Taxpayers could be on the hook for as much as £2 billion to entice anyone to buy Tata Steel’s struggling UK empire, according to research by BuzzFeed News.

Rival company Liberty House has emerged as the frontrunner for the business, which includes Port Talbot, where around 15,000 jobs rely on the steel mill.

But on Thursday night Liberty’s boss Sanjeev Gupta said the government would have to make some serious concessions before any deal could happen.

He told BBC Newsnight: “What we want is resolutions to the issues. We don’t want to take over liabilities. We want the liabilities resolved before we take them and we need a solution to the power price.”

Gupta also pointed out: “The government cannot give any money because it’s against EU regulation, so even if they’d wanted to, they would not be able to give any taxpayer money towards this because it won’t pass EU regulation.”

So what exactly can the government do? And how much will it cost?

Green taxes

One of the key sticking points, which the steel sector has complained about for several years, is green taxes that heavy industries must pay.

A carbon price floor was introduced in 2013, setting a minimum price for the amount of carbon emissions produced.

It rises annually to encourage manufacturers to use greener fuels, and the price in the UK rose from £9.54 to £18.08 per tonne of carbon last year – although the government has vowed to freeze this until at least 2020.

However, the European valuation sits at £4 per tonne, so the UK government may be forced to lower its price floor to entice Liberty.

The government is already talking about introducing a bill to make steel factories exempt from carbon taxes, which would cost £400 million over this parliament.

Energy prices

Tata said between 6% and 8% of its total production costs are on energy bills – thought to be around £60 million a year.

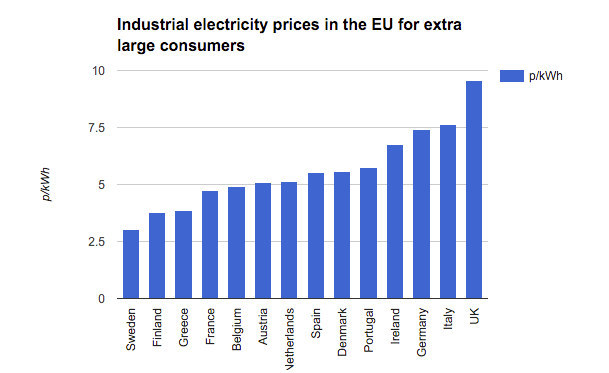

Liberty has stated it would want this reduced, especially since energy bills in the UK are the highest in Europe and therefore uncompetitive.

Pension liabilities

This is the biggest hurdle facing any potential sale. With 130,000 members of the British steel pension scheme – 15,000 active members, 30,000 deferred members who have not yet retired, and 85,000 pensioners – Liberty has made it very clear it does not want to be burdened with the cost.

The scheme is worth about £14.5 billion and there is currently a £485 million deficit, which Liberty does not want to pay. Tata had said previously it would contribute £190 million over the next four years, but if it is sold, the government could be picking up the bill.

Business rates

Not touched on by Liberty but certainly a major issue, a reduction in business rates is also something that the industry wants to be addressed.

Business rates are similar to council tax but on all commercial properties. The steel industry has been asking for rates relief, which some have claimed could breach EU rules on state aid.

The current rates bill for Port Talbot is £10.1 million this year, rising to £11.2 million by 2020. Liberty will probably want a reduction, although suggestions have been made that this would breach EU state aid rules.

One way around the state aid rules could be for the government to order an immediate revaluation of the steel factories – which is a way to calculate how much should be paid in business rates.

Bearing in mind Tata wants rid of its factories, the value could potentially be nothing, meaning a subsequent bill of £0 could be applied.

If the government decides to cut Port Talbot’s bill, other steel makers and factories will also want a reduction on this year’s bill, which is set to be £58.5 million.

Other European countries have offered rates reliefs, so it could be done if the government decides it wants to hand out the cash.

Business rates expert Paul Turner-Mitchell, who crunched the numbers, said: “Any prospective new owners considering viability are, of course, going to be concerned by the UK's level of property taxes. The Valuation Office Agency, which decides how much each steelworks is worth, could and should have revalued all sites based upon a material change in circumstances as soon as the crisis began to unravel last year."

Fixing the factory

Liberty boss Gupta said the fundamental model of Tata’s steel business in the UK needs changing. This could require around £1 billion of investment, to turn the factories into energy producers and sell electricity back to the grid.

Talk has also turned to using locally sourced scrap metal to recycle, rather than importing materials, and changing the furnaces.

This all costs money and it is unclear how much Liberty is willing to invest or if it is relying on the government to stump up the funds.

Total

It is difficult to say just how big a hit the taxpayer could be left nursing if the steel industry is to be saved, but the £485 million pension deficit, the £58.5 million business rates bill, the £1 billion investment, and the £400 million absorbed by cutting green taxes could cost £1.9 billion. The question now is whether the government thinks the cost is worth it.