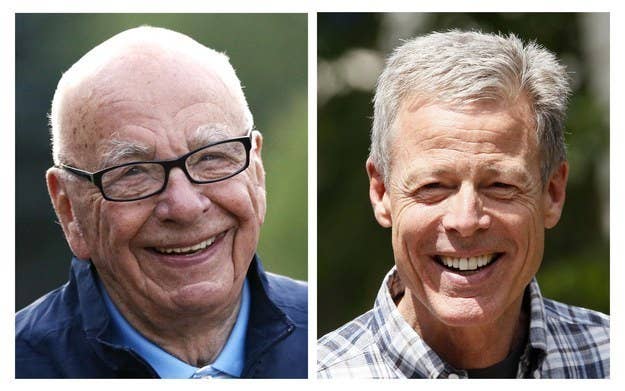

Jeff Bewkes, the chief executive of Time Warner, has long held the view that big media mergers don't create value for shareholders. But that doesn't mean he is against dealmaking.

Quite the opposite, in fact. Over the course of his tenure as Time Warner's CEO, Bewkes (pronounced "Bew-Kiss") has proven himself to be one of the most astute financial engineers in media. Since taking over the corner office on January 1, 2008, Bewkes has spun off AOL, Time Warner Cable and, most recently, Time Inc., all assets he viewed as a drag on the company's stock price and growth potential. As a result, Time Warner's stock price has gained 70% from its $48.87 per share closing price the day after Bewkes took over as CEO to the $83.13 per share it ended trading at Wednesday. Using Tuesday's closing price of $71.01, before news of Rupert Murdoch's unsolicited takeover offer broke, and the share price gain is still a very robust 45.3%.

"I always felt that selling off cable was setting up something to do down the road," said famed investor Mario Gabelli, whose firm owns sizable positions in both Time Warner and 21st Century Fox.

Indeed, unlike Murdoch or Viacom's Sumner Redstone or Comcast's Brian Roberts, Bewkes has no familial or emotional attachment to Time Warner. He doesn't own or control the company; he didn't build it from scratch; his kids won't inherit it. People close to Bewkes will tell you he is unsentimental about any of Time Warner's assets. Sure, he loves HBO, but that's because of the $1.7 billion in operating cash flow the pay-TV network throws off annually.

Bewkes is, above all else, a finance guy. He began his Time Warner career more than three decades ago as HBO's chief financial officer. He has judiciously remade the executive ranks of Time Warner with moneymen, elevating CFO John Martin to lead Turner Broadcasting and Kevin Tsujihara, an MBA graduate from Stanford, to head Warner Bros film studio. People close to Bewkes say that he takes his mandate to maximize returns for shareholders quite literally.

And that is why Time Warner's days as an independent company are numbered.

Whether it is Murdoch or someone else — CBS or Google, perhaps — Time Warner is now there for the taking. While Bewkes and the company's board, in rejecting Fox's proposal, said that "continuing to execute [our] strategic plan will create significantly more value for the company and its stockholders," they actually have to prove that.

"Now they have to show shareholders that they can get the stock to $85 on their own," said a source close to the situation who asked not to be identified.

That is not impossible, and certainly Bewkes would love to prove to investors they he can get Time Warner shares to that level independently. But even if he can, there's nothing to stop Murdoch or someone else from simply offering more. Dealmaking 101 posits that your first offer is never your best and final one. And with many major institutional investors, such as Blackrock, Vanguard, and Capital Group Companies, holding positions in both Fox and Time Warner, you can bet Murdoch's people are already working the phones asking what price would entice them to pressure Time Warner's board to enter into negotiations or tender their shares if things turned hostile.

Evidence that Time Warner's investors are receptive to a deal can be found in the company's stock price gain. Even though Time Warner rejected the bid and Fox conceded that there are no active discussions currently taking place, which would theoretically signal that a deal is dead on arrival, Time Warner shares still ended trading yesterday at $83.13, a sign that investors think a sweetened bid is forthcoming from Murdoch or someone else entering the fray.

Gabelli, for instance, said that if $100 per share in cash were offered it wouldn't matter to him who put it on the table. For its part, Time Warner's rejection cited concern over the valuation of the stock portion of Fox's offer, which implies that it might be receptive a new offer with a richer cash component.

Murdoch is, of course, not shy about paying up for what he wants. He so coveted Wall Street Journal owner Dow Jones that he offered $60 per share for it when its stock price wasn't trading even close to that. Two years later he ended having to write down the value of that deal by half, but no matter, he got what he wanted.

A second source with knowledge of the situation said that while Murdoch will be "disciplined" on price, he "didn't enter into this lightly" and hopes Time Warner will reconsider entering into negotiations.

Two years ago Bewkes agreed to a contract extension that will keep him as CEO of Time Warner through 2017. By then, he will be 65, and while sources said he would like to end his career by grooming a successor he may not have a choice anymore.

"At the right price, he's almost forced to do a deal," said one of these sources.

Representative for Time Warner and Fox did not return calls for comment.