Those born in the early 1980s have about half the wealth that those born in the 1970s had at their age, a major report has found.

The Institute for Fiscal Studies (IFS) think tank warned that people who are now in their early thirties are finding it much harder than their predecessors to build up wealth in housing and pensions as they get older.

The study, published on Friday, is the first time the IFS has looked at both overall household wealth and total income of different generations. BuzzFeed News delved into the report to find out how millennials are struggling.

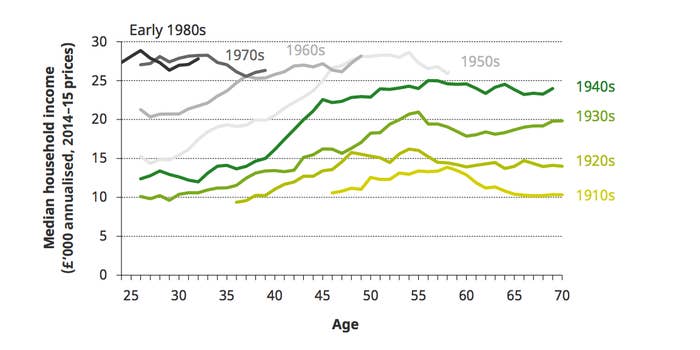

1. People born in the early 1980s were the first post-war age group not to enjoy higher incomes in early adulthood than those born in the previous decade.

When you look at ages 25–30 on this graph, it's clear that people born in each decade have enjoyed markedly better incomes than the cohort before – until you reach those born in the 1980s, when the trend stops.

The graph compares the average household incomes of those born in different decades across their working lives and into retirement. (Incomes are

expressed in 2014–15 prices and are the equivalent amounts for a childless couple.)

It shows a broadly similar pattern for each age group – incomes rise quite quickly during early working-age, these increases slow down as workers near retirement, and incomes fall slightly as people retire.

But different age groups have different ~levels~ of income. Up to and including those born in the 1950s, each cohort has had a higher income than the cohort before them did at the same age.

That's to be expected because incomes have risen as the economy has grown over time. But it is no longer true for those born after 1960 – they do not have higher incomes than their predecessors did at the same age.

Yet while those born in the 1960s and 1970s no longer have higher incomes than their predecessors, they ~did~ have higher incomes during early adulthood.

"By contrast, the average incomes of those born in the early 1980s have been similar to those of the 1970s cohort at the same age throughout their working-age lives so far, and are now, if anything, slightly lower," the IFS said.

This isn't just thanks to weak income growth in the economy as a whole – but because the recession in the late 2000s hit young adults hardest, with cuts in employment and pay.

2. Those born in the early 1980s are less likely to buy their own home in early adulthood than any generation for half a century.

This graph shows how at the age of 30, only 40% of those born in the early 1980s were homeowners, compared to at least 55% of those born in the 1940s, 1950s, 1960s, and 1970s.

Of those born in the 1940s and 1950s, around 80% have become owner-occupiers. The report said: "It looks highly unlikely that any of the more recent cohorts will match that homeownership rate."

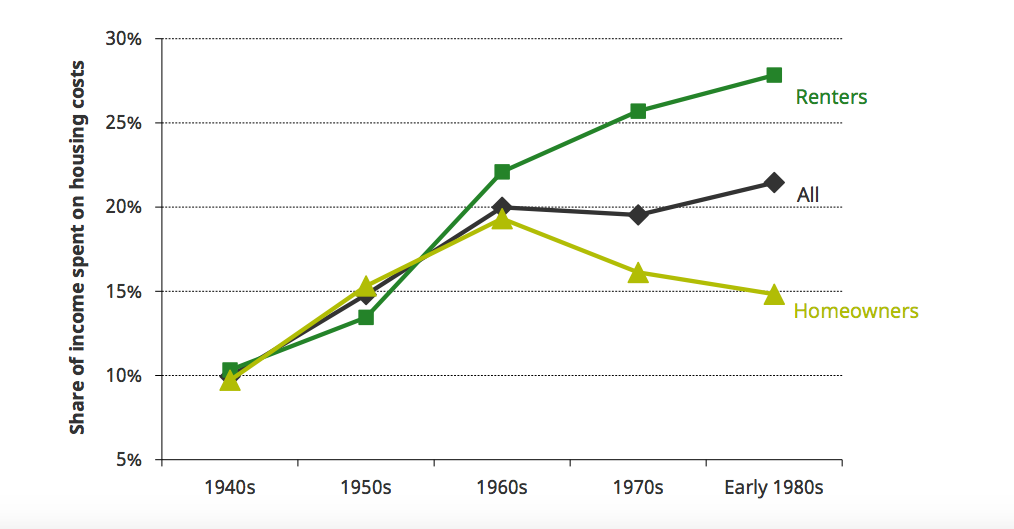

3. And while homeownership rates among young people are falling, the cost of rent is rising faster than wages

This graph demonstrates the average share of income that different age groups spent on housing costs between the ages of 26 and 30.

Renters born in the early 1980s spent 28% of their income on housing costs, compared to 15% for homeowners. But at the same age, renters born in the 1950s spent just 14% of their income on housing costs, compared to 15% for homeowners.

So a decline in homeownership has been accompanied by a big divergence in the costs paid by renters and homeowners.

