Investing

21 Non-Rich Folks Told Us The Out-Of-Touch Things They Hate Hearing From The Wealthy, And This Proves That Rich People Live In A Completely Different World

"I am a master at making a budget. That's not the problem. Lack of money TO budget is the problem."

I Just Retired Early At Age 41 — Here's How I Did It

In 2017, I was a newly divorced single mom living paycheck to paycheck. Now I'm retired.

Legit Finance Influencers Shared How You Can Spot Scams Online And It's So Important

"If it sounds too good to be true, it might just be."

I Asked A Money Expert What I Should Cross Off My Checklist By Age 35

From making a will to stashing away savings, there's a lot to think about.

11 Great Documentaries That Might Change The Way You Think About Money

BRB, I'm bingewatching my way to riches.

10 Money Management Tools That I Genuinely Enjoy Using All The Time

Psst, most of them are FREE.

You Can Start Investing In A Greener Future For Exactly $1 — Here's How

"We can be a part of something that is bigger than us."

12 Super Hard "Would You Rather" Questions That Might Change How You Think About Money

When in doubt, trust your gut.

If You're A Cryptocurrency Investor, We Want To Hear Your Story

We wanna hear about your wins, your losses, and everything in between.

The Woman Who Went Viral On TikTok For Revealing How She'll Retire With $6M Answers Your Money Questions

You asked. Tori answered.

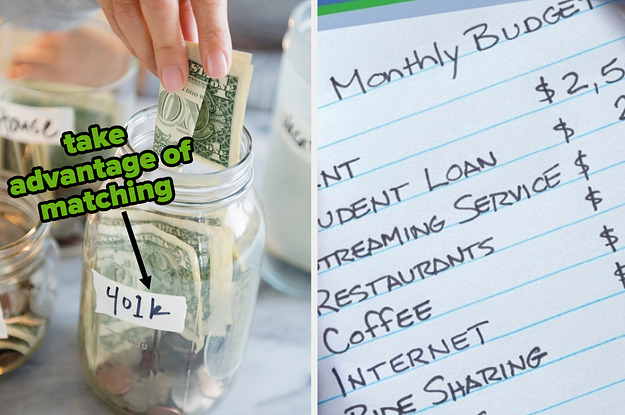

14 Tips For Saving For Retirement Without A 401(k)

"Don't wait until you have an employer that gives you the ability to participate in a retirement plan."

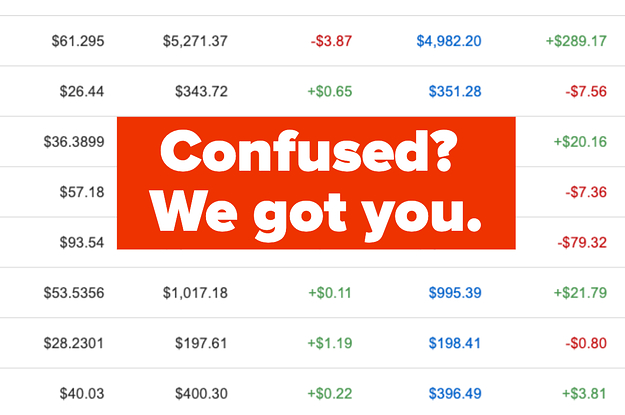

I Started Sticking My Extra Money In The Stock Market — Here's What I Learned

It's time to talk about stonks.

