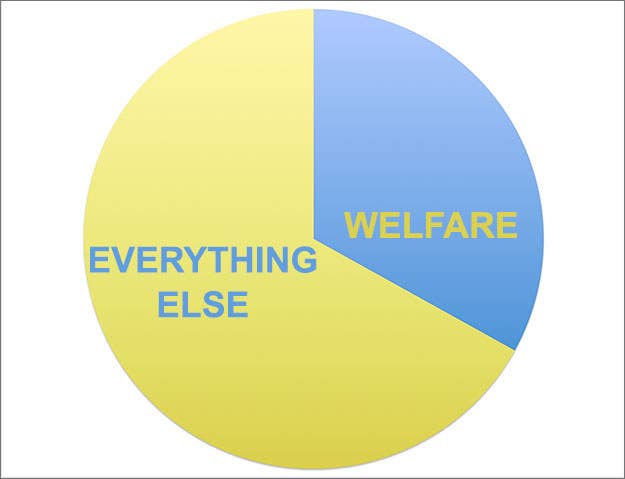

Last year, Britain spent £251 billion on "social protection" – better known as welfare. That's 37% of the total government budget.

The Tories have said they want to cut this by £12 billion – but that might be trickier than it sounds.

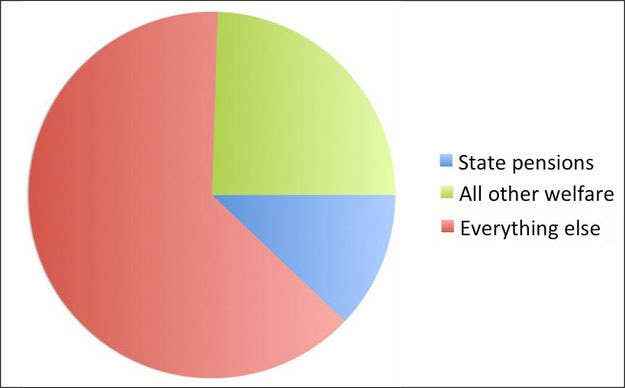

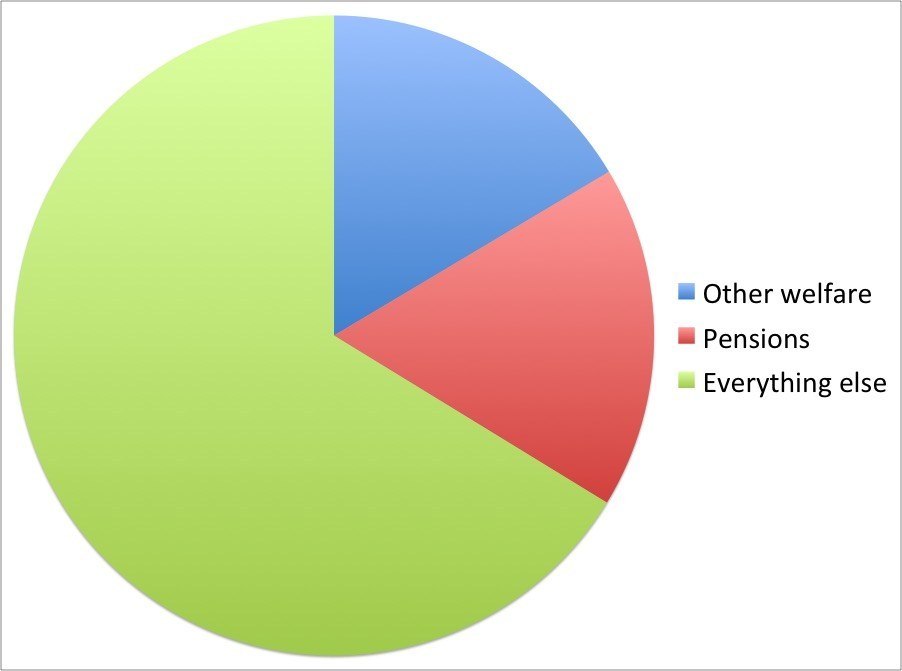

We tend to think of "welfare" as handouts to unemployed people, but it's much more than that. For instance, £83 billion goes on state pensions.

