Way back in 1999, when lots of Americans were predicting that the Y2K bug would bring the world’s computers to a screeching halt, Andy Grove, the chairman of Intel, was making another prediction about how computers would change life on Earth.

“In five years' time,” said Grove, “there won't be any internet companies. All companies will be internet companies or they will be dead.”

Sure enough, this prediction turned out to be prettyyy accurate. Nearly every company you can think of has a digital presence. When we can’t look up a company’s website, it feels totally weird. Beyond the client-facing side of things, the internet has made it easier for businesses to communicate, serve customers WAY better, and lower costs.

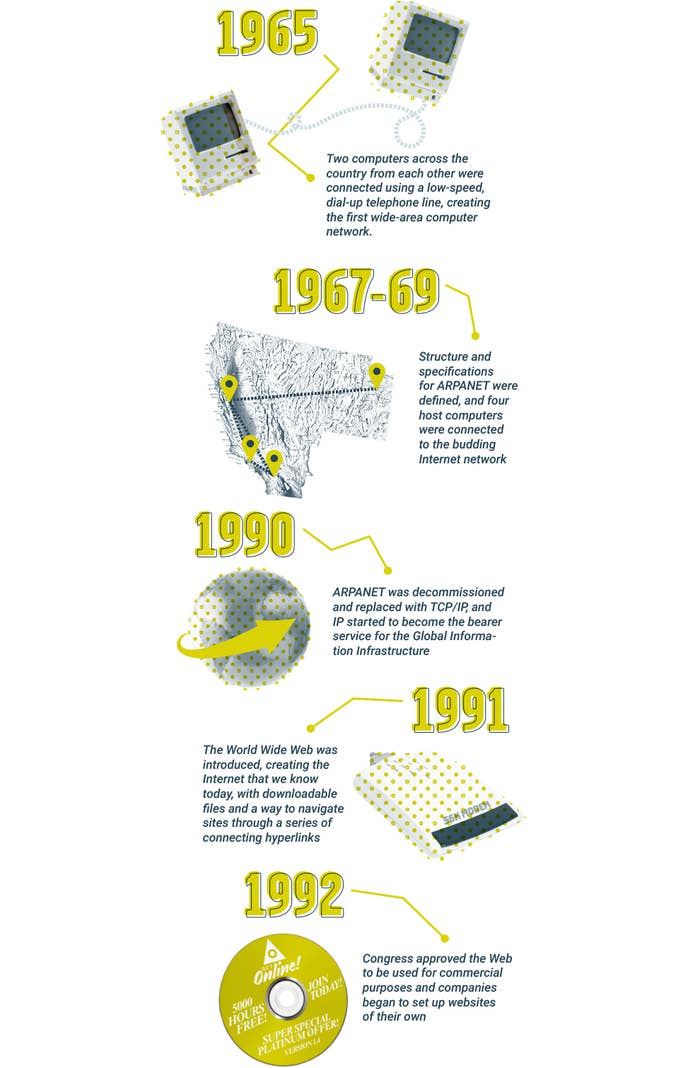

But the internet didn’t just spring from nothing. Like anything groundbreaking, the digital world we live in had to be invented.

Since 1992, the internet has been an integral part of our lives. But no matter how you slice it, almost one-third of the world’s 6.8 billion people uses the internet regularly. Congratulations! You’re one of them!

Though online banking is common today, it may have been harder to see it coming in the 1970s, when the first wireless call was made from the super-awkward brick cell phone that's been the butt of so many jokes over the years. However, that didn’t stop the big banks from spending the 1970s and 1980s devoting more and more of their operating expenses to data processing and telecommunications. As the 1990s and 2000s came around, handheld computers started to become more of a thing (still looking pretty awk!). During the same time period, banks really began to beef up their IT budgets and staffs.

Fast-forward to your life now, where you get to carry around a smartphone that has access to all your savings at the touch of a button. And this phone doesn’t just carry your money — it also sends your money electronically, notifies you when your balances are low, and deposits checks by simply taking a picture of the check. Welcome to the future. Please, have a seat in this future chair so you can take this all in!

Gill Haus, the managing vice president of technology at Capital One, only sees this digital revolution in banking expanding, though it may not be apps that drive digital banking in the future.