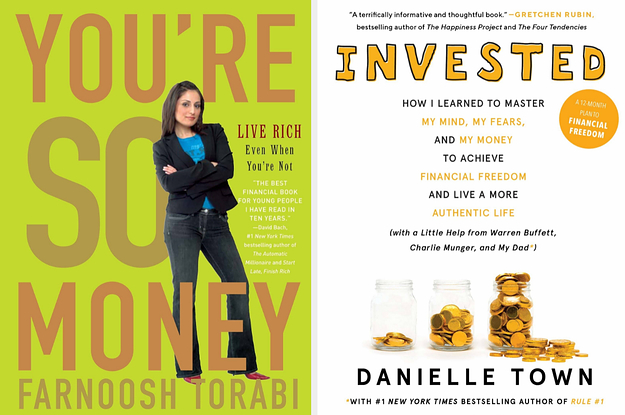

9 Books That Totally Changed My Relationship With Money

I spent the last 15 years ignoring, agonizing over, and then slowly getting rid of almost $100,000 in debt. These are the books that helped me get to zero — and then start investing.

14 Things About Roth IRAs That They Should Have Taught You In School

You'll dream about Roth IRAs after this.

This Woman Went Viral On TikTok For Revealing How She'll Retire With 6 Million Dollars — And She's Only 26

Tori Dunlap went viral on TikTok for her investing advice, and she's committed to helping others.

7 Things That I, A High School Student, Have Learned About Money On TikTok

They don't teach this stuff in school but I'm not gonna let that stop me.

FYI, Your Money Probably Isn't Working As Hard As It Should — Here Are 12 Ways To Fix That

Because you're already busting your bum to make a living.

11 Of The Most Commonly Googled Questions About Investing Answered By An Expert

Whether you're a total beginner or just need some help filling in a few gaps, here's what you should know.

What's One Investment Mistake You've Learned From?

Now's your chance to tell your story (and help others avoid a similar mistake).

11 Beginner-Friendly Apps For Anyone Who's Curious About Investing

~Slightly~ easier than manipulating the stock market.

15 Things That Might Actually Help You Understand The Stock Market

Podcasts, books, online courses... Oh my.

17 Investing Vocabulary Words That Every Twentysomething Should Know

Divid-end the confusion.

I Started Investing In Stocks Over A Year Ago; Here Are 6 Tips For People Who Don't Know Where To Begin

Don't invest money you're going to need soon.

Here's What Millennial Women Need To Know About Money And The Pay Gap In 2019

“My generation failed you. Completely failed you,” said Ellevest CEO Sallie Krawcheck. “We played the game the way it was laid out.”

Judge These 17 "Shark Tank" Products, And We'll Reveal If You'll Ever Become A Millionaire

Are you the next Mark Cuban?

Actually, Birkin Bags Aren't A Better Investment Than Stocks And Gold

Don't go ditching your 401k just yet.

To Make Investing Approachable To Young Adults, Stash Taps Their Passions

Based on focus groups, Stash developed three categories of investments: "I believe," "I like," and "I want."

Could 2015 Be The Year Of Mass Hedge Fund Closures?

While 2014 saw a near-record number of hedge funds close their doors, experts predict the industry's extinction rate will be even higher this year. It will be especially tough for the small guys.

9 Insanely Simple Steps To Fix Your Finances This Year

Is your money still funny? Make 2015 the year you ~really~ laugh all the way to the bank.

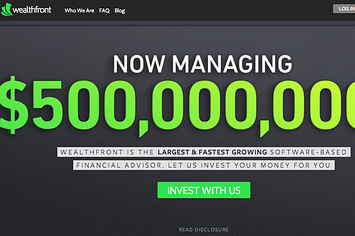

Online Investment Advisor Wealthfront Raises $64 Million

The money, on top of $65.5 million Wealthfront has already raised, gives it $100 million in cash. The war chest will be put to good use in a battle with some of America's financial giants.

