You've been thinking about it for a long time and you FINALLY decided to get a credit card.

Expectation: You've been dreaming of this day for your whole life and it's finally here! It's gonna rule!

Reality: It turns out to be a little anticlimactic.

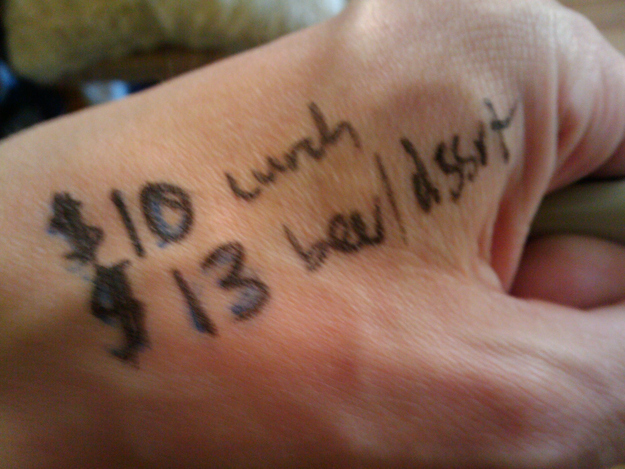

Expectation: You'll be extra diligent about keeping track of your finances.

Reality: You get lazy and just start swiping willy-nilly.

Expectation: You have a great dinner with your friends and you're ready to pay your half of the bill. Put it on plastic, waiter.

Reality: Oh, credit card roulette? What? I have to pay for everyone's meal now?

Expectation: Now that you have credit you can finally rent your dream apartment.

Reality: Oh, you won't be able to pay your bill if you move? I guess you're staying in that basement apartment for awhile.

Expectation: You can maybe at least afford a sweet entertainment set-up...

Reality: You reached your monthly spending limit already. Where did it even go?

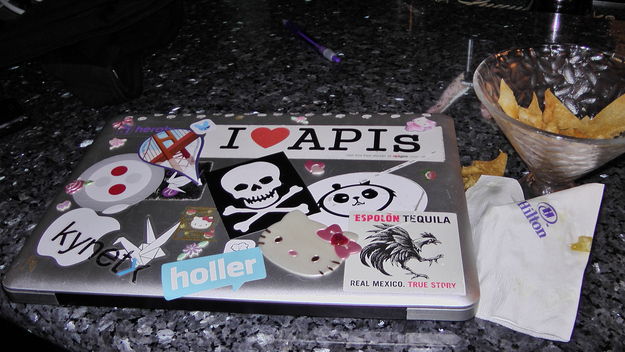

Expectation: Now that you have a credit card you can go out and party every night!

Reality: You accrue too much debt too quickly...then a "party" is some potato chips and your laptop.

Reality: Shopping! Plastic, baby!

Reality: Bills, bills, bills.

Expectation: You want to share you new card with the whole world!

Reality: You didn't actually blur out the card number or anything. Welcome to identity theft.

We know it's stressful, but there's no need to panic. Just figure out a financial plan and everything will stay under control.

And at the end of the day, you never know when you're gonna need a credit card.