George Osborne outlined the government's spending plans in his Budget statement on Wednesday afternoon, announcing a sugar levy on soft drinks and other eye-catching measures that nevertheless failed to distract from gloomier economic forecasts.

Here are the main points:

* A "sugar tax" on fizzy drinks, raising £500 million to go to school sports.

* Growth forecasts revised down for the rest of this parliament.

* Osborne has missed his own debt reduction target again.

* An extra £3.5 billion in fresh spending cuts to allow the chancellor to keep to his promise of a £10 billion budget surplus by 2020.

* The introduction of a "lifetime ISA" to help people save money.

* A plan to end council control of schools in England by turning them into academies.

Here is the chancellor's Budget document in full – and below is a bit more detail on some of the key points.

The UK economy is going to grow more slowly than predicted:

New figures released by the Office for Budget Responsibility (OBR) have shown that the UK's economy is expected to grow at a slower pace than predicted just a few months ago when the chancellor delivered the Autumn Statement in November.

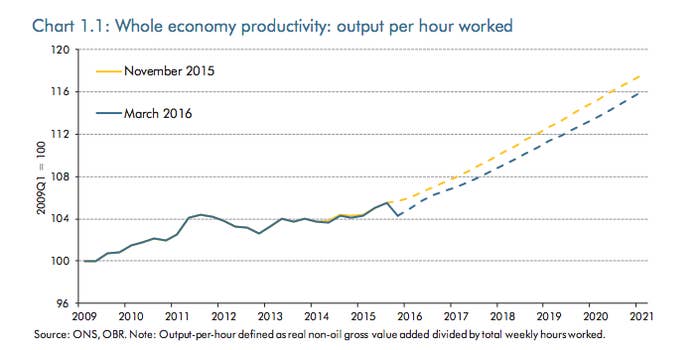

Back then, the OBR forecast that the UK economy would grow by 2.4% this year, but now it says that there had been a "false dawn" and a longer period of "weak productivity growth" after the financial crisis has forced them to bring their forecast down to around 2%.

The chancellor also announced that he had missed his target for bringing down the national debt. Before the general election he pledged to bring down the ratio of debt to gross domestic product (GDP) each year, but new figures have revised the expected level of debt up to 82.6% next year.

However, despite the revised figures, Osborne insisted that the UK would still have a budget surplus of £10.4 billion in 2019/20.

The OBR said the government was "back on course" to achieve that, but added that "given the size and distribution of past forecasting errors, that still puts the probability of meeting the surplus target in 2019/20 only slightly above 50%".

An extra £3.5 billion in spending cuts:

Osborne revealed a range of new cuts that he said would amount to a saving of £3.5 billion from public spending in 2019/20, which he said was "more than achievable" while maintaining protections to the most vulnerable.

Savings will come from welfare, he said, by targeting for support those who need it most, but he claimed that overall welfare spending would still rise by more than a billion pounds and that there would be more spent in real terms to support disabled people.

Here's the line showing the govt saving more than a billion a year cutting disability benefits

On international aid, he said he will continue to spend 0.7% of national income on development but, as growth has been downgraded, that will amount to £650 million less spent on that budget in 2019/20.

He also said public sector pensions would be "reformed" to save £400 billion "in the long term", adding that contributions from public sector employers will rise so the value of people's pensions will not be affected.

"Each of these decisions are a demonstration of our determination that the British economy will stay on course and we will not burden our children and grandchildren," said Osborne.

A "sugar levy" on soft drinks:

The chancellor unveiled what he called a "soft drinks industry levy", which essentially amounts to a tax on sugary drinks.

The levy will have two different bands depending on how much sugar there is in each drink. The main charge will be for a drink with 5 grams of sugar per 100ml but there will be a higher rate for drinks with more than 8 grams per 100ml.

People in Scotland have already noted that Irn Bru will be in the higher band and the share price of Barr's, the company that makes Scotland's other national drink, has already dropped by 5% since the announcement.

Osborne said he would invest the money from his fizzy drinks levy, which he estimates will raise £520 million when it's introduced in 2018, into doubling the amount spent on school PE lessons and extending the school day to provide for a greater range of activities.

The chancellor added that the levy would not apply to fruit juice or milk-based drinks, so your milkshakes are safe.

A "lifetime ISA" to help young people save money for retirement:

Osborne launched what he called a "lifetime ISA" for people under 40 to help them save money to take into retirement or buy a house.

He said young savers will be able to get an additional 25% bonus from the government on their savings of up to £4,000 each year, which can then be accessed to buy a first home or after they retire.

He also announced a new income tax threshold of £11,500, meaning that no income tax will be paid on earnings until they exceed that amount.

All English schools to become academies:

Osborne announced that every primary and secondary school in England will either be an academy or be on the way to becoming one by the end of this parliament in 2020, with help from extra funding allocated in the Budget.

That would make them independent from council control or, as the chancellor said, "set them free from local education bureaucracy".

He said a special focus would be on schools in the North where performance has "not been as strong as we'd like", adding that he will consider the compulsory teaching of maths until school pupils reach the age of 18 and will provide an extra £500 million of "additional core funding" to schools.

In his response, Labour leader Jeremy Corbyn called the budget "a culmination of six years of [Osborne's] failures".

"It's a recovery built on sand on a Budget of failure," said Corbyn. "He's failed on the budget deficit, failed on debt, failed on investment, failed on productivity, failed on trade deficit, failed on the welfare cap, failed to tackle inequality in this country."

Corbyn said Osborne had "announced growth is revised down last year, this year, every year that's forecast. Business investment revised down, government investment revised down.

"It's a very good thing that the chancellor is blaming the last government: He was the chancellor in the last government."