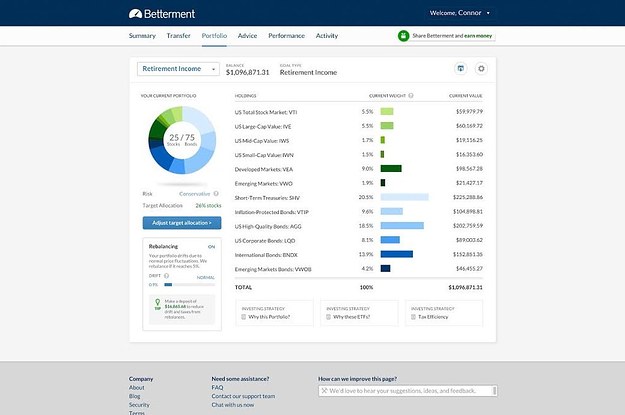

This Startup Says Competition From A $2 Trillion Giant Is "Really Exciting"

Why Betterment's founder Jon Stein couldn't be happier that Charles Schwab is competing with him.

Exclusive: Low Interest Forces Cancellation Of SALT Asia, One Of The Hedge Fund Industry's Biggest Conferences

Several sources familiar with the situation said the Asian counterpart of Anthony Scaramucci's Skybridge Alternatives conference, dubbed "the Super Bowl of hedge fund conferences," has been scrapped due to low interest and a scheduling snafu.

Warren Buffett And Dan Loeb Are On Opposite Sides Of A Verizon Bet

Both powerhouse investors made big bets on Verizon in the first quarter, but Loeb has since sold out of his position in the telecommunications company while Buffett has added nearly 4 million shares to his stake.

Activist Hedge Fund Buys Large Stake In Struggling World Wrestling Entertainment

Eminence Capital disclosed Monday it had taken a 9.6% stake in World Wrestling Entertainment. Eminence last year waged a successful activist campaign to merge Men's Wearhouse and JoS. A. Bank.

Goldman: We're Too Big To Sue

The giant bank points to the huge scope of its business as a defense against a pay discrimination suit. Goldman lawyers said there was no evidence of a company-wide policy that disadvantaged women in pay and promotion

CEO Pay Emerges As This Year's Hot Button Issue

Investor discontent for executive compensation packages has caught many corporate boards off guard, particularly since stock prices are generally up, experts say.

The Most Cold-Blooded Financial Death Notice Ever

This is pretty dehumanizing.

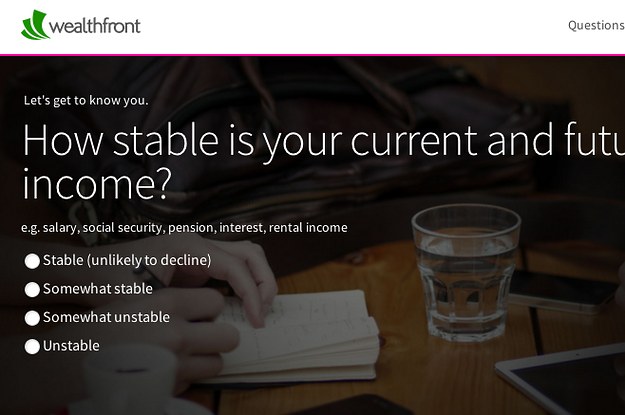

It's Not The Stock Market That Young People Don't Trust, It's The Advisers

"Millennials" are remarkably conservative investors, if they invest at all, in part because of their lack of faith in financial advisers. But a new breed of software-based advisers like Wealthfront and Betterment is banking on them still trusting the market.

Buffett Takes Another Shot At The Hedge Fund Industry

The Oracle of Omaha recently sent a letter to a San Francisco pension plan, advising the $20 billion fund not to invest in hedge funds. It's the latest development in Buffett's tenuous history with the hedge fund world.

"Uber For Investing" Startup Wealthfront Now Has $1 Billion In Assets

The leading automated financial advisory startup has rocketed up from $700 million in assets in February to cross the billion-dollar mark less than four months later, as its young demographic has continued to invest using the algorithm-based technology.

Where Exactly Is The Line For Insider Trading And Did Carl Icahn Cross It?

Everything you need to know to understand the insider trading investigation involving Carl Icahn, Phil Mickelson, and Billy Walters over suspicious trades of Clorox.