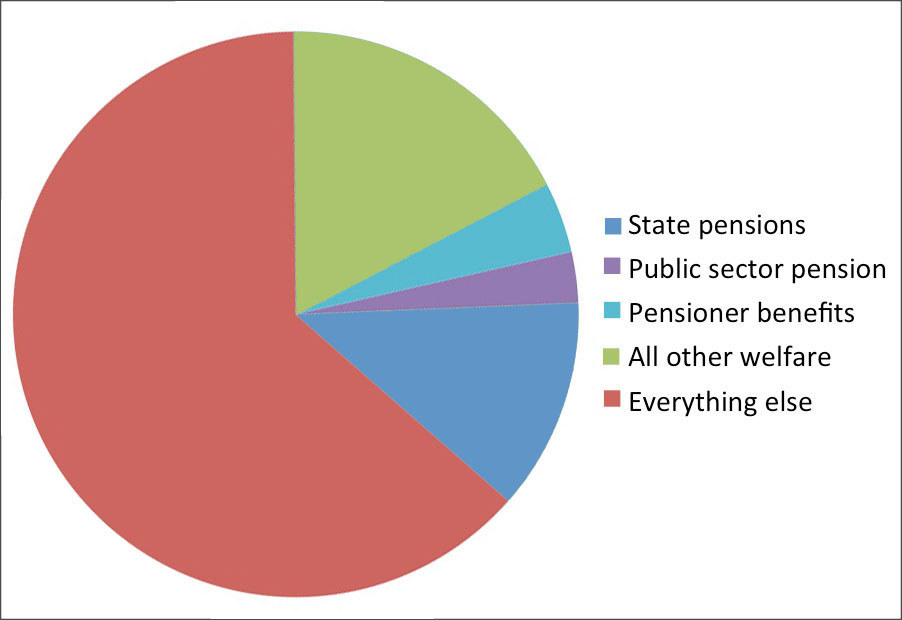

In fact, a total of £131 billion goes to pensioners.

As well as the £83 billion on state pensions, we spend £20 billion on other forms of pension (largely those for public-sector workers), and £28 billion on other benefits for OAPs.

That £28 billion breaks down into £15 billion on pensioner-specific benefits (such as the winter fuel allowance) and £13 billion on general benefits (such as disability allowance or housing benefit) that happen to be received by pensioners.

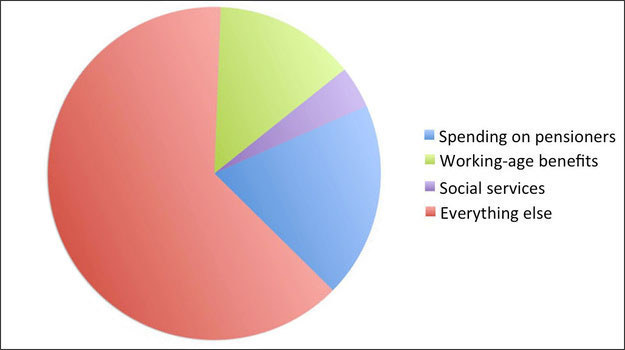

By comparison, £94 billion goes on benefits for working-age people.

However, of that about £28 billion goes on "personal social services". This could cover anything from the cost of looking after children to caring for elderly and disabled people – in other words, it's not a direct cash payment like a pension or jobseeker's allowance.

