonus is given to them in shares.

Jump in FTSE 100 due to sterling's fall will increase share-related compensation to CEOs. Brexit bonuses for big bosses!