Here's How Hedge Fund Managers Make All That Money

A new report out today from Citi details findings that show hedge fund assets will swell to nearly $6 trillion in the next four years, doubling the size of the industry. At fees of 2% of assets and 20% of profits, members of the at-times controversial industry stand to make a lot of money.

Movie Theater Chain AMC Entertainment Hot Among Hedge Funds As Summer Movie Season Heats Up

The newly public AMC Entertainment was the favorite stock of hedge funds in the first quarter, and analysts say the company is on a tear, buoyed by projections of a better-than-expected summer blockbuster season.

9 Life Lessons The World's Highest-Earning Hedge Fund Manager Knows To Be True

Speaking at the SALT 2014 Conference in Las Vegas, Appaloosa Management's David Tepper served up more than a few opinions, platitudes, and general lessons on life.

Whole Foods Stock Falls 20%, Dragging Down The Entire Organic Grocery Industry

After announcing its growth had flatlined due to mounting competition in the organic grocery space, shares of Whole Foods stock plummeted more than 20% and dragged down its specialty grocery peers.

20-Somethings Don't Want To Own Homes, Says One Hedge Fund Manager

At least that's the bet one hedge fund manager is making, shorting the home building sector on the belief that a "generational shift" is creating permanent renters.

Employees Often End Up The Losers In Activist Investing Campaigns

Experts say that while activist investing campaigns can be great for shareholders, they often result in job losses, stagnating wages, and increased hours for employees. One such example can be seen in the impending integration of Jos. A. Bank into Men's Wearhouse, a merger that resulted from a fiercely contested activist investing campaign.

Are You Good Or Awful With Money?

401(what?) LOL.

Short Sellers' New Favorite Platform: Twitter

Hedge fund managers are increasingly tweeting their research and their sharp-edged attacks betting that a company's stock will fall instead of rise, in a medium that was made for stirring up trouble.

What Kind Of Investor Are You?

Make money money money, make money.

Shares Of Russia's Two Largest Banks Are Down Significantly, Could Dip Even Lower

"If Russia starts firing bullets, this morning's slide is nothing."

Sotheby's Stock Plummets As Dan Loeb's Third Point Pushes Back For More Board Seats

Dan Loeb's Third Point Partners is demanding Sotheby's open up all three board seats the $14 billion hedge fund is seeking. At this point, Sotheby's is only offering one seat for Loeb, and the stock has fallen more than $3 per share in just over 24 hours.

Is Wealthfront The Answer To Getting "Millennials" To Save For Retirement?

The leading mobile financial advisory service is going after a younger, more tech-savvy demographic with low fees and a fiercely independent corporate mission. But is the model sustainable?

Prominent Hedge Fund Manager Throws Shade On Critic In Message Board Fight

An anonymous commenter on a hedge fund message board criticized hedge fund manager Whitney Tilson's market-moving call on a company called MagicJack yesterday. He didn't take it well.

The Top Hedge Funds Of 2013 Had Some CRAZY Returns

Though it was a year of tepid returns for the average hedge fund, these three had absolutely mind-blowing performance in 2013, according to Morningstar data. 600%+ anyone?

Bitcoin Falls Flat Among Davos Crowd

The cybercurrency, which is supposed to make money transfers across the globe easier, is barely on the radar of those gathered at the World Economic Forum this week.

Booze And Broccoli Send Costco Shares Soaring

Sales of fresh foods and liquor drove a strong December performance for Costco. The warehouse club giant is expected to have a very good 2014, according to analyst firm Sterne Agee.

Kraft's Earnings Could Melt From Velveeta Shortage

The Velveeta cheese wells have run dry, largely due to a surge in demand from celebrations surrounding the New Year and post-season football.

Four Hedge Fund Trends To Watch For In 2014

Hedge funds with the strongest brands should rake in investor cash this year, according to a report out today from hedge fund consultancy Agecroft Partners.

