To bundle or not to bundle — that has been the question dominating conversation about the TV industry in recent years. On one side, the bundling truthers argue that packaging channels together provides more choice for consumers at a cheaper cost. Residing on the other side are proponents of unbundling, also known as "a la carte," who believe that consumers should be allowed to choose and pay for only the channels they want to watch and not be forced to subsidize dozens of other networks they don't.

The debate has been the topic of much study, from research firms to consulting groups to government agencies, and frequently the results show that bundling is indeed a better value. A new report released Wednesday, from entertainment analyst and managing director at Needham & Co. Laura Martin, tackles the issue from a different angle. Instead of looking at the issue from the perspective of network owners, which is often how the debate is framed, Martin's report hones in on the economic consequences for consumers if unbundling were to become a reality.

Her findings, outlined below, support the notion of keeping the TV bundle intact. That is, of course, if you are still inclined to subscribe to a pay-TV package at all. Martin's report ends by citing the rise of online video — which has resulted not just in "cord-cutters," but also "cord-nevers" — and notes that "young adults aren't watching much television."

Some top takeaways from Needham's report:

Though 90% of U.S. households pay to receive as many as 180 channels, the average number of channels viewers watch has remained static at 18 for the past few years.

Needham estimates that households decide to subscribe after identifying between 16–20 channels they want to watch.

The average TV household watches about 4,400 hours of TV annually and pays about $720 per year, which equates to 16 cents per viewing hour and $4 per channel per year based on 180 channels.

Last year, consumers paid out $75 billion to U.S. TV providers, while total TV advertising was $76 billion.

Advertisers paid $1.24, or $56 billion, last year for every $1.00, or $45 billion, paid by consumers for TV content. (The other $30 billion consumers spent went into the pockets of pay-TV distributors.)

To maintain all 180 channels under an "a la carte" system, consumers would have to increase their annual spending on TV to $1,260, an increase of 75% above the $720 per year they currently spend.

Someone would need to make up for the $56 billion in national TV advertising revenue lost. Of course, not every channel needs to or would survive in an unbundled world.

Needham estimates it costs about $280 million annually to run an entertainment cable channel, which means that to break even it would need to average 165,000 viewers over an entire year.

Based on 2012 viewing levels, allowing consumers to choose their own channel packages would end up killing 124 networks.

The report says that only 56 channels would survive in a move to "a la carte" programming, which is the number of channels that achieved an average of 165,000 viewers for the entire year in 2012 according to Nielsen ratings.

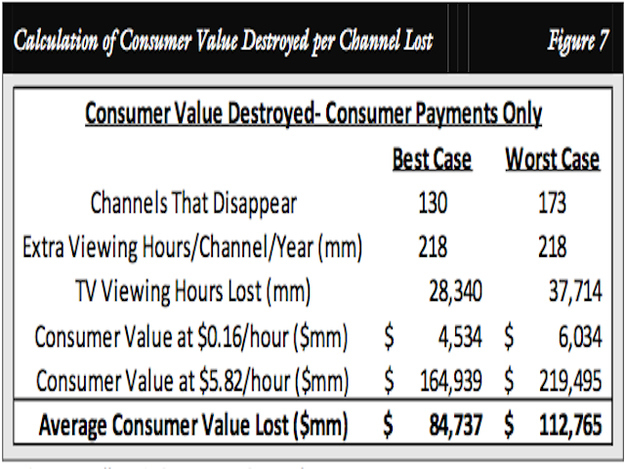

The decrease in channel choice equates to a loss of between $80 billion and $113 billion in consumer value, according to Needham's calculations.

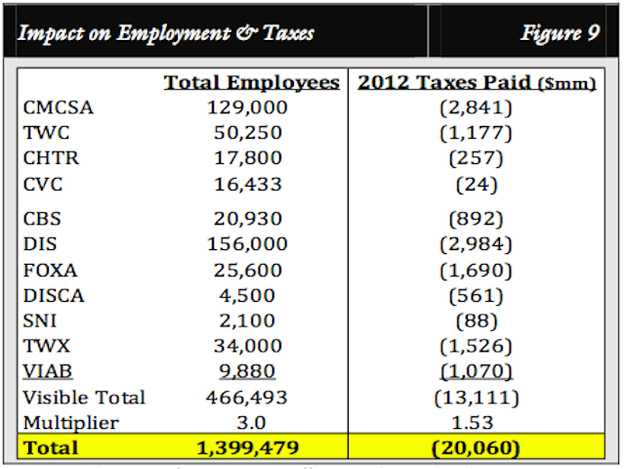

Unbundling would put roughly 1.4 million jobs at risk and result in raising taxes to the tune of about $20 billion to make up for the lost tax revenue from TV.

The elimination of channels and loss of revenue would inevitably lead to job loss in the TV industry, particularly in cities such as New York and Los Angeles.

The bundling and unbundling debate could all be moot, of course, since, as Needham notes, young adults aren't watching much television.

"Unless the content participants create programming this group [18- to 34-year-olds] wants to watch, there will be no TV ecosystem to save in 10 years," Martin wrote in her report. "There are 180 channels that have the potential to crack the code to create 18 channels that 21-year-olds think are worth paying a monthly subscription fee for."

Citing figures from Moffett Research, the report notes that 115,000 households canceled their pay-TV subscription in this year's third quarter and concludes that "people do consider having zero TV channels a viable option."

And in a nod to what young adults are watching, the report cites Big Frame, Defy Media, Fullscreen, Machinima, Maker Studios, and other private online video companies that are stealing eyeballs from TV.