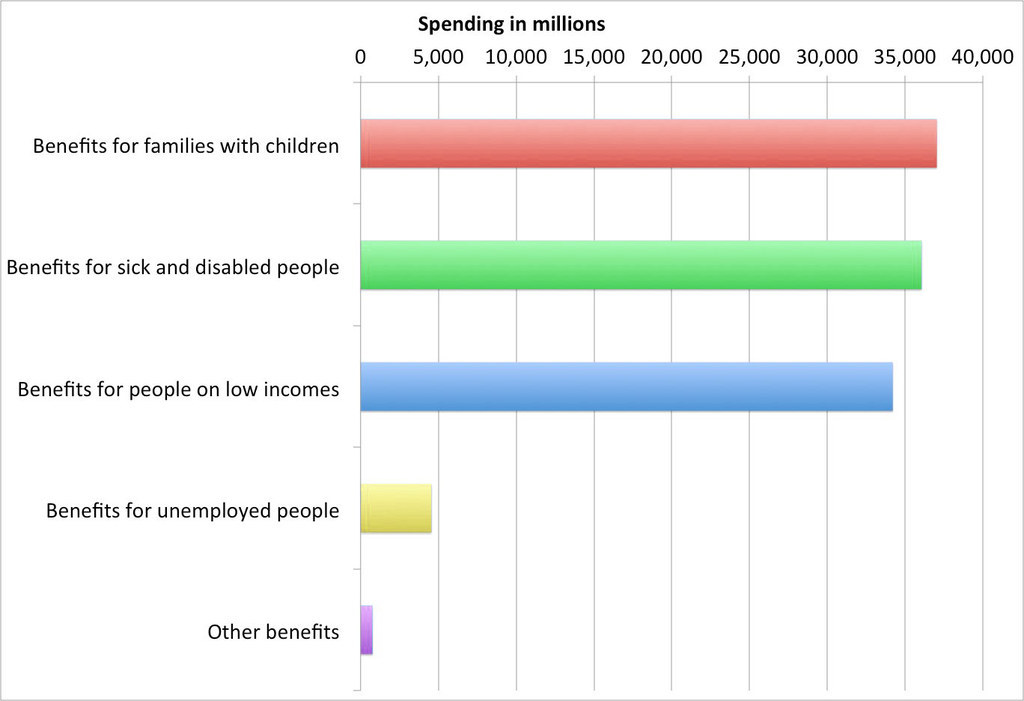

The benefits that go to working-age people break down like this.

About £37 billion goes on child benefit and other family support. About £36 billion goes on benefits for people who are ill or disabled. About £34 billion goes on things like tax credits to support people on low income. And about £4.5 billion goes to the unemployed.

(This actually overstates the total, since some of the disability and child support money will be going to people of retirement age.)

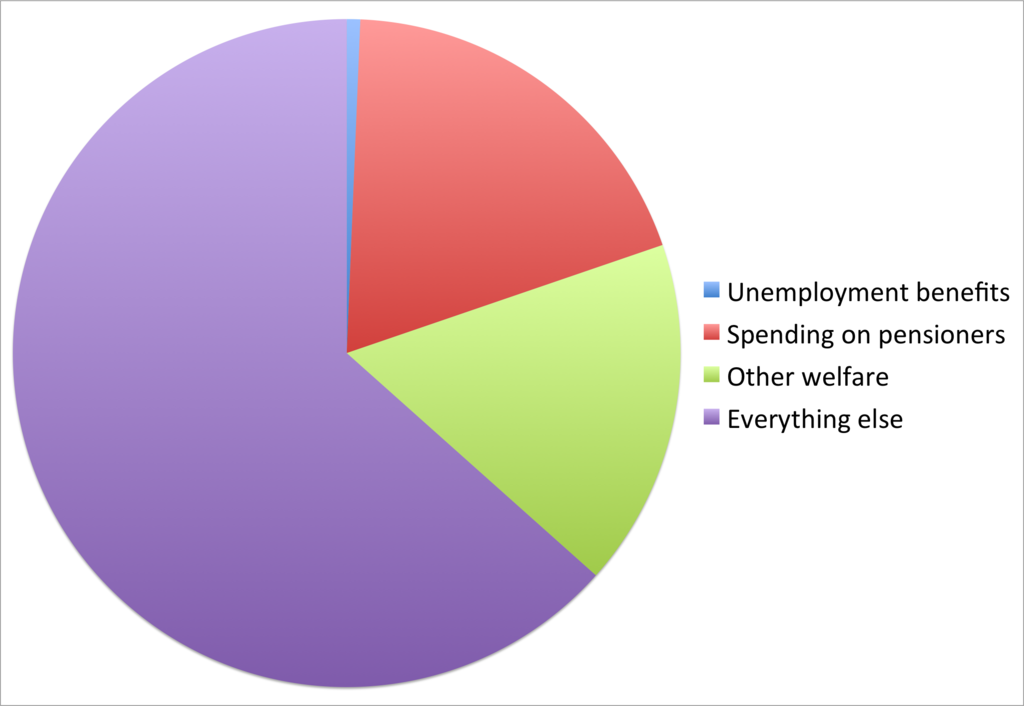

Here's that £4.5 billion on unemployment benefits in the context of total government spending.

