Tipping culture, gun laws, coffee, slang — there's a lot that separates Australia from the United States.

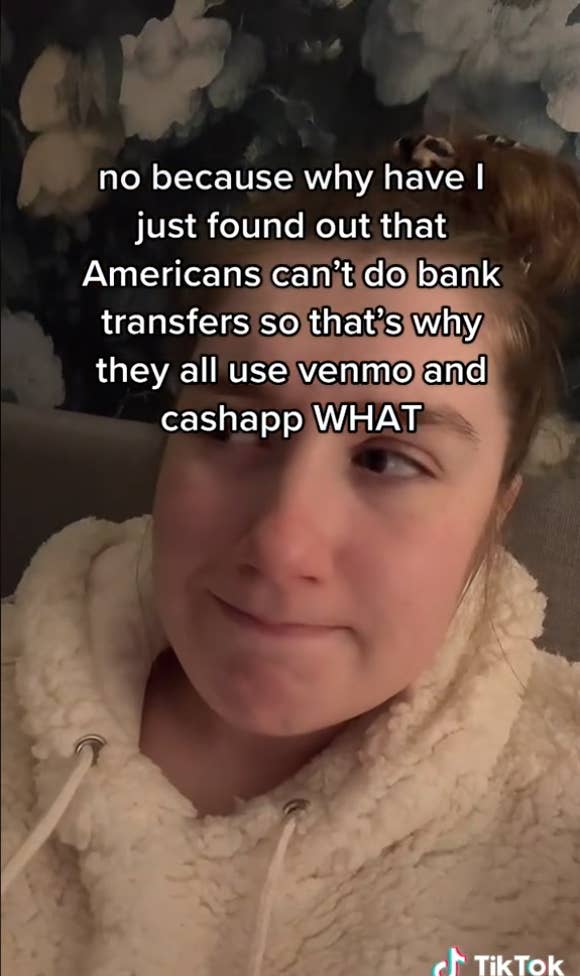

Now, if the TikTok doesn't load for whatever reason, the basic gist of it is the realisation that Americans supposedly can't do bank transfers, which might explain why you're all so reliant on Venmo and Cashapp.

Like, SAY WHAT? Obviously, bank transfers exist in the US, but I believe this TikTok was referring to instant transfers that can be done through mobile banking apps.

Mobile banking transfers are extremely common in Australia. I can't tell you the number of times I've been in Coles or Woolies (two of our biggest supermarket chains) and had my card declined because I had forgotten to transfer money from my savings account to my everyday debit one.

To remedy this, I'll quickly do a transfer on my phone through my bank app. Voilà, I've got money to spend!

This also works for when you need to transfer money to another account. For example, when you're splitting a meal with a large group of people. You grab someone's bank details, transfer and bingo, your portion has been paid.

Back to the TikTok and it has gone mega viral, with over two million views. Australians have been sounding off their confusion in the comments and, of course, couldn't resist a slight roast at our international friends.

One response in particular really piqued my curiosity, in that Americans have to pay to withdraw money from their own accounts.

A quick Google search confirmed this, with one website saying that wire transfer fees are "generally between $25 and $30 for outgoing transfers to a bank account within the US and between $45 and $50 for transfers going out of the US."

Tbh, this shocked me to my core. I can't imagine paying to transfer money from one bank account to another.

But then, if all this is true, that does explain the reliance on Venmo and Cashapp in the US. In Australia, we do have similar apps — like Beem It, for example — but they're not as popular or prevalent.

Another comment also mentioned that some Americans are still paid via cheque, which I'm assuming they then have to deposit either electronically or in-person at a bank. This seems very old-school… By comparison, Australians get their pay deposited directly into their bank accounts.

Considering that contactless payments only really started becoming a widespread thing in the US recently (whereas it's been part of Australian culture for ages), are Americans really that far behind in terms of banking technology? Or is the reality different to what I'm — and other Australians — are presuming?