“Mobile isn’t going anywhere,” says Haus. “Form factors may change. We may rely more heavily on ‘bots’ and less on apps. Regardless, people will continue to want to interact with their money on their terms, and that means digitally.”

Um, ATM bots? Clearly we'd love to get those, like...now...but we'll probably have to wait a little while longer for something THAT futurist. For now, apps are still very much a part of the digital banking game. Level Money’s CEO, Jake Fuentes, sees the app as part of a larger move to make banking less daunting to the consumer:

“We know that money management with credit cards and modern banking can be a real challenge. We’re changing that. Too often, banks focus on the terms, conditions, interest rates, and fee structures of their products, which can be incredibly confusing unless we spend time to figure it all out. Our job is to translate the way banks talk into the way humans live, helping people make the best decisions without having to spend time managing money.”

In 2001, Jerry Miller, the chief information officer for Sears, spoke of the internet’s impact on business:

“External customers now have the power to determine when they shop, what they want to shop for, and how they want to receive the goods (by mail, by truck, or for pickup at the nearest store). At the same time, information directly collected about customers' buying habits assists retailers in tailoring product offerings and promotions to individuals.”

In a nutshell, the internet is a win-win for customers and companies. Customers get the ease of shopping for what they want when they want, and the customer’s online buying habits are then used by companies to target advertising more specifically than ever before in business history.

It’s not just retail that is #winning because of the internet. As the world has become more and more connected, globetrotting has become easier and easier. In 2015, E3, a digital agency in the UK, laid out the new opportunities and challenges for the travel and hospitality industries.

One of the coolest opportunities mentioned in E3’s report comes in the form of that thing with the bars you miss like crazy when you're on an underground subway: Wi-Fi. In 2014, the Helsinki Airport found a way to harness Wi-Fi to ease airport congestion. Seventy percent of the phones traveling through Helsinki are Wi-Fi enabled, which allows for customers’ pathways through the airport to be monitored with 300 iBeacons. Monitoring these pathways allows the airport to know when and where traffic jams are occurring, and it gives some clues as to how to fix such jams. Yes, Wi-Fi does more than help you post your crazy-amazing vacation photos on social media!

This easy access to Wi-Fi and the internet poses new challenges as well, mainly in the form of what has become known as the DIY Traveler, or the Silent Traveler. They’re referred to as Silent Travelers because the travel business can’t identify, and thus fulfill, the travelers’ needs. Do you plan and book all your travel yourself using just your jet-setting savvy and various electronic devices? You might very well be one of these ~mystery~ travelers! Today, the DIY/Silent Travelers book everything for themselves online from a mix of resources, which makes it very hard to know how to serve them better.

One clear preference has emerged from this new breed of traveler, though: a desire for authentic experiences. No matter where you’re visiting in the world, the internet has made it easier to meet locals, stay in their homes, visit their fave restaurants, and drink at their fave bars.

This has led to more travelers saying "no thanks" to being a clichéd tourist and instead using the internet to seek out more local experiences. As a result, websites that offer rooms in people’s apartments and that tell you where to eat, sightsee, or take epic selfies in any given city have become super popular.

There is definitely no industry in America that hasn’t been touched in some way by the World Wide Web, the internet, and our mobile access to both. What isn’t certain is what digital will look like in 10 years for industries, both in America and worldwide.

Does the current trend continue, making the world a place where you buy basically everything online, get all your travel recommendations from strangers who have gone before you, and manage all your finances from your smartphone while you're commuting to and from work? Or does digital take us to new places we can’t even imagine yet?

Capital One’s Gill Haus has a view of the present that provides clues to the future:

“Mobile has created an environment in which we are connected to customers numerous times a day. This provides an opportunity for us (and other businesses) to provide answers and services in a way we couldn’t before. It also has changed the scale at which our products and systems need to perform. Customers have the ability to engage 24/7, and this means businesses have no downtime and higher expectations.”

If what Gill says is true (and it feels like it is), then a 24/7 presence with no downtime probably means the future of digital and mobile for business will be here sooner than we think.

Brought to you by Capital One.

*This article is sponsored by Capital One. Capital One does not provide, endorse, or guarantee any third-party product, service, information, or recommendation listed above.

Design by James Devogelear / © BuzzFeed

Thumbnail images via iStock