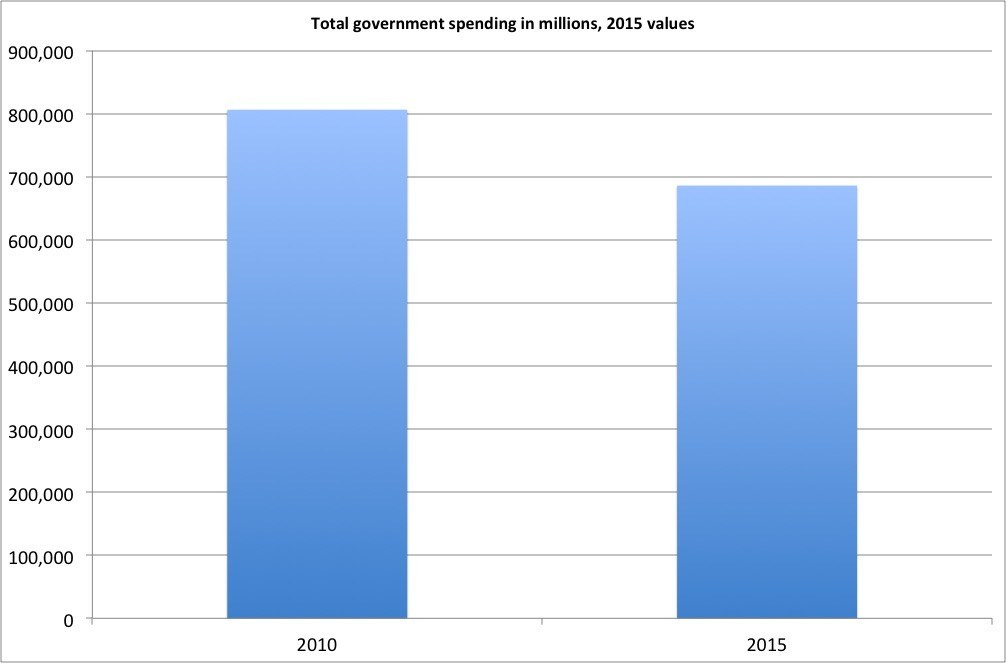

There have already been significant cuts to welfare spending. In 2010, when the Coalition came to power, total government spending was equivalent to £806 billion in today's money, of which £272 billion was welfare and pensions.

In real terms, that means there's been an 8% cut in welfare spending and a 15% cut in government spending overall.

The government has promised that the £12 billion won't come out of pensions.

In fact, the Conservatives have pledged to keep the "triple lock", meaning that pensions will keep rising in line with inflation or wages. They've also promised to maintain all the pensioner-specific benefits.

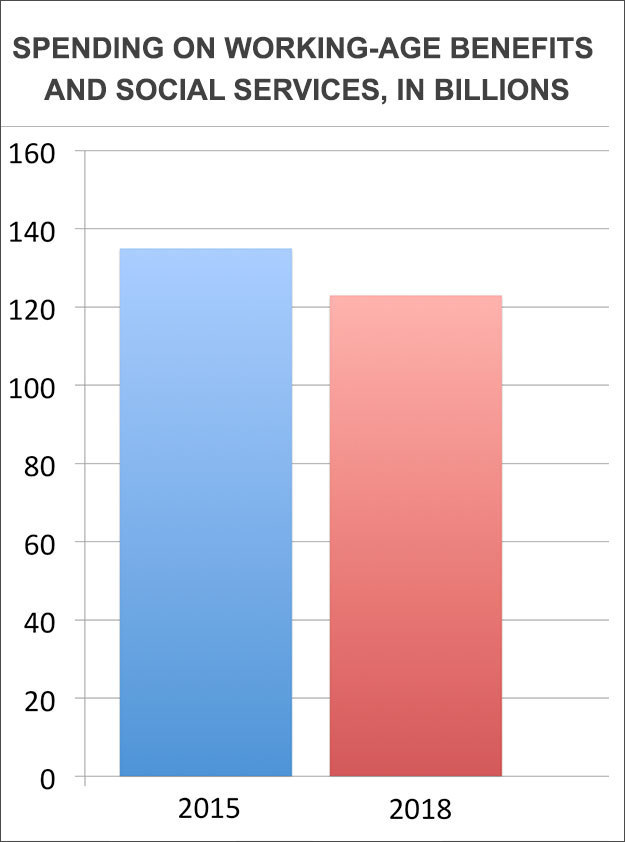

That means it has to come from the £107 billion spent on working-age benefits and the £28 billion spent on social services, amounting to a cut of almost 10%.

That's the equivalent of the full jobseeker's allowance for 3,156,897 people for a year.

Or child benefit allowance for 6,708,407 two-child families.

Until George Osborne's emergency Budget on July 8, no one will know exactly where the cuts are going to fall.