1. The First U.S. National Debt was Taken On by Everyone's Favorite Founding Father

2. The Debt Hamilton Took on?: $19,608.81

3. The Current National Debt? Try $19.7 TRILLION dollars

4. That's More than $61,000 Per U.S. Citizen

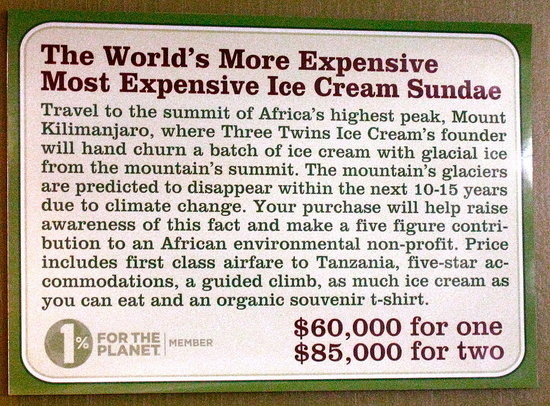

5. Our Government Could have Spent That on Hand-Churned Himalayan-Glacier-Water Ice Cream For All of Us!

6. The Number 3 Holder of U.S. Debt is ... Ireland?

7. The Federal Debt is Projected to be 23.21 Trillion by 2026

8. Hillary Clinton's Policies are Projected to Add a Further $200 Billion to the U.S. Debt in that Timeframe

9. On the Other Hand, Donald Trump's Policies are Projected to Add $5 TRILLION to the U.S. Debt

10. With That Said, We Wouldn't Know What to Do Without It

11. The Debt Tends to Increase under Republican Presidents

Despite the reputation they foster as the fiscally sensible party, the U.S. debt gets comparably larger when they are in office. It's enough to make you want to throw a shoe.

12. Not Everyone Agrees that the Current Debt Situation is a Gigantic Problem

The arguments against holding a federal debt are that interest rates and inflation will both be higher, which will in turn lead to the double-whammy of slower economic growth and higher taxes. So far, this has not turned out to be the case. The Fed has the ability to "artificially" lower interest rates, and they have done just that. Critics argue they cannot do so forever, but there are no cracks in the armor.

At least ...