1. California homeowners are STILL paying drastically lower rates for their property taxes, and public services suffer

2. A home in California can ONLY be reassessed for tax purposes when it is purchased or a change in ownership has occurred

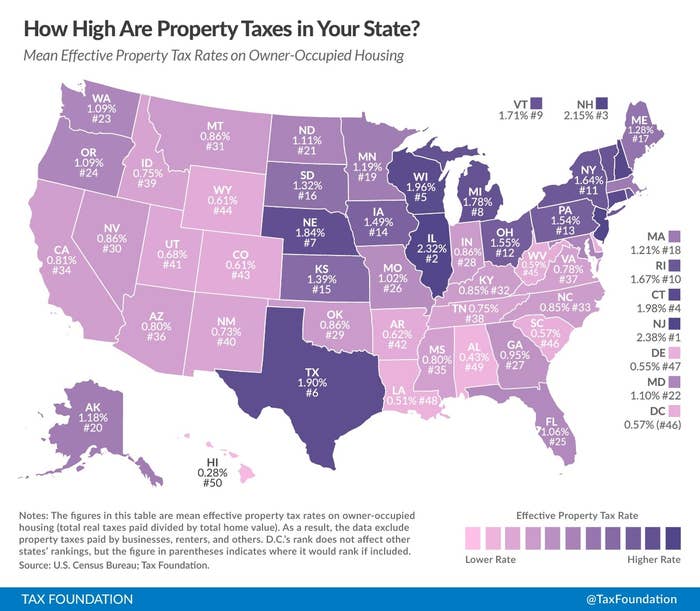

3. Californians aren’t the only ones feeling the brunt of this epidemic, as many cities nationwide are facing steeper property taxes than had been foreseen in past years.

4. People have tried to challenge the fairness of Proposition 13…and they lost.

5. The same conditions which led Californians to pass Prop. 13 in 1978 are brewing again, as discontent for our tax system grows.

View this video on YouTube

As The Kinks so eloquently put it, “The tax man's taken all my dough // And left me in this stately home”. The situation has not improved since the 1970s, but has simply manifested itself into a different form of discontent. Those same feelings of being taken advantage of by the government holds true to present day. We are currently seeing the tax plans of Donald Trump simplifying the tax code for the wealthy and the policies of “democratic socialists” gaining momentum amongst the millennial generation that has seen the current tax model wreak havoc on their parents’ livelihoods.

6. California’s Prop. 13 has evolved and developed our discontent with the tax system by pushing us to find solutions and rise above conformity.

7. Prop. 13 is proof that a tax revolt has happened, and that it most definitely can happen again, with caution.

8. The 2016 Election saw the rise of new forms of thinking in terms of taxation and deviation from the norm in a campaign platform.