24 Invaluable Skills To Learn For Free Online This Year

Here's an easy resolution: This stuff is all free as long as you have access to a computer, and the skills you learn will be invaluable in your career, and/or life in general.

Meet One Of The Hedge Fund World's Quickest-Rising Stars

Sahm Adrangi, 32, went from pondering a journalism career to managing a $300 million hedge fund. He spoke with BuzzFeed about his career transformation, the climate for hedge funds, and some activist investor campaigns currently being waged.

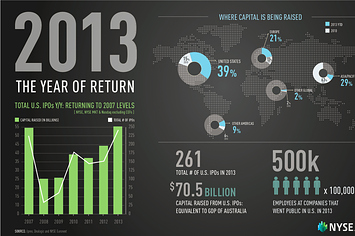

There Were More IPOs In 2013 Than The Boom Year Of 2007

Sure Twitter IPOed with bells on, but 260 other companies held their initial public offerings in the U.S. this year.

Everything You Always Wanted To Know About The Stock Market But Were Too Afraid To Ask

What in the world is the stock market? Here are your 10 most basic finance questions, answered.

Sign-Holding Student's Bitcoin Account Passes $25,000 After Being On ESPN

How one college student's sign made him a small Bitcoin fortune.

Mac 'N' Cheese, Other Packaged Foods No Longer Being Bought In Bulk

Instead of stockpiling pantries, consumers are now buying for just one week at a time. The effects are being felt in the earnings of packaged foods companies like Kellogg and Kraft.

The 16 Most Important Bitcoinaires

The cybercurrency is deliberately opaque, making it nearly impossible to track who holds it, but a few bitcoin owners have outed themselves proudly. Meet the known — and still-mysterious — bitcoin tycoons.

Your Credit Card Is More Valuable Than You Think (If You Have The Right One)

A free iPad sounds great, until you realize that you have to spend $60,000 to get it. Here's a look at some of the most popular credit cards on the market from various different banks and their reward programs.

9 Other Massive White Collar Criminal Fines Over The Years

Now that SAC Capital is facing a steep penalty of nearly $2 billion, these other white collar offenders are probably counting their pennies and breathing a (slight) sigh of relief.

14 Surefire Signs You're Part Of Finance Twitter

When will you be on CNBC again? #inflation

Hedge Funds Not Convinced Green Mountain Coffee's Strong Performance Is Real

The K-Cup giant Green Mountain Coffee Roasters relinquished its monopoly over the single-serve coffee industry a year ago, but its stock has performed well ever since. Big name hedge fund managers, however, say a downfall is imminent.

How Companies Like Twitter And Facebook Get So Rich

The courtship of startups by venture capital firms is the greatest love story of our time.

Investors Hungry For Breakfast And Snack Food Companies

The combination of cheaper grain prices, a crop production surplus, and the end of a drought have Citigroup analysts chomping at the bit about the packaged goods industry, which is poised to have an exceptional 2014.

Activist Investors Are Getting In The Way Of M&A

From the perspective of the private equity sector, anyway.

Whitney Tilson Blasts Education Company K12

The education activist and hedge fund manager is taking a major stand against the online education and tech company by publicly shorting its stock, calling K12's practices and academic results "dismal." And K12's model undermines the charter school movement in which he is deeply entrenched.

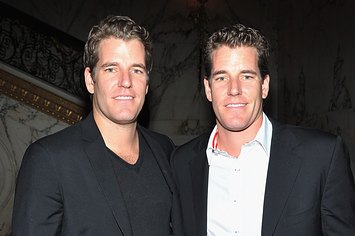

9 Things The Winklevoss Twins Taught Me About Bitcoin

Tyler and Cameron Winklevoss finally got their moment Tuesday morning to tell the world just how much they love Bitcoin, "the internet of money." Here are the most noteworthy Bitcoin facts imparted to an audience of investors at the Value Investing Congress.

9 Things Every Twentysomething Needs To Know About Money

UGH. But seriously, these are things you really need to know.