Citigroup analysts have been vocal about their belief in a "U.S. bourbon renaissance/whiskey revolution" this year, and today reiterated their buy rating on shares of Beam Inc., the maker of Jim Beam, Maker's Mark and Skinnygirl.

Brown spirits, specifically whiskey, account for about half of Beam's $2.5 billion in annual sales, and that's a category that has been taking market share from vodka in the past few decades.

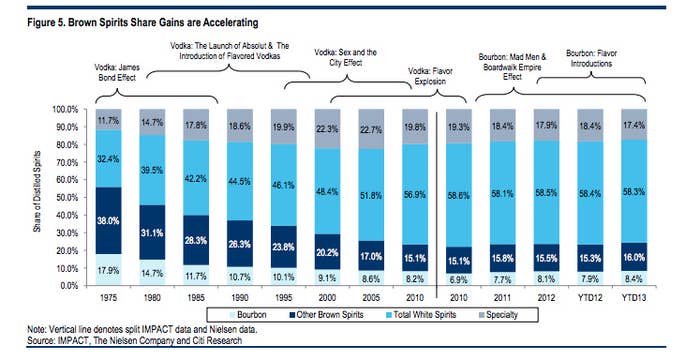

Citigroup illustrates the potential rise of bourbon and other brown spirits through this chart below. Vodka, fueled by the "James Bond Effect" and the "Sex and the City Effect," and the introduction of new flavors, has been edging bourbon and scotch out for many of the past few decades. However, the brown liquors have been staging a small comeback since 2010, the analysts say, with their own set of flavors and what they term the "Mad Men & Boardwalk Empire Effect."

Zoomed in to the past few years from above.

Beam, especially, has been a leader in adding new flavors to bourbon, starting with Red Stag in 2009, Jim Beam Honey two years later, and most recently, the 70-proof Jim Beam Maple in the third quarter, the analysts wrote. That's helping attract female drinkers: 45% of Red Stag consumers are women, while women typically account for only 20% of bourbon consumption.

Still, Beam, which makes 25% of annual sales from white spirits, is grappling in the near-term with a slowdown for Pinnacle and the Skinnygirl brand.

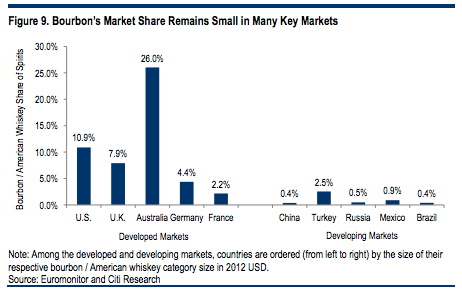

The company must continue to attract millennial males and expand the growth of its bourbon, whiskey, and scotch portfolio internationally, the analysts wrote.