1.

Set up a second checking account for all your non-essential expenses.

2.

Get the Acorns app and watch your change transform into hundreds of dollars.

3.

If ever you're paid more than twice a month, deposit the extra money into your savings account.

5.

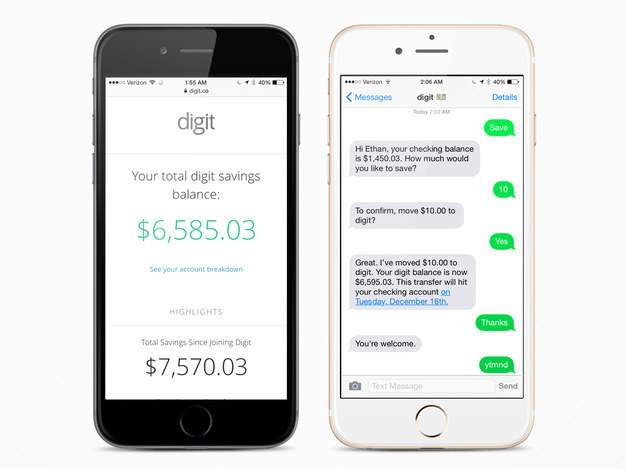

Get Digit — an app that sneaks a minuscule amount of money out of your checking account almost every day.

7.

Do the 52-week money saving challenge.

8.

Keep larger bills in your wallet.

9.

Don't spend your $5 bills.

10.

At the end of every day, put all the cash you find in your pocket in a designated container.

11.

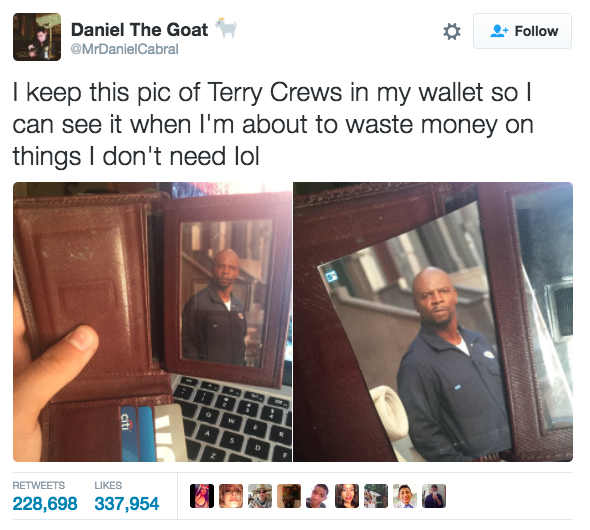

Make someone hold you accountable for your spending.

Want to be featured in similar BuzzFeed posts? Follow the BuzzFeed Community on Facebook and Twitter!