Earlier this week a van was spotted driving around Shoreditch in London encouraging startup companies to move to Berlin in the wake of the Brexit vote.

The vultures are circling ð©ðª ... #london #Berlin #brexit #startups

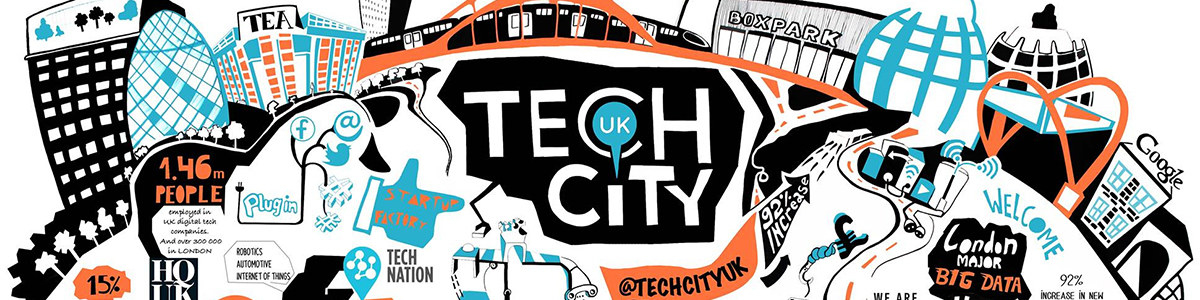

Shoreditch, aka Tech City, has been heavily promoted by chancellor George Osborne as the Silicon Valley of Europe.

Over the past six years the UK's digital economy has seen $3.5 billion of investment and the sector has grown 32% faster than the wider economy.

But the decision by UK voters last week to leave the European Union has now put Osborne's plans in doubt.

BuzzFeed News spoke to business owners and tech experts on what they think the impact of Brexit will be and whether firms are actually considering leaving London.

The industry says it is concerned that, post-Brexit:

– New rules around immigration could cut off tech firms from the best possible employees from around the world;

– UK banks could tighten up their lending to small businesses as a potential recession starts to take hold (despite the Bank of England encouraging them to keep lending);

– And venture capital investors (who offer early-stage investment) could keep their money and investing it in countries where the future is less uncertain.

Patrik Arnesson, co-founder and CEO of Football Addicts, the Swedish startup behind the Forza Football app, which has 3 million active users per month, told BuzzFeed News he had planned to open a London office but that since Brexit he has put that on hold.

“The UK is the home of football and we’re the world’s biggest football app," he said, "but the big challenge for tech companies is to find great talent and to find great talent you need to look all over the world.

“After Brexit one of the biggest important things is moving people around and that becomes harder. That’s why we’ve put these plans on hold because those advantages could disappear.

“The UK is also English-speaking, which was a big benefit for us, but the most important part is to be able to freely and easily move people and if that opportunity disappears that’s very, very bad.”

He currently employs 30 staff from eight different countries and is considering a move to Dublin to take advantage of Ireland’s EU status.

Fintech companies – aka technology companies for the financial sector – could also be hit, and twice as hard, with French president François Hollande calling for the UK to have its ability to sign off deals in euros stripped.

According to a report by KPMG, 44,000 workers are employed in UK fintech – one of the dominant areas in London’s tech scene – and of those 5,500 are from continental Europe.

Patrick Imbach, head of tech growth at KPMG, warned that the Brexit vote could lead to Tech City struggling.

“One of the most attractive things about London is that it can be easily used as a springboard for European expansion," he said.

"If regulatory passporting rights are removed for UK-based companies [as Hollande is suggesting] and tech talent from across Europe can no longer flexibly work in UK FinTechs, it might encourage existing FinTechs to move and new startups to consider alternative locations to build their business.”

Hussayn Kassai, the boss of Onfido, an ID checking tech firm which employs workers from 41 different countries, speaking 35 languages, said employment was a major issue and could challenge the UK's future as a tech hub.

“There aren’t enough UK graduates with the skills we need," he said, "which not only makes it difficult for us to recruit, but also makes it harder for us to compete with EU businesses who have a stronger talent pool.

“Aside from the fact that we’d become a less attractive employer to talent outside the UK, the amount of paperwork and red tape we’d have to go through in order to recruit from abroad would leave us trailing our competitors. Agility and speed are among our major advantages, and we can’t afford to forego them.”

He also warned that leaving the EU will hamper international growth and said he could move his operations overseas if necessary: "We already have an office in Lisbon, and might be forced to make that our main base if the UK starts to struggle."

There is some hope that the tech trade could grow, according to Kassai, and a company like his could benefit from disruption to traditional banking, pushing potential customers to upstart alternatives.

This view was echoed by Damian Kimmelman, chief executive of DueDil, a information and intelligence gathering service, who said in a blog post:

Ultimately, Brexit could create opacity in the markets and a regulatory quagmire. This is unfortunate for the UK and the economy, but it also creates precisely the right environment for fintech firms to thrive. UK startups will act where the financial institutions can’t and provide innovative solutions to new problems, helping consumers and businesses use their money more wisely.

But he warned: “Let there be no doubt – Brexit is a tragedy. Instead of taking on challenges with its European partners, Britain is taking precisely the wrong course, injecting needless uncertainty and negativity into the economy.”

Even if employment issues are sorted, the question remains: Who will fund the sector and invest in the future of British technology?

According to KPMG's Imbach, investors are already starting to worry and have withdrawn from funding.

"Uncertainty around Brexit dominated talk in the UK in the second quarter of the year," he said, "and was no doubt substantially contributing to the almost 50% drop in venture capital investment in the country compared to the first quarter of this year. However, VC funding has not yet been halted due to Brexit fears."

Nonetheless, most tech firms agree that – as in the rest of the investment and financial world – uncertainty is bad for business.

It explains why Osborne has been so keen to get things sorted quickly and has taken up the mantra: “Britain is still open for business”.

Gerard Grech, chief executive of Tech City UK, which promotes the country’s tech hub, echoed the chancellor’s call and demanded more clarification for its future.

“There will be a period of EU negotiations over the next two years," Grech said, "but no matter how that develops, we can be sure the UK will remain at the forefront of innovation and entrepreneurship, and the tech community – with its spirit of problem-solving – will be at the heart of that.”

The experts agree: London and the UK's tech scene will survive leaving the EU, but what form in takes in the future remains far from certain.