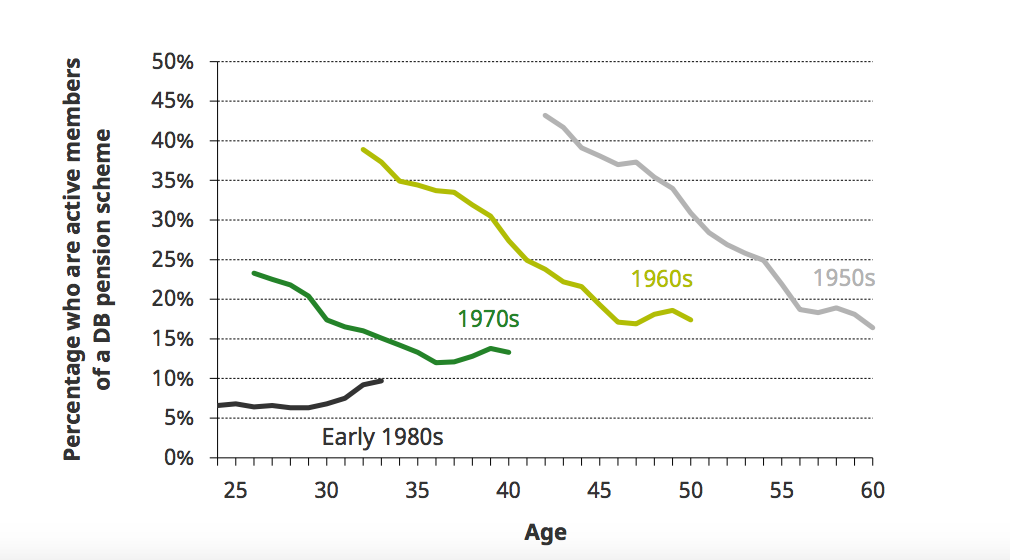

4. People born in the 1980s don't have access to generous private sector pension schemes like their predecessors did.

This graph shows the percentage of private sector workers who are active members of a "defined benefit" pension scheme, for people born in different decades.

Many employers closed these generous pensions to new members in the early 2000s, warning they were unaffordable. It means that, among those born in the 1950s and 1960s, there's been a sharp decline in the proportion of workers who are members (as many of them moved jobs over time).

But crucially, for those born in the early 1980s, the vast majority never had access to such a scheme in the first place. In their early thirties, less than 10% of private sector workers born in the early 1980s were active members – compared with nearly 40% of those born in the 1960s.

The IFS said the recent introduction of "auto-enrolment" means younger people have higher overall pension membership than their predecessors – but at much lower levels of generosity.

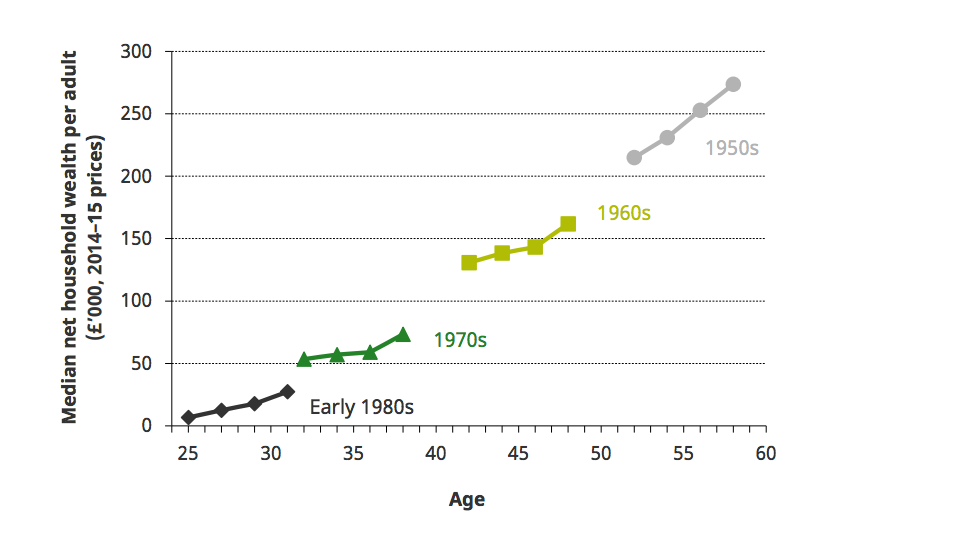

5. This all means that people born in the early 1980s have significantly less wealth than those born in the previous decade did at around the same age.

The graph above compares average household wealth per adult for those born in

different decades. This is the sum of the value of any property owned (minus mortgage debt), the value of financial assets held, and any wealth held in private pensions.

In their early thirties, the early 1980s group have average household wealth per adult of £27,000 – that's just under half that of the 1970s cohort at around the same age (£53,000).

6. It's low homeownership among millennials that's really driving the wealth differential between age groups.

This graph splits the average household wealth per adult into its three components – net property wealth, private pension wealth and net financial wealth.

It's clear that the wealth differential between those born in the early 1980s and 1970s at similar ages is driven by the lower homeownership rates of the younger group.

"The fact that the younger cohort does not look to be on track to match the wealth accumulation of their predecessors is explained by their much lower average

net property wealth," the report said.

Andrew Hood, an author of the report and a research economist at the IFS, said: "By the time they hit their early thirties, those born in the early 1980s had about half as much wealth as those born in the 1970s did at the same age.

"Sharp falls in homeownership rates and in access to generous company pension schemes, alongside historically low interest rates, will make it much harder for today’s young adults to build up wealth in future than it was for previous generations."

Susan Kramer, the Liberal Democrats' Treasury spokesperson, added: "This is what happens when short-term political calculations override the need to build a better future for everyone.

"Year after year, government after government, we are failing to support the next generation, often because the simplest political solution is to focus purely on those more likely to vote. We need to redress the balance between generations."