Dr. Jenaya Calderilla is a licensed physician who has worked in various settings, including hospital medicine, outpatient medicine, hospice, and post-acute rehabilitation. She is currently a practicing wound care specialist.

And last month, she went viral after making a three-part TikTok series sharing how people without insurance can negotiate the cost of their medical bills.

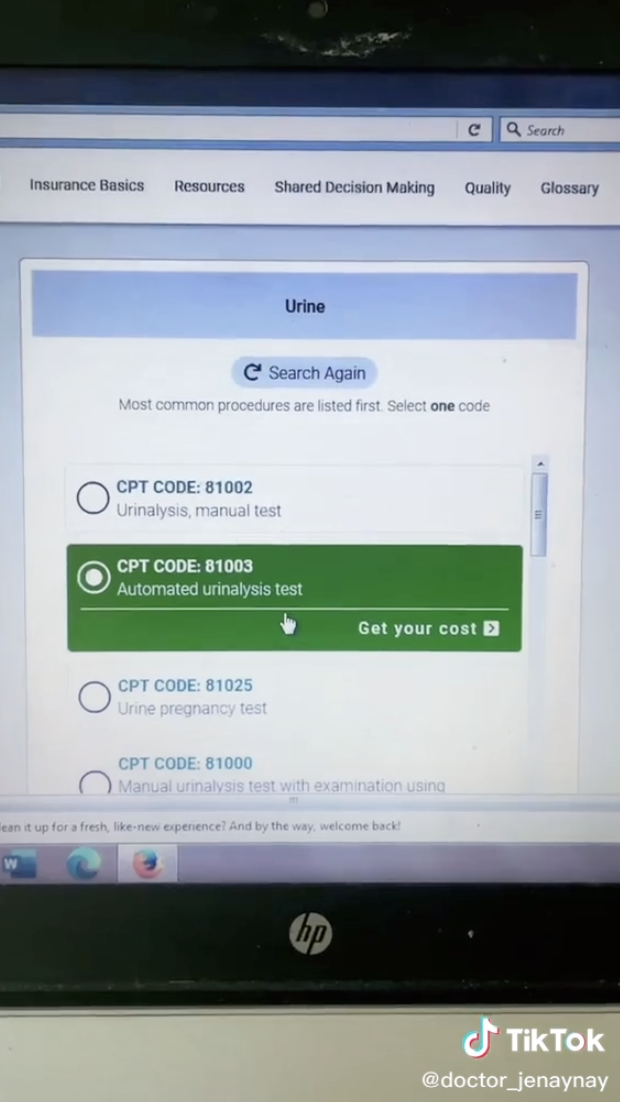

In the TikToks, which have over 4.5 million views combined, Dr. Calderilla explains that the first step to negotiating is to always get an itemized breakdown of the bill to see if the charges are fair. To find out if the price you're being charged is reasonable for your area, you can visit FairHealthConsumer.org.

If you look at your medical bill and find the code for the service you received is wrong — which can happen — then you can call and get it corrected. However, if you were charged for the right procedure but it is way more expensive than what is typically charged in your area, you can ask the hospital to lower it to the "reasonable" and "customary" price.

BuzzFeed spoke to Dr. Calderilla, who said hospitals really do want to work with you. "The best thing to do is be honest that you cannot afford the bill. There are discounts for cash-pay patients. You can always set up a payment plan to avoid being sent to collections and have it negatively reflected on your credit," she added.

It is important to note that negotiating medical bills only works if you are uninsured. "It gets a little more complicated if you have insurance and a high deductible, which is another financial barrier to healthcare. Once you sign up with insurance (typically through your employer) and then use your insurance for medical services, you are obligated to pay your portion of the bill in accordance with the 'explanation of benefits' of your insurance. That is why these costs are non-negotiable," said Dr. Calderilla.

"When employers are having open enrollment, I highly encourage everyone to review the materials carefully to know exactly what your out-of-pocket expenses will be. There are usually health insurance counselors available when open enrollment occurs. They are a great resource to explain your benefits before you decide which plan is best for you."

Dr. Calderilla is passionate about helping the medically underserved community. "Once I understood that one of the largest barriers to healthcare is the cost, I began to look into ways to make healthcare more affordable for everyone. Many people don’t know that some states did not expand their Medicaid, and despite the passing of the Affordable Care Act, not every state expanded the coverage. Unfortunately, there are millions of Americans still uninsured," she said.

If you are looking to apply for charity care for medical expenses, Dr. Calderilla has partnered with the nonprofit organization Dollar For. "I have also been in contact with a health share company called Sedera that is a great alternative to health insurance for young and healthy people who cannot afford insurance. Health shares are another resource available for individuals who are uninsured and cannot afford insurance," she said.

For more medical-related content, you can follow Dr. Calderilla on TikTok and Instagram.