You may have heard the news last week that we're about to pay a lot more for online purchases from overseas.

That's because state treasurers and the federal government agreed to start applying the GST to all products purchased overseas that cost more than $20.

But things may be worst than we first thought.

Because now federal treasurer Joe Hockey says we may as well apply the GST to all purchases, regardless of the price.

Speaking this morning on the ABC, Hockey said the "dynamics have changed" when it comes to applying the GST to online purchases.

"Previously, the challenge was how do you impose the GST when it comes across our borders into Australia?" he told Radio National's Fran Kelly, saying the threshold may as well be lowered to zero.

"That was going to be incredibly clumsy and logistically a nightmare. What we've identified is a new way... to be able to impose the GST on the supplier overseas."

"So now we can go to the Amazons, we can go to the various retailers overseas and say, 'you have to apply the GST to goods that you are selling into the Australian market', and they will do so."

"Really though, what's the difference between $20 and zero dollars?", you may ask. Well, the difference is precisely $20.

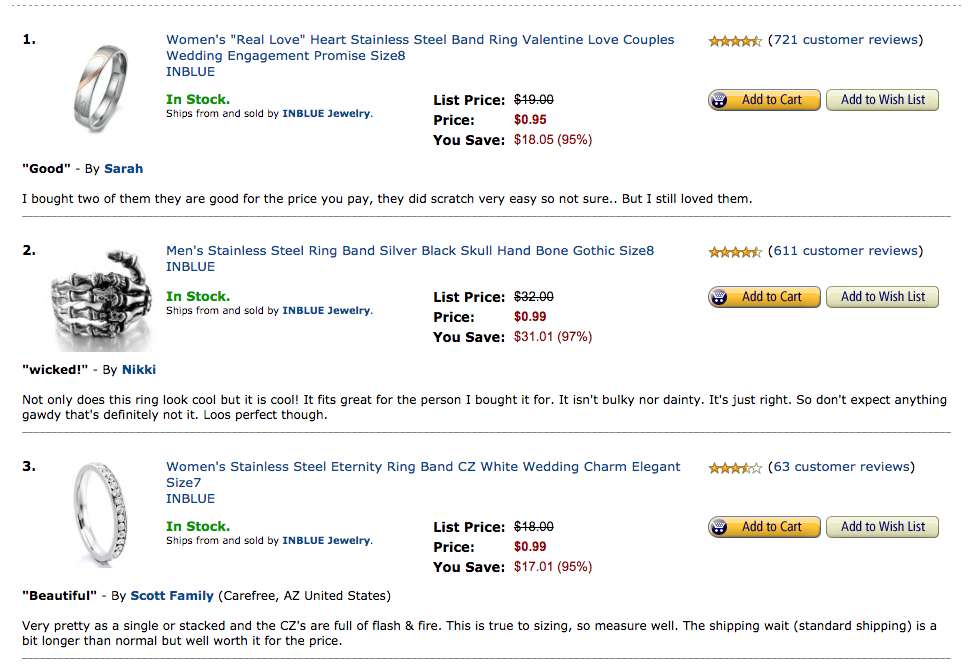

That means some of these wonderfully cheap Amazon purchases may soon have the GST applied to them.

And who wants to pay an extra 9.5 for a "Women's 'Real Love' Heart Stainless Steel Band Ring Valentine Love Couples Wedding Engagement Promise Size8"? Not us.

But that's not all, applying the GST to online sales may actually cost more than 10%. As consumer group Choice warned last week, prices may increase by up to a whopping 256% for purchases under $100.

That's because lowering the GST threshold may also see the introduction of collection and processing fees at a time when Australian consumers are already paying more for products than in other countries.

In the UK, where there the GST threshold is £15 ($27.15 AUD) consumers have to pick up their parcels from the post office, where they have to pay a £8 processing fee.

The Treasurer says the change is necessary to level the playing field for traditional retailers in Australia, and that technological advances mean it's much easier to impose a lower threshold than in the past.

The good news is the changes won't take effect for a while, so you go right ahead and drunkenly buy that Nicholas Cage phone case you've been eyeing off.