For a glance at what American fast food could look like in the future, take a look at what's going on at Panera.

"Panera 2.0," the name the St. Louis soup and sandwich chain gave to a plan it launched in 2014, is in large part about turning restaurants into eateries for the 21st century. Stores are illuminated by twinkling tablets that allow customers to punch in orders themselves, and have taken the place of some cashiers. Orders pour in from Panera's smartphone app, too. Menus are now more customizable, promote more paid add-ons, and are getting — ever so gradually — pricier.

Meanwhile, the chain has been touting its exhaustive list of artificial ingredients banned from its kitchens, in the name of more natural eating.

Consumers seem to have embraced the changes at Panera: Digital orders in remodeled restaurants now account for 22% of sales, the chain said Wednesday, and transaction counts are growing.

"Indeed, to our knowledge, this is the highest digital utilization percentage of any public restaurant company in the industry, exclusive of the pizza [chains]," Panera CEO Ron Shaich told investors Wednesday.

Similar changes have been trickling through fast food, from McDonald's (which is installing ordering kiosks) to Taco Bell (which has a mobile app).

The emergence of self-service ordering in fast food must be understood, to some extent, in relation to rising wages and health care costs.

A number of cities recently passed $15 minimum wages, including Seattle, San Francisco, Los Angeles, and a fast-food–specific hike in New York, and more are expected to approve similar increases. "We believe the structural pressure on labor costs will likely continue for the foreseeable future," said Shaich.

As far as labor is concerned, one of the benefits of Panera's 2.0 system is that self-service ordering facilitates "more efficient" use of workers in stores, Shaich said. As labor costs rise, it frees up workers from cashier duties to help move more orders through the kitchen faster. This, of course, assumes the technology is bringing in more orders.

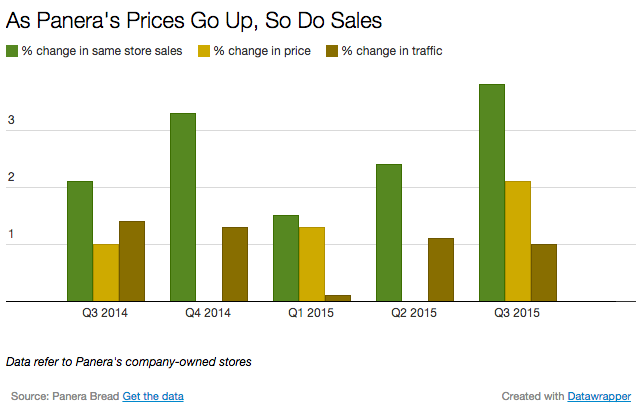

Sales in the remodeled stores are in fact growing faster than in the old stores. Still, Panera has had to increase menu prices to offset rising expenses, despite efficiency gains from self-service ordering. The chain increased menu prices 1% in September 2014, then 1.3% in early 2015, and then 2.1% last quarter.

Panera's customers don't seem to mind the new prices — not yet anyhow — as reflected by continued traffic growth. The average order in Panera is already more than $10, according to data from restaurant consultancy Technomic.

More price hikes are on the way.

Shaich told investors the recent price increase was still "not quite enough" to cover rising wage and health care costs and food inflation in the third quarter, "but going forward, our plan is to do just that. We believe we can effectively take price to cover inflation, particularly when competitors are doing the same thing, which is what we're seeing when we see minimum wage increases."

In other words, he sees menu prices increasing at Panera and its competitors. Already, Starbucks and Chipotle increased prices this year after workers got raises.

Labor expenses at Panera have increased to 32.6% of sales, up from 29.4% in 2012, as a result of wage increases and the labor needs in the 2.0 restaurants. Its operating profit margin last quarter was down 1.2% from a year ago "primarily the result of structural wage increases and costs related to the startup and transition expenses associated with our strategic initiatives," according to the company.

Similar trends may very well emerge at other fast-food chains. Taco Bell also launched an ordering app last year and recently added ordering capabilities to its website. Starbucks began rolling out mobile ordering in 2015. McDonald's is installing in-store kiosks and will start testing mobile ordering in 2016. Chipotle this month said it is looking to improve its mobile-ordering system.

Fast food is getting more digital as it raises pay for workers and offers them more benefits. It also seems to be tightening historically lax food quality standards, with initiatives to remove artificial ingredients and buy meat raised without antibiotics. Many consumers have demanded these changes from restaurants, and now, it appears, it's time for them to pay for it.